Rosy outlook ahead for select retailers

The wealth effect and a much brighter economic outlook could lead consumers to resume historic levels of spending.

The wealth effect and a much brighter economic outlook are shaping up to push consumers to resume historic levels of spending at retailers, and the type of companies most set to benefit from the shopper rush are travel, online department stores, hardware and convenience stores.

The latest research from UBS, drawing on fresh data from a survey of 1000 consumers for its Evidence Lab, points to an improving retail outlook, bolstered by rising residential property prices and a greater willingness for consumers to spend money.

There was an uplift in the outlook for wealth against the UBS consumer survey conducted just before the federal election in May, with consumers also more positive about the future growth of wages.

Meanwhile, environmental, social and governance factors are becoming increasingly topical when it comes to both consumer preferences and investing, UBS found, but this was split along generational fault lines.

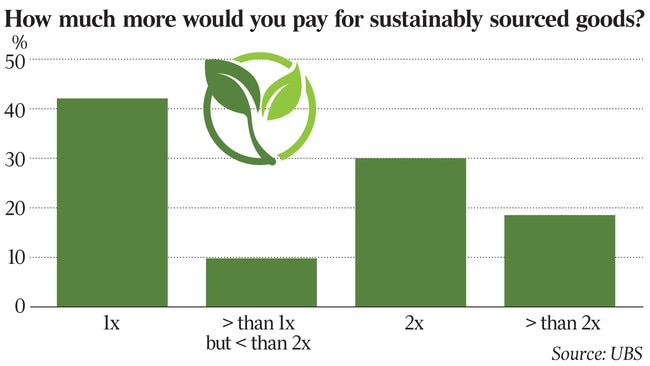

The survey found that one cohort was not willing to pay much extra for ESG outcomes while another — generally younger — would pay more than double for ESG outcomes, particularly when it came to buying renewable energy and sustainably sourced consumer products.

But the rising tide of the wealth effect is not expected to lift all boats, and UBS analysts Ben Gilbert and Pieter Stoltz have fixed on a portfolio of key retail stocks that should be rewarded by a return of shoppers to the stores.

“Overall, results were positive for the broader consumer outlook, particularly home improvement and fast food,’’ Mr Gilbert said in the latest UBS deep dive into the minds of consumers and sent to clients on Monday night.

“Travel intentions softened a touch, but key brands Flight Centre and Webjet are winning share,” Mr Gilbert said. “Flight Centre and Webjet customer spend intentions increased significantly versus the May 2019 study, suggesting share growth, with the market outlook to improve as household wealth rises.”

Price and convenience were still key for drivers looking for a petrol station and snack, and with well-located fuel sites, Viva Energy was on the UBS stock list.

“Viva Energy, superior sites (location) and improved pricing reinforces our view on the volume opportunity, not priced in.”

Households are feeling wealthier, UBS found, with 29 per cent of respondents net positive on their 12-month forward finance outlook against only about 8 per cent in the May survey. Despite near-record low housing turnover, about 15 per cent of respondents said they spent more on DIY projects year-on-year, with about 50 per cent saying they are intending to undertake a home improvement project in the next six months.

“This suggests limited impact from weaker housing activity: positive for Wesfarmers (which owns Bunnings) and to a lesser extent Metcash (Mitre 10).”

But not all retailers are expected to gain. The shift towards convenience through such things as food delivery and meal kits continues at the expense of cooking at home. Aggregator food and restaurant websites are driving the growth, with potential risk to Domino’s Pizza if it is unable to hold share, UBS warned.

A retailer’s ESG credentials are growing in importance for consumers. The same attitude was evident in choosing investment products.

“Consumers revealed they were more willing to pay for sustainably sourced goods than for renewable energy, given 30 per cent said they would pay double for sustainable sourced goods and 20 per cent said they would pay double for renewable energy.

“When it came to ESG investments, consumers often said they would be willing to give up 5 per cent or even 10 per cent of their retirement savings in order to invest in an ESG aware option but the majority were not willing to give up more than 1 per cent.’’

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout