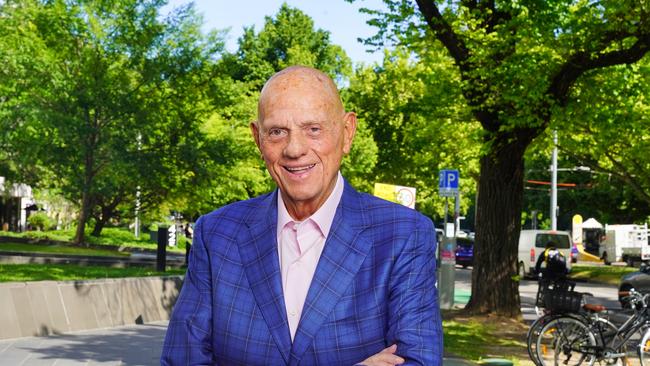

Billionaire Solomon Lew attends Myer AGM for the first time in a decade

Billionaire Solomon Lew has made a surprise appearance at Myer’s AGM to listen to new executive chair Olivia Wirth, who has pushed the purchase of his apparel brands.

Billionaire Solomon Lew has made a surprise appearance at the Myer annual general meeting in Melbourne on Tuesday, entering just before the shareholders’ meeting started to hear from new Myer executive chair Olivia Wirth.

The retail giant is preparing to finalise a deal to buy a portfolio of fashion and apparel brands from Mr Lew’s Premier Investments for more than $860m in Myer shares. The deal will result in Mr Lew emerging as the largest shareholder in Myer and joining the board as a non-executive director. It is the first time Mr Lew has attended a Myer AGM in almost a decade and since his publicly listed fashion and investment vehicle, Premier Investments, bought a stake in the retailer eight years ago.

Mr Lew took his place at the back of the auditorium and was joined by an associate. He did not ask any questions of Ms Wirth and left at the end of the AGM. He declined to comment when approached by The Australian.

On Friday Premier Investments will hold its AGM.

In October, Myer and Premier Investments reached a deal to buy fashion apparel brands Just Jeans, Portmans, Dotti, Jay Jays and Jacqui E for $864m in Myer shares and Premier to pay Myer $82m in cash.

At the AGM on Tuesday Ms Wirth reported to investors that trading in the first half of the 2025 financial year had been challenging – consistent with trading throughout 2024.

Ms Wirth said inflationary cost pressures, as well as a number of other factors, were continuing to make market conditions tougher, however trading through the Black Friday period was encouraging.

“Whilst the importance of Black Friday in the retail calendar grows each year – starting earlier and featuring greater sales activity – Christmas remains a very important trading period, and a material determinant of our first-half result,” she told shareholders.

“As we approach this period, the team remains very focused on preparations for Christmas, and we will provide the market with further detail in due course.”

Ms Wirth said the department store owner was taking immediate steps to improve the performance of its fashion brands Sass & Bide, Marcs and David Lawrence. This would include resetting Sass & Bide as a concession and online model, closing unprofitable, stand-alone retail stores, and restructuring Sass & Bide’s support operations to remove duplication with Myer Group functions. Ms Wirth said when she took on the role of chair, the board commenced a comprehensive strategic review to increase Myer’s profitability and drive sustainable earnings growth.

“Our strategic vision is to create a leading Australian retail platform, by identifying opportunities to deliver a step-change in Myer’s market position, and generate substantial strategic and financial benefits to create value for you, our valued shareholders,” she said. “To achieve this, we are focused on six key strategic priorities. We want to appeal to new and underpenetrated customer segments seeking more fashionable choices and an easy, enjoyable shopping experience.

“That means having the right product at the right time, and curating the best mix of private label, national brands and concessions across our categories.

“We want to expand Myer’s omni-channel and online capabilities, sales and offerings. If you look at the Australian apparel and beauty sectors, growth is predominantly coming from online channels. Given our store footprint and e-commerce platforms, Myer is well placed to capitalise.”

She said there was “huge potential” in unlocking further value through its Myer One loyalty scheme and creating a loyalty ecosystem which facilitates cross-selling, a greater share of the customer wallet and lifetime value.

She argued in favour of the proposed acquisition of Just Jeans, Jay Jays, Jacqui E, Portmans and Dotti from Premier Investments saying the deal would be “transformational” for Myer.

“We can fast track our strategic priorities by leveraging our complementary strengths to create one of the leading retail platforms across Australia and New Zealand. The strategic and financial rationale of this transaction is compelling,” Ms Wirth said.

“It significantly enhances our scale to extract growth and operating leverage benefits, and unlocks significant latent potential by bringing apparel brands into Myer’s omni-channel ecosystem.

“With a combined store network of 783 stores and more than 17,300 team members, the combined Myer Group also creates the opportunity to leverage Myer’s market-leading Myer One loyalty program and e-commerce platform across an enlarged and engaged customer base.

“Apparel brands’ customer base addresses key target customer demographics for Myer and its brands, expands Myer’s exclusive and private-label portfolio and strengthens our brand management capabilities.”

If the deal is approved by Myer’s and Premier Investments’ shareholders, the Myer shares Premier Investments receives as part of the deal – as well as its existing 31.16 per cent stake it currently has – will be distributed to Premier Investments shareholders.

This will result in Premier Investments ceasing to be a shareholder in Myer. It is expected that Century Plaza, Mr Lew’s private investment vehicle, will become Myer’s largest shareholder with a pro forma shareholding of 26.8 per cent. Myer shares closed up 1.25 per cent at $1.22.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout