Property prices fall as regions accelerate, says PropTrack

All capital city property prices have fallen from the boom time peaks as regional markets record the fastest quarterly falls in a decade.

All capital city property prices have fallen from the boom time peaks as regional markets record the fastest quarterly falls in a decade.

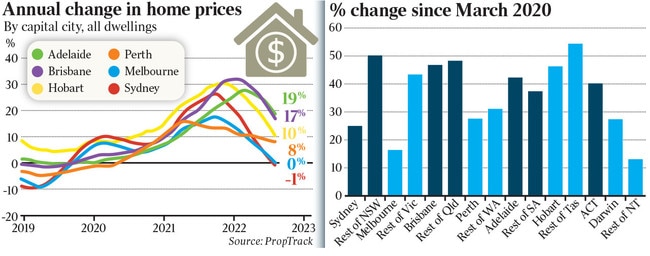

PropTrack’s latest Home Price Index has revealed housing prices fell 0.39 per cent nationally through August. Capital city prices came back 0.42 per cent over the month, led by declines in Sydney, Melbourne and Hobart.

Regional costs contracted 0.34 per cent, culminating in a 1.2 per cent decline over the quarter – the greatest three-month change since 2011. Interest rate increases and the resulting fall in borrowing capacity for most buyers is the main reason for prices coming back, said PropTrack economist Paul Ryan. While falls have not accelerated since the market turned around in the middle of the year, he believes the impact of rate changes is lagged.

“We’re seeing persistent price all across the country now, pretty much with no exception,” Mr Ryan said. “We still really haven’t seen the effect of interest rates increasing in early August, except through expectations because it takes time for those higher interest rates to affect people’s pre-approvals and how much they can borrow and bid.”

The Reserve Bank’s swift movement to combat inflation has caused interest rates to rise at the fastest pace since 1994, with the expectation of a further percentage point increase by the end of the year.

Adelaide’s resilience against falls came to an end through August, recording a fall of 0.12 per cent, the first fall since the boom. Falls in Sydney (down 0.49 per cent) and Melbourne (down 0.47 per cent) were edged out by Hobart (down 0.56 per cent). Elsewhere, Brisbane fell 0.32 per cent, and the ACT was down 0.39 per cent.

The only two places that recorded gains were Darwin and Perth, up 0.14 per cent and 0.04 per cent respectively.

All broader regional areas are also falling, except in South Australia. Mr Ryan does not believe the change is attributable to people’s preferences for lifestyle locations changing but rather a reflection of the massive pandemic price gains.

“We definitely saw prices increase more in regional areas and capital cities over the past few years,” the economist said. “It will be interesting to see if, through this cycle, the regions fall more than capital cities after they saw the biggest upswing … we think that all of those preference shifts and that strong demand that pushed regional areas up over the past few years will mean they won’t fall as much over the next year or two as well.”

Sydney and Melbourne’s prices are now about 4.5 per cent back from their respective peaks in March and April. PropTrack expected the largest falls to hit the country’s two largest property markets as a result of reduced borrowing capacity preventing buyers to buy relatively expensive homes, Mr Ryan said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout