Office vacancies rising as Covid lockdowns drive corporates to shift away

The largest companies in Australia are making tough decisions about how much space they need, driving up office vacancies and putting CBDs at risk.

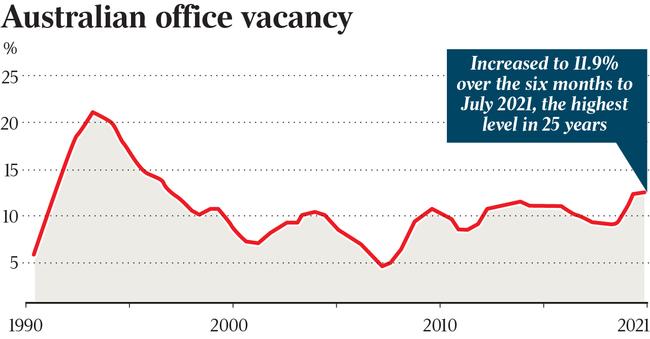

The nation’s office markets have been slugged by their highest vacancy levels in a quarter of a century with extended lockdowns in major capitals derailing signs of recovery and prompting large companies to weigh up cutting space.

Big companies ranging from Atlassian, National Australia Bank and Telstra have indicated they will adopt more flexible working styles, while the economic slowdown in NSW driven by Covid-19 restrictions will also hit demand for space.

The office vacancy rate hit 11.9 per cent nationally, with Melbourne the laggard market after repeated lockdowns, and uncertainty is now looming over Sydney as workers face a long period out of the CBD. City landlords are already offering hefty incentives to keep tenants, with some going to more healthy buildings.

But the market is awaiting moves by bigger companies that are confronting the reality that staff are demanding more days at home. At the same time, they want to cut office space costs while also being ready for an economic recovery next year.

The Property Council said capital city office markets had shown resilience in the face of the impacts of Covid-19 over the first half of 2021, with the Melbourne CBD the outlier as demand for office space fell by the largest level on record.

The nationwide vacancy rate for all office markets increased only slightly from 11.6 per cent to 11.9 per cent in the first half, according to the PCA’s latest report, which measures the levels of leased space, not worker occupancy of office space.

For now, the Sydney CBD is deserted, with Brisbane also locked down and Melbourne only slowly recovering. Canberra, Adelaide and Perth have been less affected by lockdowns.

Overall, CBD vacancy edged higher, from 11.1 per cent to 11.2 per cent. Non-CBD markets recorded a small vacancy increase, from 13 per cent to 13.6 per cent.

Property Council chief executive Ken Morrison said the numbers reflected solid demand for offices amid the disruptions of the pandemic. “Australia’s office markets have shown remarkable resilience over the past six months, with overall aggregate vacancy levels only increasing slightly,” he said.

Leasing deals were starting to happen and leasing adviser, Lpc Cresa director Julian Kurath, said there was more confidence in the market. But he said the latest lockdowns confirmed the need to reposition.

Mr Kurath said smaller tenants had been quickest off the mark, but larger companies were also working to cut spaces. “It’s now moving up into the middle,” he said. “They’re drawing a line in the sand to say this is how we’re going to go, as opposed to just the little guys doing that.”

The lockdowns put a spanner in the works of landlords hoping for a quick bounce back, but agents are still optimistic the leasing market will come back once vaccines are rolled out.

CBRE head of office leasing, Pacific, Mark Curtain, said that, notwithstanding the recent lockdowns in NSW and Victoria and their expected impact on activity in the second half of the year, the national leasing market rebounded strongly in the first half.

“Given the extent of the ongoing lockdown in NSW, we anticipate the second half of 2021 inquiry and deal volumes will be impacted, but to what degree is hard to determine at this point,” Mr Curtain said. “We remain optimistic that the number of unforeseen lockdowns will diminish as vaccination rates reach targeted levels across the population, resulting in more stable conditions in late 2021 and moving into 2022.”

Colliers said new inquiries for office space in major markets were steadily increasing as smaller businesses regained confidence. The pain is at the big end, with a 29 per cent reduction in inquiries from the 3000sq m-plus size segment.

Colliers managing director of office leasing Simon Hunt is optimistic the NSW capital will come back. “The current Sydney restrictions may delay some decisions in the near term. However, the momentum gained over the first half of 2021 and the confidence of overall market conditions means that this is more of a momentary delay as opposed to any activity being placed on hold indefinitely,” Mr Hunt said.

The Melbourne CBD and metro markets had an increase in inquiry numbers for a smaller amount of space, year-on-year.