Sydney property prices following historical cycles, says Core Logic

Sydney house price falls might be sticking to the historical script, but the affordability job is not done, says the property industry.

Market watchers need not despair at the recent downturn in Sydney property prices that are just mirroring similar trends seen in the past 40 years, according to CoreLogic’s research head Tim Lawless.

Since 1984 several periods have experienced the recent peak-to-trough fall in prices of 6.2 per cent.

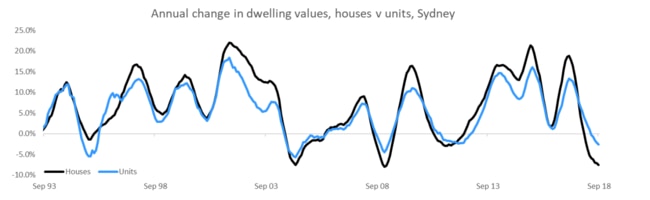

Mr Lawless said that Sydney’s housing values are falling at a steeper rate than unit values, something that’s likely to be due to affordability. Younger buyers are benefiting from lower prices as they continue to enter the market.

New data from CoreLogic shows “first home buyers have responded to stamp duty concessions and affordability is now improving.

“However the deposit barrier remains a substantial hurdle for this segment of the market,” Mr Lawless said.

But falling prices are not answer to Sydney’s affordability crisis says Steve Mann, chief executive of Urban Development Institute of Australia NSW.

“The underlying demand for housing remains strong, so we need the state government to release more land, with infrastructure funded by a fairer contributions scheme, delivering more affordable housing to the market” Mr Mann said.

“It’s not good enough to look at this year’s fall in prices and say the job is done. Finance is tight and there are still too many young families in Sydney locked out of the market.”

The number of investors in the market has fallen more than 10 per cent from the peak on 54.8 per cent in 2015 to 41.7 per cent at present.