Green bond market set to double over the next year: AXA

The global green bond market is set to double to more than $US2 trillion over the next year, according to Jerome Broustra of AXA Investment Managers.

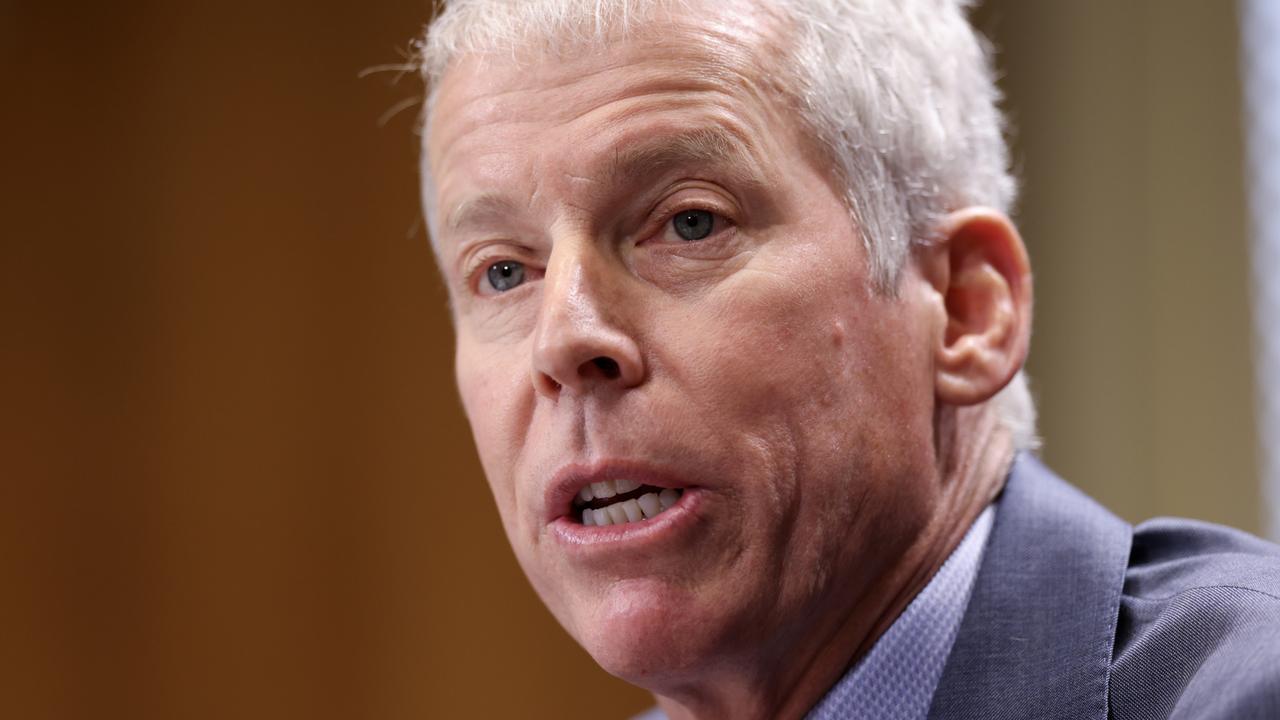

The global green bond market is set to double to more than $US2 trillion ($3.1 trillion) over the next year as investors look for more opportunities to decarbonise their portfolios, according to AXA Investment Managers’ global head of multi-asset solutions, Jerome Broustra.

Speaking on a visit to Australia, the Paris-based Mr Broustra said Australian institutional investors were increasingly interested in green bonds as the market was becoming much more liquid and transparent.

At the same time major banks, including Westpac and National Australia Bank, and some state governments were issuing their own green bonds.

“The market is almost doubling in size every year,” Mr Broustra said. “There is a growing demand from clients who see them as a great opportunity to reduce their carbon footprint.

“Interest in green bonds is picking up in Australia as they are transparent instruments which are easy to invest in.

“We feel there is a strong commitment in Australia from investors who are eager to consider investing in green bonds.”

He said that as the market became more sophisticated, it was much easier to measure the impact of investing in the bonds, delivering on commitments to a lower carbon economy.

“We are seeing a lot of traction in this as an asset class,” he said.

First launched by the World Bank in 2008, green bonds raise funds for projects which have environmental benefits, and support the transition to a lower carbon economy.

The funds can be used for renewable energy projects, green buildings, cleaner transport and investments by companies and governments in green energy and decarbonisation.

Mr Broustra said there was now a more diverse range of green bond issuers as concern about the need to reduce carbon emissions and adapt to climate change rose. Initially focused on utilities and quasi-sovereign entities like the World Bank and US government-owned mortgage arm Fannie Mae, the issuer market is now expanding to governments, corporations and banks.

New players such as healthcare companies are also issuing green bonds.

“The market is much more diversified than when it was launched,” he said.

He said green bonds were seen as “one of the fastest and most efficient instruments to help the transition to a more sustainable, lower carbon economy”.

Most current issuers of green bonds are in the US and Europe.

But Mr Broustra said AXA was watching the development of the market in Australia through banks and state governments.

The Victorian government was one of the pioneers in Australia, issuing $300m in green bonds in 2016 to finance investment in transport, low-carbon buildings, renewable energy and water.

The Treasury Corporation of Victoria issued $2.5bn in green and sustainability bonds over the last financial year.

Bloomberg has estimated that the Australian green bond market will hit a record of $4.6bn in new debt sold this year.

The NSW government says there is more than $5bn in its sustainability bonds on the market.

Meanwhile, National Australia Bank announced in July that it was supporting the NBN to issue its first green bond to help reduce the network’s emissions and transition to a low-carbon economy.

Mr Broustra said it was important that investors bought green bonds through reputable companies that were monitoring the bonds and their issuers to ensure they delivered on their promises. He said there was a risk of greenwashing unless there were strict programs to monitor the use of the bonds, including third-party verification.

He said AXA had “key performance indicators” for green bonds which it could track.

Mr Broustra said investors were becoming more confident about green bonds once they understood how they worked.