Westpac forecasts 7 per cent rise in house prices for 2023

Westpac has jumped on the bandwagon and is forecasting rising house prices for 2023 as the interest rate environment improves and demand outstrips supply.

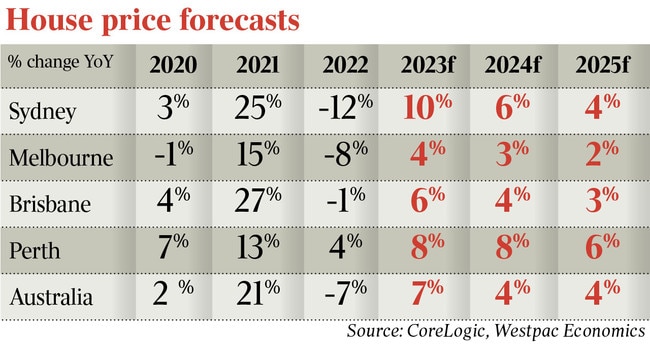

Westpac has lifted its forecast for national house price inflation to 7 per cent for 2023, joining the Commonwealth Bank and National Australia Bank in backing a more optimistic outlook on interest rates and economic growth.

The forecast comes after the bank predicted a flat 2023 in April. Westpac expects a 4 per cent price rise in 2024.

Westpac senior economist Scott Haslem said the outlook looked “less challenging” as interest rates were set to remain on hold for an extended period and start to fall in the second half of 2024.

“The growth outlook also looks a little less threatening, with labour market conditions holding up better than expected and rate rises now expected to deliver a milder hit to disposable incomes,” he said.

“The consistent picture from prices, turnover, auction activity, new finance approvals and sentiment is of a broadening recovery, albeit one that is being led by prices with the volume of activity and demand still relatively subdued.”

Westpac said capital city house prices had risen 4 per cent so far this calendar year, retracing much of the 9.7 per cent fall over the previous 10 months, with a 5.2 per cent rise from the low point.

“Most notably, gains have been well-sustained despite further rate hikes from the RBA in February, March, May and June,” Mr Haslem said.

He said the impetus for gains looked to be mainly coming from a sharp acceleration in migration inflows and an associated tightening in rental markets, all against a backdrop of low levels of ‘‘on-market’’ supply.

In July, NAB forecast property prices would rise by 4.7 per cent in 2023 and around 5 per cent next year.

In May the CBA said we could expect home prices to rise by 3 per cent this year and 5 per cent in 2024.

In April, ANZ – which previously predicted that house prices would slump by 11 per cent this year across Australia – revised its forecast to flat for the rest of 2023 and rising 5 per cent in 2024.

CoreLogic’s executive research director for the Asia-Pacific, Tim Lawless, said forecasts had been on a “bit of a roller coaster ride”.

“But the reason we’re now seeing home values rising does not come back to the normal factors we usually look for in Australia – interest rates coming down or more credit and more fiscal policies favouring first-home buyers,” he said.

“None of that has really happened. What’s behind it is the imbalance between supply and demand.

“Listing numbers have been remarkably low in places like Brisbane and Adelaide and have been tracking 40 per cent below average. Then you have demand generally at average, if not higher than average.

“It’s basically Economics 101 – supply and demand.”

A recent PropTrack Property Market Outlook Report forecast property prices nationally were set to increase a further 2 per cent to 5 per cent by the end of 2023, following a 2.3 per cent rise over the first half of the year.

In the capital cities prices are expected to increase 3 per cent to 6 per cent, with Hobart and Darwin to be the only capitals to see prices fall over the remainder of 2023.

PropTrack director of economic research Cameron Kusher said house prices in 2024 would either be flat or rise by 3 per cent. “But there are so many moving parts with all of this,” he said.

“If we did get interest cuts next year it could stimulate higher prices. Another thing that could drive higher prices is if there was a relaxation of the mortgage serviceability buffer, which is currently 3 per cent.

“On the flip side the things that could drive prices lower or a more moderate increase is more stock on the market, more forced sales and a broader economic slowdown if more people are out of a job.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout