It’s not just Australian companies worried about travel. In some cases offshore fund managers are saying they don’t see foreigners on their doorstep.

US and British trips are still being made, but as the disease spreads those planned for the next few days are increasingly in jeopardy.

It’s also not just investor trips that are affected, with law firm Clayton Utz on Thursday cancelling a two-day conference after a staff member reported potential contact with the virus.

The 95-year-old grandmother of the support staff member’s spouse sadly died from the disease this week.

The spouse is awaiting test results, but out of caution the Sydney event, involving hundreds of staff and clients, was cancelled.

Companies contacted said the trips were sometimes cancelled at the behest of the offshore investors, who were not anxious to see a chain of Australian executives on their doorstep.

Long-scheduled international conferences, like the 23rd annual Credit Suisse Asian Investment Conference planned for Hong Kong at month’s end, were already in jeopardy due to the riots but have been killed altogether by the virus.

A planned Citibank-JP conference due in London last week was converted to a “virtual” conference but an international REIT conference planned for month’s end in Miami is still scheduled to be held.

Those still travelling are going to the US and or London but none contacted are travelling to either Singapore or Hong Kong, two mainstays of the investor roadshow.

Suncorp’s Steve Johnston just visited Britain.

In some cases the offshore meetings will be conducted by locals, with Lendlease European chief Neil Martin and his CFO Tom Mackellar handling the London meetings.

The US was always planned for the middle of the year and will proceed as scheduled.

The Bank of Montreal Global Mining conference in Miami went ahead as planned at the end of February.

CBA has done the domestic rounds but is not planning for its international tour until mid-May, starting in the US, then London, with no Asian stops scheduled.

QBE, like others, restricted its investor roadshow to London and Australia.

Woolworths is doing all international meetings by video conference.

The plans are changing by the day, so meetings planned for the past few weeks have proceeded as planned but those due this week are being cancelled.

Rio’s team delivered their results in London and then, like some others, travelled to Perth non-stop, avoiding any Asian stopover.

BHP executives are returning from Britain after a swing through the US.

CBA only allows “business-critical” offshore flights.

Qantas is sticking to its line that two-thirds of revenue are derived from Australia but as the disease rolls through it must be hitting its bottom line big time.

Diversionary tactics

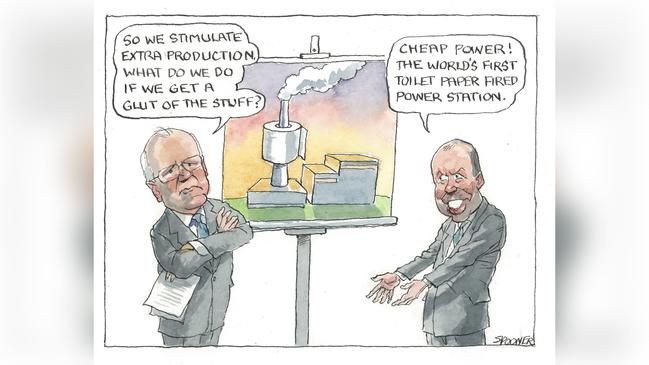

The Australian economy grew by just 2.2 per cent last year, which should be kept in mind as Canberra plays up the impact of the virus and the bushfires.

The facts are, the external events hit an already weak economy — which raises the question of just what the Feds were doing about it and what they have planned now.

The narrative now is to put all the focus on the virus, but while its impact is real and growing, it’s a diversionary tactic from the government.

The Reserve Bank’s rate cut will have minimum positive benefits and quantifiable negative impact on bank profits and retiree incomes.

The congo line of self-serving pleas for help are understandable but apart from the long-ago-demanded productivity reforms, the trick from Canberra is to put money in the hands of those who will actually spend it.

Rental assistance for the less wealthy, tax breaks for companies who employ apprentices and low income tax rebates are among the measures which should be considered.

Some sceptics think the government will delay assistance measures until later in the election cycle but surely that is too cynical.

Getting off lightly

The collapsed NewSat’s former boss Adrian Ballintine was fined just $15,000 on Thursday after pleading guilty to authorising false inventories for diverting funds from the public company to a private company. The company collapsed in 2015, leaving shareholders short of $20m.

The penalty, after Ballantyne admitted guilt last month, is a sick joke and must be appealed by ASIC.

Baird’s latest move

Mike “Magic” Baird worked in banking for 20 years before going into politics and then to NAB three years ago before quitting on Thursday.

He is playing down a return to politics, without committing on the record, and said he would take some time before deciding on his next journey.

Baird leaves with some 21,422 NAB shares, worth $497,633 and paying annual dividends of $42,841, after picking up $1.7m in all last year.

Australian politics and business would probably be better served if more people followed his path of crossing the line between the two.

Consumer concerns

Vodafone and TPG shareholders are clear winners from their stunning Federal Court victory against the ACCC and incumbents Telstra and Optus get a more stable market, but whether consumers win is very much a moot point.

The ACCC, as flagged in this column on Thursday, declared it would not appeal because presiding judge Justice John Middleton left no grounds.

ACCC chief Rod Sims disagrees with his decision and is working towards a formal paper showing how the concentrated nature of Australian industry is not benefiting consumers, which will include data flowing from this merger.

The argument is that, given Vodafone has yet to make a dollar in this country after 27 years, the combination of its mobile brand with TPG’s fixed line business will prove a more viable competitor to Optus. But arguably Telstra is ahead of both.

That’s the point of an oligopoly in which Telstra operates, thanks in part to billions in government subsidies, a superior mobile offering and overall business — and the other two will battle it out for second place.

Maybe this will see more gains on top of those, which through technological change have delivered better prices for consumers.

The ACCC has lost six straight merger cases. Its chief Rod Sims wants to build a case for better laws like a concentration threshold, which means a merger that breaches the line will have to prove it does not lessen competition.

That is a bridge too far in its attempt to talk the courts into taking a different attitude to mergers.

A dismal record in court, however, ignores the fact the regulator has stopped many other deals by raising objections that are not challenged in court.

Few are challenged, in part because of the time taken and the reality that there are often competing buyers who can see the value on offer when the dominant players in a market want to combine to milk the monopoly rent.

The coronavirus is playing havoc with the usual roadshow rounds for Australian companies, with Asian calls by video only and some companies like Woolworths cancelling all international investor meetings.