Should you invest in a climate transition ETF?

Even a bear market can’t stop new exchange-traded funds hitting up investors, despite the funds seesawing between gains and losses.

The rise of thematic exchange-traded funds has brought mixed results for investors, with some – including crypto ETFs – performing dismally for their short lives.

Are energy transition ETFs any different? This emerging theme is no short story – the transition to net zero has a couple of decades to run and, according to NAB chief executive Ross McEwan, is the “single biggest economic opportunity for Australia”.

So far, ETFs focused on the transition on the market have seesawed from early gains to losses, in a warning to investors that this is not a market for the faint-hearted, even if it does prove to be a good long-term investment.

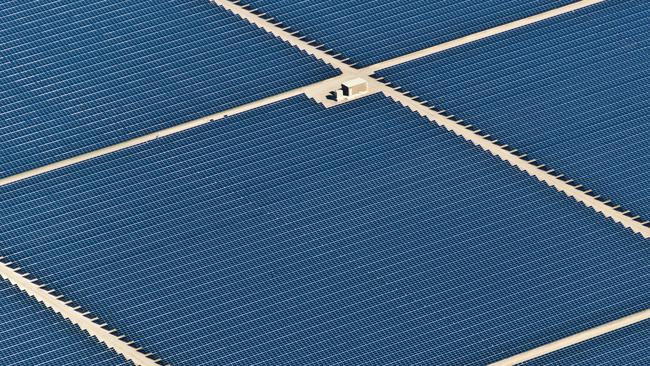

Take BetaShares’ ASX-listed solar ETF. The fund, launched in June, provides exposure to a portfolio of leading global companies in the solar energy industry. Among its holdings are solar panel maker First Solar; solar microinverter manufacturer Enphase Energy and Tesla.

Between launch and September 30, TANN climbed close to 14 per cent to $12.60 (it hit a high of $14.43 on September 9).

Since then it has tumbled 10 per cent, in a worrying sign for investors. For the year to date TANN is now up just 3.9 per cent.

BetaShares’ uranium ETF has fared slightly better after attracting about $20m in funds since June. It is down 4.3 per cent over the past month but is up 5.7 per cent year to date. This is after it climbed 20 per cent for the three months to September 30, before paring those gains.

VanEck’s Green Metals ETF, meanwhile, which launched just under a year ago, has tumbled 25 per cent from its listing price.

The latest entrant to the energy transition space, VanEck’s carbon credit ETF, hit the market just over a week ago.

The ETF tracks the ICE Global Carbon Futures Index, which sources carbon credit futures prices from the four largest carbon markets and emission trading schemes, including the EU’s emissions trading scheme and the Western Climate Initiative.

VanEck has launched the fund just as scrutiny on carbon credits is intensifying – critics have called the market a sham – VanEck’s Asia Pacific chief executive, Arian Neiron, lauds the exposure to global carbon credit futures and said the fund had received “strong interest” from investors.

“XCO2 has traded half a million in its first week in an environment where risk appetite is low due to investor sentiment being subdued,” Mr Neiron told The Weekend Australian.

Investors and advisers are still in the discovery phase when it comes to carbon credit futures, he said. “The appetite is there but there is a learning process that has to be undertaken …. While carbon credits and carbon pricing instruments have been in existence for decades offshore, Australians are only now getting some exposure.”

Melbourne-based financial adviser James McFall, of Yield Financial Planning, recommends ETFs to clients because of the low cost, adding that thematic ETFs are a good way to play the various themes of the market.

“Energy is a thematic that is strong at the moment. And in Australia, we don‘t actually have enough of them (thematic ETFs), in my view,” he said.

“The overall stock market is both the best and the worst of everything, whereas thematic ETFs provide an opportunity to pick the eyes out of it, to have an overweight position to the better performing areas and/or to go underweight the areas that you don‘t think are going to do well.”

Stockspot investment manager Marc Jocum, meanwhile, urges caution. For Mr Jocum, thematic ETFs do have a place in a portfolio, but at the edges only. “The core of your portfolio should be invested in very low-cost index tracking ETFs that are very simple and vanilla,” he says.

“Our advice to clients is you can obviously allocate a small portion of your portfolio to (thematic ETFs), but there‘s a lot of risk involved in it.”

While noting thematic ETFs have higher fees than the broader index-hugging funds, Mr Jocum predicted that this segment of the market, particularly climate-focused ETFs, “will grow exponentially” over time.

“The ETF market is quite saturated at the moment. It’s the innovative products out there that will be launched.”

But a word of warning: by the time a thematic ETF hits the market, it’s often at the point of peak hype in the theme, he says.

“You’re really making a bet when it comes to a lot of these thematic ETFs on which one’s going to be the winner,” he adds.

“That’s really hard.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout