Property falls short on price growth

The common belief that property prices double every 10 years has been blown away.

The common belief that property prices double every 10 years has been blown away, with weak economic growth and a building boom keeping a lid on values.

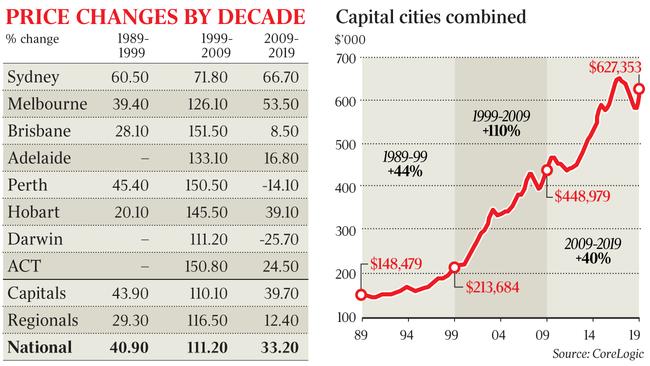

Combined capital city prices showed a lift of just a third since 2009, despite several significant cycles of gains through the 2010s, culminating in Sydney prices cracking the $1m median in 2017.

Yet property values in the city grew only 66 per cent in the 2010s, according to data from property researcher CoreLogic.

National property prices rose just 33 per cent in the past decade, a huge turnaround from the 2000s when prices climbed 110 per cent. The trend of lower capital gains is not likely to change, says CoreLogic director of research Tim Lawless, as climbing household debt and clipped wage growth puts pressure on the market. “It is highly unlikely prices will double going forward, given the elevated debt position of households,” he said.

“Also, with wages growth constrained and the ratio of housing values to household incomes once again worsening, it’s hard to see households being able to leverage as much as they could previously.

“Economic growth is forecast to remain below trend for the next couple of years at least, implying lower-than-average jobs growth and persistently soft wages growth, which is another factor likely to keep a lid on housing prices.”

Weaker economic conditions following the 2008 global financial crisis, a large number of new properties on the market that helped relieve undersupply pressure and a restricted lending environment helped put a cap on prices through the 2010s.

Huge growth through the 2000s also came off the back of lower prices in the 1990s.

Melbourne prices were up 53.5 per cent between 2009 and 2019. Hobart rose 39.1 per cent, while modest gains were reported in Adelaide (16.8 per cent) and Brisbane (8.5 per cent). Perth and Darwin prices went backwards by 14.1 per cent and 25.7 per cent.

The shift means investors may need to re-evaluate their expectations around the return they receive from investment properties. As capital gains fail to meet the expectations of some, yields fell to 3.8 per cent nationally through 2019, well below the 5 per cent returns that were a given in the 1980s and 90s.

Investment management adviser Escala Partners chief investment officer Tracey McNaughton said residential property could still be an attractive investment as part of a diversified portfolio.

“The key is buying right and balancing the inherent risks of the market,” she said. “It is a bias Australians have but you should not be investing in residential property purely for tax reasons either.”

Melbourne financial adviser and founder of Verse Wealth, Corey Wastel, said getting the right advice was the difference between a purchase with good capital gains and yields or a lemon.

“If you are buying property, engage a buyers advocate and remember it is a long-term investment. It is not about cash-flow gains in the short to medium term, it is about capital growth,” Mr Wastel said.

Unfazed by real estate price rises or falls, Australis music group chief executive Trevor Morrow and his wife, Liz, are selling their holiday house in the scenic NSW village of Burrawang, south of Sydney.

“We love the area and bought here five years ago, but we work fairly hard and could not get here as often we would like,” said Mr Morrow, adding that he loved the area and wanted to buy a property with even more acreage.

The couple expect at least $1.8m for their four-bedroom Burrawang house set amid historic buildings and near the village pub. The selling agent is Sandie Dunne of Drew Lindsay Agency.