Treasury Wine Estates holds profits despite China tariffs lockout

Treasury Wine Estates chief executive Tim Ford believes he can walk both sides of the wineshop aisle.

Treasury Wine Estates chief executive Tim Ford believes he can walk both sides of the wineshop aisle as he maintains growth for his luxury and premium wines led by the iconic Penfolds and ramps up 19 Crimes, fronted by US rapper Snoop Dogg, to become a second global brand.

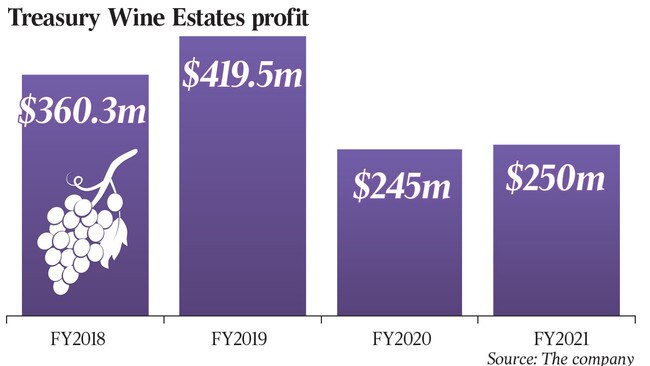

And both ends of the company’s bulging wine portfolio are helping to fill the massive earnings hole left by the imposition of crippling tariffs announced by the Chinese government last year, with Treasury Wine pulling off a return to profit growth in 2021 despite the loss of its billion dollar Chinese market and disruptions caused by Covid-19.

But the winemaker isn’t giving up on China completely and later this year will sell part of the latest Penfolds range carrying the 176 per cent price tariff as it attempts to keep the Penfolds brand alive in the communist country.

Unveiling Treasury Wine’s full-year results on Thursday which showed a 1.8 per cent lift in full-year net profit to $250m that reversed the 25 per cent decline in earnings in 2020, Mr Ford said drinkers were shifting up the price curve to demand more premium wines.

Its flagship Penfolds brand was winning new customers and despite being all but locked out of China raising fears of an oversupply of Penfolds brands looking for a home it had held its pricing for the latest Penfolds vintage release.

Meanwhile, 19 Crimes, a more affordable wine sold with imagery of Snoop Dogg on the label had grown to 5 million cases a year in sales, following a hugely successful launch in the US, and was now finding similar success in Europe where sales were heading to 1 million cases to become Treasury Wine’s second global brand after Penfolds.

“We feel pretty good around the mindset we have in the business,” Mr Ford told The Australian as Treasury Wine held its sales decline to only 3 per cent to $2.569 billion for 2021 despite the twin challenges of China – once its most profitable market – and Covid-19.

“Two significant events through a year leaves you with a couple of choices, you do the best you can and have a woe is me approach or you take control of your agenda and take control of what you can control and drive it. And I think we have done a fabulous job of taking that control and executing that plan.”

That plan included earlier this year a new divisional split aimed at maximising the benefits of separate focus across its brand portfolios, rather than regions, and from fiscal 2022, Treasury Wine will operate under three new internal divisions being Penfolds, Treasury Premium Brands and Treasury Americas.

“This is the way we want to run and grow the business now going forward, it is the right way to grow our business with a China market or without a China market. It has proven to be probably one of the best decisions we have taken over the last 12 months. ”

Investors will be rewarded with a much higher dividend despite the lost sales from China, with a final dividend of 13 cents per share declared, fully franked, an increase of 62.5 per cent on 2020 final dividend. The final dividend is payable on October 1.

Treasury Wine revealed an improving net sales revenue per case of wine shipped from Treasury Wine’s warehouses across all its regions taking in the Americas, Europe, Asia and Australia that was generated by continued premiumisation of the market and consumer tastes turning to more pricey wines, which generates better profit margins for the winemaker.

“I think certainly you are seeing probably consistently in most markets around the globe, UK maybe the exception here, that consumer demand for wine under $10 has declined and even through the pandemic period consumer demand for above $10 a bottle which is where we start our premium category has certainly increased.

“Consumers are engaging more with brands that resonate with them and certainly the willingness to spend more on a bottle of wine to enjoy it more at home than traditionally they have has played to the strengths of our portfolio.”

The growth in its sales of luxury and premium wines helped counter the reduced sales from restaurants, cafes, pubs and clubs caused by Covid-19 lockdowns.

In terms of its key divisions, in the Americas earnings rose 22.9 per cent to $168.3m, in Asia (dominated by China) earnings fell 14.9 per cent to $205.4m and in Australia and New Zealand earnings rose 9.7 per cent to $142.7m.

Treasury Wine shares fell 19c to close at $12.50.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout