Sohn Hearts & Minds Investment Leaders Conference live coverage

A French lottery business, a US sportswear giant, and two well known Australian companies are some of the recommendations from the Sohn Heart & Minds Investor Leaders conference.

All the coverage from the first in-person Sohn Hearts & Minds Investment Leaders Conference since the Covid-19 pandemic, with top stock picks and market insights from leading fund managers.

Anthony Aboud, Perpetual

Mr Aboud has named French lottery business Française des Jeux as his stock pick.

Comparing FDJ to ASX-listed The Lottery Corp, Mr Aboud said buying the French company today “is like buying the Lottery Corp in 2017”.

The appeal is specifically in growth of the online business. Online in Australia’s lottery business has gone from 15 per cent distribution to 38 per cent in recent years. France’s FDJ hasn’t yet had this uplift.

FDJ was formerly government owned and was privatised in November 2019. The French lottery is the 4th largest in the world, Mr Aboud said.

Its online penetration is much more immature than other markets, including Australia’s, he said.

The French lotto’s online (penetration) was 5 per cent (at IPO). The UK is 40 per cent, in Norway it’s 50 per cent. I can’t see any reason why the French can’t get to (these higher levels).

Since IPO, the company’s management “haven’t wasted any time” in boosting online sales, he said. Their online sales have gone from 5 to 11 per cent since IPO.

The company is trading at 9.5 times EBITDA compared to Australia’s The Lottery Corp at 16 times EBITDA.

The company also has €1.2bn cash.

“I think there’s a fair bit of upside. The main risks (include) that they have a bit of cash and could make a dumb acquisition.” A further risk is of a delayed buyback, he said.

James Miller, Firetrail Investments

Mr Miller has named US-listed Darling Ingredients as his stock pick.

“This company is 140 years old. It collects 15 per cent of the world’s animal fats in animal byproducts, and has relationships with over 200,000 restaurants around the world.”

Darling Ingredients develops and produces sustainable natural ingredients from edible and inedible bio-nutrients to make renewable diesel.

Its customers are in the food, animal feed, fuel, bioenergy and fertilizer industries.

Demand is rising, and is set to double by 2025, Mr Miller predicted.

On the supply side, it is very constrained, he added.

The stock is trading at 11 times earnings. Its closest peer, a European company, still has half its business in fossil fuels.

“Darling is providing a decarbonisation solution that the world needs right now,” Mr Miller said.

-

Fred Woollard, Samuel Terry Asset Management

Mr Woollard has named AMP as his stock pick

AMP listed on the ASX in 1998 and its shares have fallen over 90 per cent since then, Mr Woollard told the audience.

“The sum of the parts are worth substantially more than its market capitalisation,” he said.

“AMP will soon have surplus cash of over $2bn, it owns a profitable bank and also owns a market leading wealth business in New Zealand.”

The platform business makes around $100m a year, which is almost perfectly offset by losses in the financial planning division,” he said.

“We think the platform could be sold for $1bn.

“Finally, AMP owns two minority stakes in a Chinese business and a US property platform. These are opaque but are great assets.

“We think the sum of the parts is over $2 a share compared to the share price of $1.28.

“The balance sheet is strong and the management team are doing a great job of restoring the businesses.”

If management can pull it off, “we expect to make a satisfactory overall return”, he said.

“AMP keeps getting cheaper. The most important recent change is we finally have a first-class CEO in Alexis George. She is an industry veteran and understands the nuts and bolts of the business. Under (her) AMP has been shrinking and returning capital to shareholders.

AMP has returned or committed to return $1.3bn to shareholders. Last year AMP bought back $200m of shares and is in the process of buying back a further $350m worth.

AMP should shrink and simplify, in an orderly manner, he said.

It should avoids acquisitions, continue selling assets and keep returning cash to shareholders, he said.

Catherine Allfrey, WaveStone Capital

Ms Allfrey has named Transurban as her stock pick.

“(Transurban) is a large company that has what we call a lot of quality attributes,” Ms Allfrey told the audience.

The company is an inflation play.

“If inflation is short term, it will be very beneficial to Transurban. Toll roads are overwhelmingly linked to inflation,” she said.

“We’re looking at 15-16 per cent increases for Transurban if the market is correct on inflation. This is going to have a compound effect on its revenue.”

Commenting on the company’s debt, Ms Allfrey said there was “no doubt Transurban has a lot of debt”.

“But 90 per cent of it is fixed and the weighted average maturity of that debt is seven years.

The inflation impact would see “a $400m revenue lift over the next three years for Transurban”, she added.

“You’ve got close to double-digit revenue growth at the top line. You’ve got 70 per cent EBITDA margins. We’re going to see near double digit growth in distributions in the next few years.”

David Walsh: Bitcoin could hit $0

Professional gambler David Walsh has predicted bitcoin could fall to zero but admits blockchain technology has value.

“I think future opportunities will consist of not trying to forecast the market but trying to forecast algorithmic uncertainties like flash crashes,” Mr Walsh told the audience.

“You just accept those and trade the other side, they’re going to keep happening in bitcoin.

“Bitcoin is going to go to zero. Well, if it doesn’t go to zero, it’s never going to be a forecastable commodity out of which you can make money.”

Mr Walsh, a mathematician and professional gambler who is part of a syndicate that bets $10bn a year, said there was merit to the blockchain technology underpinning the cryptocurrency.

“If you’re trading in bitcoin, I’m not on your team or if you’re trading in crypto in general,” he said..

“Blockchain is a very good idea. The figures are good. It’s a brilliant idea.”

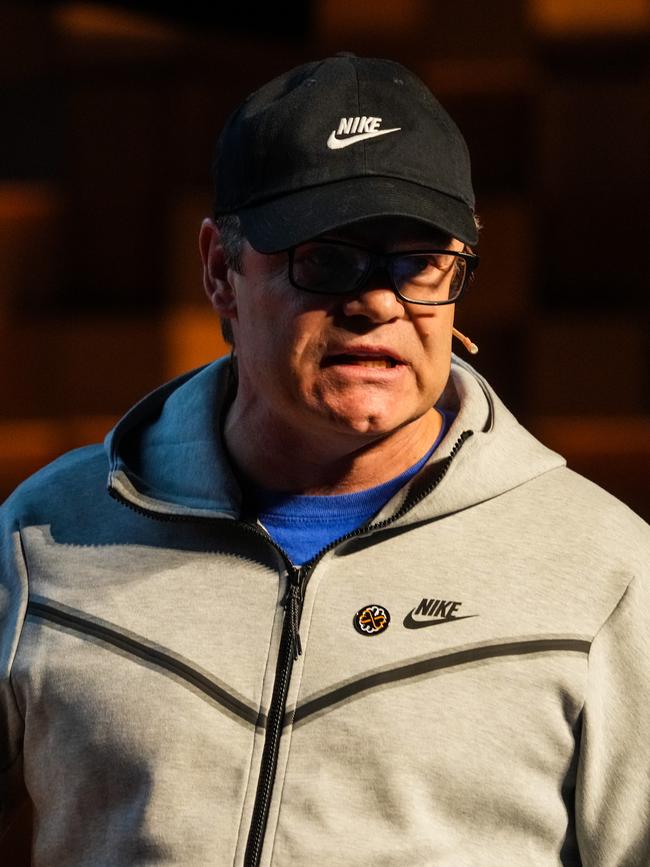

Bob Desmond, Claremont Global

Mr Desmond has named sportswear giant Nike Inc as his stock pick.

US-listed Nike generates nearly two times the revenue of its closest competitor Adidas and nearly three times the profit, Mr Desmond told the audience.

Nike is increasingly taking control of distribution and becoming a technology powerhouse.

Nike direct-to-consumer sales are now at 43 per cent, he said.

“At Claremont we love direct-to-consumer. You get to keep the wholesale margin. But what is more important is you get to control the points of sale. No more discounting.”

The company is also “hoovering up data” that allows Nike to innovate at scale and deliver the right product at the right price to the right person at the right time, Mr Desmond said.

Covid-19 has also been “absolutely fantastic” for Nike, he said.

The sportswear retailer currently trades at around 30 times earnings.

“It may look expensive but we would argue that earnings are severely understated at the moment,” Mr Desmond said.

It will grow earnings in the mid teens over the next five years, he predicted.

“It has unbelievable business economics — 26 per cent return on invested capital. It’s a great company. Just buy it.”

Tim Elliott, Regal Funds Management

Mr Elliott has named ASX-listed Champion Iron as his stock pick.

“Champion Iron ticks every box on my dream list of top quality miners,” he said.

“Best of all, it’s got a $3bn market cap at only $6 per share.”

Champion Iron is the most underappreciated and exciting play on decarbonisation, he said. “It’s completely under the radar”.

“Now’s the perfect time to buy Champion Iron after the share price fell when the iron ore price fell and the market misread its recent production report.”

Steel is the backbone of the modern world, Mr Elliott said. “The only way to eradicate poverty and lift living standards is with more steel....Miners are doing the heavy lifting on decarbonisation.”

Demand for high grade iron ore is also rising. Champion iron ore can be used to make green steel, Mr Elliott said.

Elliott also predicted premiums for high grade iron ore would surge due to demand growth comparable to lithium yet limited new supply.

He cited carbon taxes as incentivising steelmakers to pay a lot more for high grade iron ore.

“It’s rare to find any miner with such tremendous value upside. (Champion Iron) can double, without assuming a higher iron ore price.”

Joyce Meng, FACT Capital

Ms Meng has named Irish video game company Keywords Studios as her stock pick.

Ms Meng said Keywords served as the “picks and shovels” of the video game industry. It is the number one market share leader and is three times larger than the competitor, she told the audience.

“The company provides comprehensive services across all stages of gaming, from conceptual art and engineering pre-production to localization and testing post production,” she said.

“Keywords benefits from the exponential growth in the cost and complexity of games development, driven by technology improvement and increasing gamer expectations.”

Today, outsourcing penetration is only 31 per cent and significant runways expansion, she added.

“In the context of about 10 per cent market growth, we see Keywords scoring low teens organically,” she said.

“Second, Keywords has a track record of highly-creative tech M&A. The market is really fragmented. Even though Keywords is the number one market share leader ... its aggregate market share is only 5 per cent.”

Keywords trades at 13 points and 10.9 times 2023, and 2024 EBITDA, Ms Meng said.

She said she saw a 72 per cent upside to the stock, using conservative cost of capital.

Gaming still represents a comparatively inexpensive hobby with good value for experience, according to Ms Meng.

“Secondly, we anticipate positive revisions to consensus,” she said.

Keywords management historically has taken a very conservative mentality on outlook, she added.

“We are 9 per cent ahead on 2023 revenue and 12 per cent ahead on 2023 EPS, which sets it up well for (future) earnings reporting,” she said.

Tim Carleton, Auscap Asset Management

Mr Carleton has named Carsales.com as his stock pick.

Carsales.com is made up of a collection of businesses, including the Australian online marketplace and a range of businesses overseas including South Korea’s Encar, and has stakes in businesses in South America and Brazil, among others..

“They’ve managed to deliver pretty decent revenue growth since they listed, selling space on their marketplace to dealers and private sellers. But they also earn incremental revenue through the sale of advertising space and subscription services for additional data and research,” Mr Carleton said.

“They’re also able to charge for their dynamic pricing models ... they recently completed the second stage of their acquisition of Trader Interactive in the United States. This is going to give them a long runway of potential growth.

“Now that they own 100 per cent of the business, they’re getting on with monetizing it more effectively including selling more ad space more effectively, and have a dynamic pricing model.

“We’ve seen a lower share price as a result of broad market movements. These are the sorts of opportunities that we love and it offers a compound earnings growth story with an attractive valuation.”

Carsales.com has an average return on equity of over 40 per cent since listing and more than six times the market share of the number two player, Mr Carleton said.

“It’s had a very strong track record of growing earnings per share and tends to come out of periods of weakness with considerable strength,” he said.

“This business is currently trading toward the bottom of its historic valuation range when considered from a price-to-cashflow perspective.”

Mr Carleton last presented in 2018, when he pitched JB Hi-Fi as his best idea. It has been one of the best picks of the past five years.

Ramez Naam, PlanetaryVC,

The managing partner of PlanetaryVC, which invests in startups addressing global challenges including climate and energy, is speaking on clean energy.

Clean energy has gone through three phases over the years, he says.

First it was policy dependent and it had to be subsidised. Second, about a decade ago, clean energy started getting cost competitive. Now, building a new solar or wind farm is cheaper than the operating costs of putting fuel into existing older energy power, he said.

Solar costs have declined rapidly in the past decade, to the point where costs are now “a century ahead of where the world’s leading experts thought they would be just 12 years ago”, Mr Naam said.

In the coming years the clean economy will be a $US4 trillion a year market, similar to healthcare, he added.

Australia has a great opportunity due to its climate, he said.

“Of all the industrialized nations, Australia has the best provisioning of solar power of virtually any place on Earth.”

The recent energy crisis across Australia was not due to renewables, he said.

“Any time you have reliance on fossil fuels you are subject to global fossil fuel prices... in the long term renewables drive the cost of energy down and stabilise costs by reducing fluctuation.”

Lithium and copper are big opportunities for Australia as energy storage needs increase, he added.

“In the last decade, the cost of lithium ion batteries has dropped by a factor of 10. The price of solar has dropped by a factor of 5-6. So battery pricing is actually something faster even the cost of solar power.

“Australia’s biggest exports are iron ore and coal but then down the list, you see lithium and copper.”

Jun Bei Liu, Tribeca

Hong Kong-listed China Tourism Group Duty Free is Jun Bei Liu’s top stock pick.

China Duty Free is the biggest duty free operator in the world, has more than 90 per cent market share in China and is the direct beneficiary of spending by Chinese tourists. It also has regulatory tailwinds in China, Ms Liu said.

“Duty free is a very big business. In 2019, global travellers spent $US85bn in duty free. 40 per cent of that was spent by Chinese people.

“In 2016, Chinese people made 4.7 billion trips. In 2019, they made 6.3 billion trips. By 2025, they are projected to make more than 7 billion trips,” Ms Liu said.

The Hainan province in China has seen a duty free boom in recent years, even through the pandemic.

In two years the company grew 33 per cent in 2020 and 23 per cent in 2021, Ms Liu said.

“Clearly 2022 was a very hard year for the company as China went through lockdowns, including in Hainan.” Despite this, CDF still made $1bn this year.

“The largest duty free operator in the world, they drove a very hard bargain with asset owners and made an aggressive push into online sales.”

CDF has $3bn on its balance sheet and is on a global expansion, Ms Liu said.

“They want to go to Europe, the US, wherever the Chinese tourist is going...it is going to collect a whole lot of luxury brands to make them exclusive

“This company will grow compounded over 40 per cent per annum over the next three years,” Ms Liu predicted.

Ricky Sandler, Eminence Capital

The founder and chief executive of US-based Eminence Capital has named New Relic as his stock pick.

California-based New Relic is a $US4bn market cap company that allows organisations to monitor IT infrastructure.

It develops cloud-based software to help website and application owners track the performance of their services.

“New Relic is perceived as a share loser, we think it’s misperceived. Up until recently they had been losing share based on their transition to a new product platform in 2020 and 2021.”

Since 2020 the growth rate has picked back up, he said.

“Similarly, total accounts had been declining and through September this year are back growing nicely.

“New Relic is also rapidly moving to profitability. It is mischaracterised as unprofitable....The stock trades at a big discount to its peers.”

The stock has also had positive management changes in the past year, he said.

New Relic will grow 23 per cent in the coming year, but is trading at half the valuation, Mr Sandler predicted.

Nick Griffin, Munro Partners

Nick Griffin has named Dutch-listed company ASML as his stock pick this year.

A supplier to the semiconductor industry, ASML produces lithography tools for the production of semiconductors.

“Lithography is essentially just a stencil,” Mr Griffin said.

“The more precise the stencil, the more transistors you can put on an integrated circuit. And the more transistors you can put on the circuit the better.”

ASML’s technology sits in a box that sells for €190m, Mr Griffin said. The high-end version sells for more than €300m.

“We see ASML’s EPS growing from €14 today to €41 by 2025...we expect their earnings to accelerate.”

The stock has fallen in line with other semiconductor stocks in recent times but the company should see exponentially more growth in the future, he said.

Peter Cooper, Cooper Investors

Mr Cooper names Eurofins Scientific as his top pick at this year’s Sohn Hearts and Minds Investment Leaders Conference.

Eurofins, a European lab testing service, is a global champion, generating €6bn per annum, Mr Cooper said. It has generated returns of 26 per cent per annum for shareholders for two decades.

“One of the attributes of the service is it’s really cheap. (It conducts) 450 tests (per year), they cost $15 per test but what they do creates enormous value.

“Every year in this industry of testing, volumes are going up 5 per cent a year.

“So there’s regulated demand, by government, and unregulated profits ... it’s a terrific dynamic in a mission critical product that doesn’t cost very much.”

There is also growing demand on corporations to be responsible, Mr Cooper said.

“There’s three types of companies: those who do more harm than good, virtue signallers and companies on the right side of history, like Eurofins.”

Eurofins founder Gilles Martin had put in place a management system focused on decentralisation, Mr Cooper said. “That’s how he’s created this incredible scale in the business.”

“As we go into a period of recapturing inflation, these guys are very well placed to be able to do that but there’s lots of latency for pricing.”

The stock price is down 40 per cent over the past year because earnings per share are likely to be off 20 per cent this year, Mr Cooper said.

PE is at 18 times, an all-time low.

“We think this thing is worth €100 a share, that’s going to give you around a 20 per cent return,” he said.

The company has plans to expand into Asia with an ethical CEO who runs the company for both shareholders and employees, Mr Cooper said.

Cash is best asset class right now: Bill Browder

Distress in the markets has created short term opportunities, Mr Browder said. But cash is the best asset class right now and will be until assets get “really cheap”, he said.

“We’re in a world with high inflation and central banks need to do something about that..they’re going to raise interest rates and so the value of assets will go down. Once we get to a point when rates are peaking and inflation starts to go down I think there’s gonna be a great opportunity to buy assets.

“But up until that point, I think that we’re just gonna see things winding down, (amid) rising interest rates, making it more attractive to hold cash when you get an interest payment.”

Browder on Russia

Hermitage Capital Management’s Bill Browder has spoken of his early years investing in Russia in the 1990s, describing it as a wild west and detailing how his fund’s investments in the country saw him become the best fund manager in the world at the time, before he started calling out widespread corruption.

At the Sohn Hearts and Minds Investment Leaders Conference in Hobart on Friday, Mr Browder outlined his history with Russian President Vladimir Putin

“Putin shows up on the scene and he hates these oligarchs because they’ve stolen so much power from the presidency. And of course, I hated the oligarchs because they were stealing money from me.

“There’s this expression that your enemy’s enemy is your friend... I thought he was getting rid of corruption and he was great.”

Eventually Mr Browder and Mr Putin’s interests diverged, he said.

“For a number of years people didn’t touch me...but once my interests with Putin’s diverged (in the mid 2000s), I was flying back to Russia, I was the largest foreign investor in the country and I was stopped at the airport...they deported me and declared me “a threat to national security”.

Mr Browder was the largest foreign investor in Russia until 2005, when he was denied entry to the country and declared “a threat to national security” for exposing corruption in Russian state-owned companies.

Bill Browder address

The death of his lawyer, Sergei Magnitsky, in 2009, changed Mr Browder’s life forever, he said.

“There was no way I could move on (from that). I was going to make sure those people were going to pay.”

Mr Magnitsky uncovered a massive fraud committed by Russian government officials that involved the theft of US $230 million of state taxes. Sergei testified against state officials involved in this fraud and was subsequently arrested, imprisoned without trial and systematically tortured before he was killed.

Since then, Mr. Browder has sought justice outside of Russia and started a global campaign for governments around the world to impose targeted visa bans and asset freezes on human rights abusers and highly corrupt officials.

“I said how about we freeze their assets and then their visas in the West. I took this idea to Washington, and I got a few senators, (including) John McCain of Arizona... it became a federal law, Obama signed it into law in December 2012.” Since then, similar Magnitsky acts have been passed around the world, including in Australia in 2021, he added.

“I’m not interested in every country (having a Magnitsky act). I’m interested in only the countries (where) bad guys want to keep their money.”

Describing Putin as “a little man” who had stolen “a tonne of money” and was desperately scared of his people, Mr Browder said the Russian President started the Ukraine war as a distraction and would be at the Estonian border if he wins the war.

“In 22 years, a trillion dollars has been stolen by Putin and his cronies since he came to power. That was money that was supposed to be spent on health care, hospitals and schools, roads and public services, instead was spent on private jets and $500 million yachts and all sorts of disgusting and unnecessary things.

“That kind of money over 22 year period, you have to expect this to be some blowback. Putin has put himself in the situation where this is physical survival is dependent on him staying in power.

“So what does a dictator do who’s afraid of his own people? He pulls out the old dictator’s playbook prize for an enemy, and he starts a war... the purpose of going to war with Ukraine is to be a wartime president.”

Heavy hitters at Sohn

The first in-person Sohn Hearts & Minds investment conference since the Covid-19 pandemic has drawn a crowd of fundies, bankers and billionaires (and assorted others).

Those at the Thursday night knees-up to start proceedings included Premier Investments chair Solomon Lew and his wife Roza and Ariadne executive director Gary Weiss and wife Chrissy Steinmetz. Both are supporters of the conference, which donates proceeds to charity.

Also in Hobart for the event: AFL chief executive Gill McLachlan, Barrenjoey’s chief executive Brian Benari and co-executive chairmen Matthew Grounds and Guy Fowler, Andrew Forrest’s right hand man John Hartman and high-profile fund managers Geoff Wilson and Brendan O’Connor of Regal Funds Management.

The Sohn launch party, held at David Walsh’s MONA, was not short of funds management figures.

Also spotted: David Paradice, who last year agreed to sell half his operation to Charter Hall, Caledonia’s Mark Nelson, UniSuper’s chief investment officer John Pearce and Future Fund’s Ben Samild.

Then there was the Ukrainian delegation: BetaShares chief executive Alex Vynokur and Ukrainian ambassador Vasyl Myroshnychenko.

They’ll be watching Vladimir Putin’s no. 1 enemy (perhaps beyond Volodymyr Zelenskyy), Bill Browder. The financier is a major critic of the Russian government.