Tax cuts and growing population to fuel $70bn festive spending spree

Despite many economic reasons not to loosen the purse strings, Australian shoppers are forecast to spend $70bn in the run-up to Christmas.

A volatile global economy, the likelihood of elevated interest rates for longer and cost-of-living pressures fuelled by stubbornly high inflation are not expected to restrain many shoppers from opening their wallets in the run-up to Christmas Eve, with an estimated $70bn to be spent at the shops by Tuesday.

However, this spending spree, up by around 2.7 per cent on last year, will be propelled by higher prices at the sales register which, along with Australia’s big leap in population, will mask a likely drop in retail spending in real terms, given the underlying inflation rate is still sitting at around 3.5 per cent.

Matthew Hassan, Westpac head of Australian macro-forecasting, believes while the economy “isn’t going gangbusters” there should be a lift in overall spending this Christmas helped by tax cuts, a growing population and household bills not worsening.

“People’s costs haven’t declined, they still have to pay the rent and pay prices, but they aren’t rising the way they were. The tax cuts we have seen coupled with a little bit of fiscal cost-of-living measures have freed up a bit more cash for households.”

Some of these extra funds have been directed to building up household savings reserves, Mr Hassan said, but some are being spent.

“It doesn’t mean cost of living has got dramatically better, but it has improved slightly and I think for consumers they can relax a bit at this stage,” he said.

The Australian Retailers Association and research firm Roy Morgan have forecast shoppers to spend $69.8bn during the lead-up to Christmas. In total, some 16.7 million Australians will buy Christmas gifts in 2024, up 1 per cent on 2023 and on average those shoppers are forecast to spend $707 each, up $61 on the average spend recorded a year ago.

The data points to $5.7bn to be spent on clothing (up 3.3 per cent), $10.8bn on other retailing (which includes categories such as recreational goods, books, cosmetics – up 4.7 per cent), and $10.6bn on hospitality (up 4.7 per cent).

Despite the heatwave blazing through most parts of Australia, festive woolly jumpers, Santa-inspired clothing and Christmas costumes for pets are proving popular as presents.

The boss of the nation’s largest discount department stores Kmart and Target, Ian Bailey, says there has been a 10 per cent jump in sales of colourful Christmas clothing, including for pets.

At Melbourne’s Chadstone shopping centre, technology is proving popular, with noise-cancelling headphones a breakaway hit.

Australia’s biggest shopping centre it is expecting 500,000 consumers to walk through its doors this week and another 180,000 to pass through over the weekend to pick up presents.

“Technology is always popular, and this year noise-cancelling headphones and those kind of devices are always popular and with warmer weather gifts like beach robes, towels or anything to celebrate summer,” Chadstone centre manager Daniel Boyle said.

And for Bunnings the better summer is delivering strong Christmas sales for BBQs, outdoor furniture and, not surprisingly, shade cloth.

Bunnings has even teamed up with Uber for the first time to offer same-day parcel delivery for selected stores and within a five-hour delivery window.

Kmart is seeing a brisk trade in Christmas-themed clothing as consumers look to decorate themselves, and their pets, as much as their Christmas table.

“Anything Christmas-related, and I know it sounds like a funny thing to say, but Christmas clothing is just getting bigger and bigger every year,” Kmart Group CEO Mr Bailey. “And I know we live in a warm country, but people buy Christmas jumpers. We’re seeing Christmas jumpers, Christmas t-shirts, things that dogs can wear, so pets are getting involved, and I think just really trying to create that Christmas atmosphere is what people are looking for.”

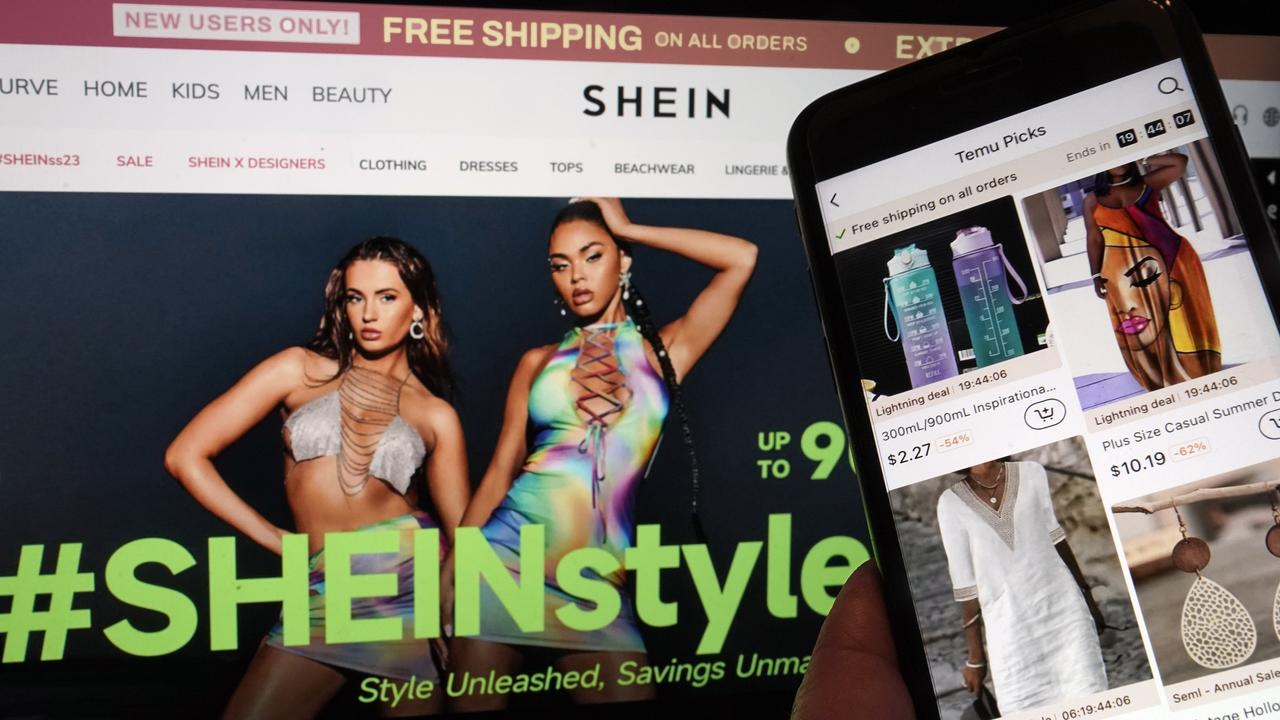

Affordability appears to be uppermost in shoppers’ minds.

“I think one thing is always true, people want to have a really wonderful Christmas, whatever is going on in their lives,” Mr Bailey said.

“So it’s a moment where everyone wants to be with friends and family, and they want to have a great time, so they’re always going to try and figure out how do I do that? But I do think the context of a more expensive world for all of us, has made life clearly more difficult for quite a number of people in our community and value has just become so important.

“I don’t think that is a temporary thing, I think it is a long-term trend because people are going to be balancing the books for quite some time.”

The holiday season this year coincides with mixed messages about the strength of the Australian economy. While the economy remains at full capacity and unemployment is at near record lows, helping to fuel spending, inflationary pressures remain stubbornly high and the cost-of-living crisis continues to cast a shadow.

The recent Westpac–Melbourne Institute Consumer Sentiment Index has reflected those conflicting forces, with the key measure of consumer sentiment falling 2 per cent to 92.8 in December, but the overall mood of shoppers seem to be ending the year in much better shape than where it started.

“Consumers continue to report solid improvements in ‘current conditions’ – reflecting assessments of finances compared to a year ago and whether now is a good ‘time to buy a major household item’ – but the latest month has seen this more than offset by a loss of confidence around the outlook, particularly for the economy,” Westpac’s Mr Hassan said.

This loss of confidence in the Australian economy flared up this week when Treasurer Jim Chalmers unveiled at the mid-year economic and fiscal outlook a $58.3bn pre-election splurge that will set in train a decade of deficits. It sparked fears that Labor’s record spending would keep inflation and interest rates high, prolonging the cost-of-living crisis.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout