REA Group’s faith in property uptick music to investors’ ears

Digital advertising company REA Group has boosted its dominance of the local market with its confidence of a recovery.

Digital advertising company REA Group has boosted its dominance of the local market even as it faces one of the toughest ever property listing environments, with its confidence about a recovery next year prompting investors to back the stock.

The company’s shares jumped 5.6 per cent to hit $96.64 yesterday as the company said it was seeing an uptick in inquiry despite the tough environment for listings expected to drag on this year.

The group cautioned that the market remained challenging as it released solid full-year results, with Australian residential listings last month almost 20 per cent below July 2018, and it said that listings for the first half of this financial year were likely to be lower than the same half last year.

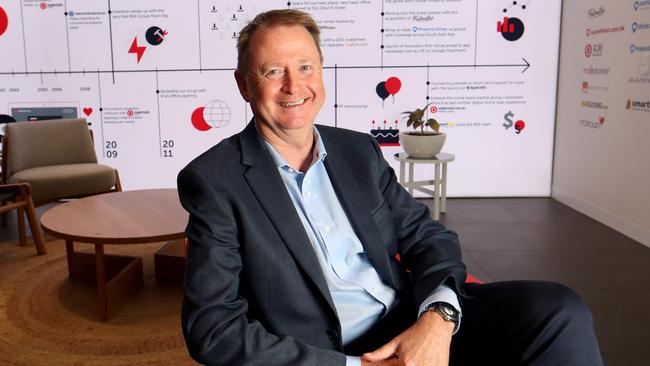

“A number of factors are now in place to support a market recovery, including lower interest rates and an improved lending environment. Coupled with a very healthy increase in buyer activity, it signals an eventual recovery of listing volumes,” REA Group chief executive Owen Wilson.

On the ground, he said, buyers were “definitely back” and banks were back lending, giving buyers more capacity to purchase in the wake of prudential changes to loan assessment rules.

“We feel confident it will come back at some stage but we’re assuming it will be negative for the half,” Mr Wilson said.

Investors bought the recovery story as REA will also benefit from price increases that came in last month and from new product offerings locally.

As well as four local real estate websites, the company also operates websites in Europe, Asia and the US, helping to offset tough conditions locally. REA said there had been listing declines of 31 per cent in Sydney and 29 per cent in Melbourne compared to July 2018, but this was partly because there was a more favourable environment at that time.

Investors accepted the group’s forecast that revenue growth would be heavily skewed towards the second half and that it would find ways to “significantly reduce” cost growth this financial year.

Growth in revenue will top cost growth this year but REA cautioned this would not be the case in every quarter.

REA’s core operations generated revenue growth of 8 per cent to $874.9 million, and an increase in earnings of 8 per cent to $501.2m.

Reported net profit of $105.3m showed a 58 per cent drop, reflecting one-off deals in both periods.

Revenue growth was driven by an 8 per cent lift in the Australian business, which the company attributed to its “resilient” residential and developer businesses, that faced challenging market conditions nationwide, particularly in the second half.

The results also reflect the full-year contribution from the Hometrack business, with Mr Wilson flagging expansion in financial services, despite lower revenues than last year when lending was tight and the property market was subdued. While the federal election result and the changes in the lending market had reduced uncertainty, Mr Wilson cautioned that the decline in mortgage settlements was expected to continue into the first half of fiscal 2020 in line with the listings environment.

Mr Wilson pointed to new products and expanded take-up of higher margin advertising as driving continued revenue growth despite significant declines in listings and new projects

REA’s Asian businesses contributed revenue of $48.6m and earnings of $7.4m.