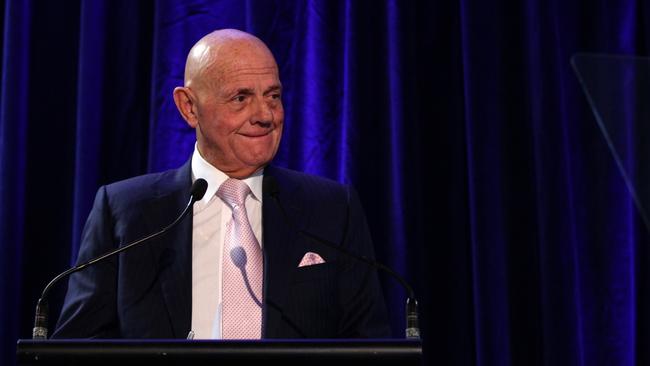

Solomon Lew’s Premier Investments beats analyst guidance for first half earnings

Billionaire fashion emperor Solomon Lew has launched a thinly-veiled attack on the Albanese government, saying it must help struggling households.

Billionaire and chairman of fashion empire Premier Investments, Solomon Lew, has launched a thinly-veiled attack on the Albanese government, saying it must “put its hand in its pocket” and help struggling households.

Mr Lew said the failure to lower utility bills, as promised by Labor when in opposition, has caused hardships for many Australians who now need fuel excise relief and tax cuts to help ease cost-of-living pressures.

Mr Lew, whose fashion empire includes Smiggle, Peter Alexander and Just Jeans, said the Albanese government had to act soon.

“My view is there needs to be a reprieve at this point in time. I think families are doing it tough, they have had 13 interest rate rises, every household must be under pressure. There’s been no cut in the utilities bills as promised and that has created a hardship for the general community,” Mr Lew said at the Premier Investments AGM on Friday.

“I’d like to see the government put their hand in their pocket and do something for the people. Obviously I would be very happy to see the federal government do something for the consumer by reducing excise tax on fuel, by having a special package of tax cuts for the working class. I think that’s very important.”

Cost-of-living pressures are becoming a growing source of pain for households as well as the federal government, which is increasingly being blamed for not doing enough to help struggling households who face rising bills, dwindling savings and shrinking disposable income – much of which is being driven by interest rate hikes from the RBA.

Shoppers were out in force over the Black Friday weekend sales campaign, with Mr Lew telling his shareholders on Friday that the company’s stable of retail chains delivered a record sales result for the Black Friday trading week, with the group to report earnings of around $200m for the first half of 2024.

Although that is above analyst expectations of around $180m, the profit now slated for the retailer’s businesses is down from $221.8m recorded for the previous corresponding period in 2023.

However, the upbeat outlook provided by Mr Lew and the performance of his fashion and apparel chains through Black Friday and Cyber Monday comes as many other discretionary retailers have reported sliding sales and more difficult trading.

The market reacted positively to the profit update and stronger than expected earnings target for the first half of 2024, with Premier Investments shares rallying 69c, or 2.83 per cent, to close at $25.11.

Addressing shareholders in Melbourne, Mr Lew said the retailer was performing well despite the growing economic headwinds.

“The first half of fiscal 2024 commenced against a backdrop of a challenging general discretionary retail environment,” Mr Lew said.

“Consumers are facing increased cost of living pressures with rising interest rates and inflation. Pleasingly, Premier Retail delivered a record sales result during this year’s Black Friday trading week.”

Mr Lew did not provide a sales update in his chairman’s address, so it is unknown if Premier Retail’s sales have risen or fallen since the company last updated the market at its full-year results in September. Later he said it wasn’t the normal practice for Premier to release sales updates at the AGM.

Mr Lew said Premier Investments expected its Premier Retail arm to post earnings before interest and tax of around $200m, although much would depend on the outcome of the crucial Christmas trading period that had now begun. The weather would also play a part.

“We have two months of trading (ahead), our best trading period, we have 44 per cent of our trade to go for this half, there is 24 days to Christmas … then we have the Boxing Day sale, then new year sale and January sale and back to school.

“And then depending on the weather, how long the summer season will trade out for, and if we are expecting a longer hotter summer then I think you will find there will be more margin in the sales. Look, it’s early days.

“The group is well prepared for this critical trade period, through delivering wanted product and value for our customers across all channels and markets.”

Turning to the company’s performance in 2023, Mr Lew said the group’s retail portfolio, consisting of seven brands, contributed earnings of $356.5m, up 6.4 per cent on 2022 and up 113 per cent on pre-Covid 19 results.

This strong profit, he said, was delivered off a record $1.644bn in global sales for 2023, up 9.7 per cent with record sales results for its sleepwear chain Peter Alexander and a record Smiggle global sales result.

Mr Lew said Premier Investments had maintained a strong balance sheet to end fiscal 2023 with cash on hand of $417.6m, a 25.6 per cent stake in kitchen appliances maker Breville worth $829.3m and a 25.79 per cent stake in department store owner Myer worth $137.7m.

Recently Premier Investments has upped its stake in Myer to 28.8 per cent and Mr Lew told his shareholders he welcomed efforts to refresh the Myer board, which had seen the recent appointment of businessman and investor Gary Weiss and former Qantas loyalty boss Olivia Wirth to the board.

Previously Mr Weiss was a long-serving director of Premier Investments.

He said Premier Investments in September had announced the appointment of Andrea Weiss to the board as a non-executive director, Premier’s first overseas director.

There was no update on the strategic review launched in August that could possibly see parts of Premier Investments’ business demerged or sold. Following the sudden departure of Premier Retail chief executive Richard Murray in August the company is being run by its chief financial officer John Bryce. Mr Lew said at this time Premier Investments was not looking for a new CEO.