Mum-and-dad landlords sell up amid housing reforms

A spike in the investors selling up comes as national cabinet flagged a strengthening in rental rights across the country.

Thousands of mum-and-dad landlords are selling off their rental properties in response to state Labor governments’ strengthening of renter protections and increasing interest rates, with the threat of more changes on the horizon.

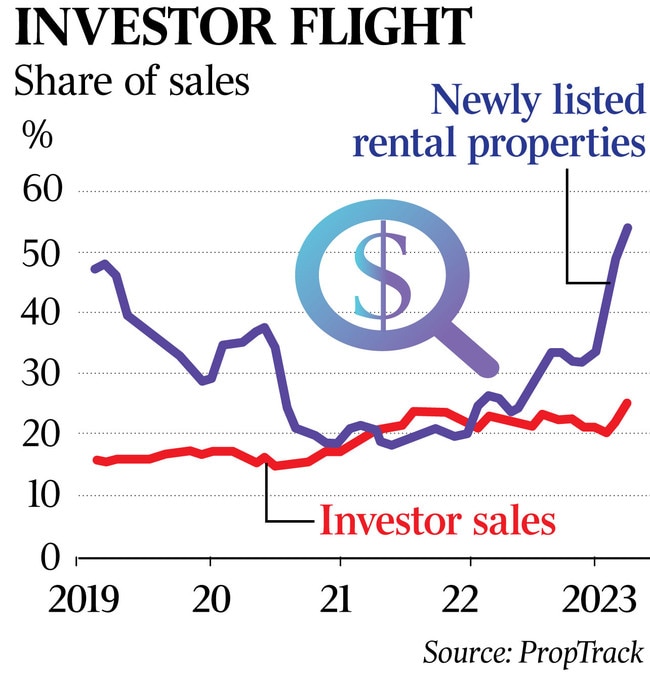

New data from PropTrack has revealed a spike in the number of investors cashing out of the market, with sales remaining notably higher than pre-Covid levels for the past two years.

It comes as Anthony Albanese secured the support of state and territory leaders on Friday for changes to strengthen “renters’ rights” on a national level and committing an extra $2bn in the May budget for 7000 more affordable homes.

The nation’s housing ministers will present policy options to help renters by the end of the year, with the group set to examine programs regulating landlord decisions on the size and frequency of rent increases.

“What will occur over coming months is looking at different programs that are in place … Some of those are around the frequency of any rent increase that can occur. In at least one jurisdiction’s case, it’s also over the amount that can occur of any increase,” the Prime Minister said in Brisbane.

Leading investors and real estate experts on Friday warned Mr Albanese that governments had disincentivised “demonised” landlords who provide the markets with millions of homes, and further change threatens to shake confidence in the wider property market.

Fewer landlords have been in the buying market since 2017 when numbers peaked, which has caused the rental pool nationally to shrink. With fewer homes and heightened local and migrant demand, asking rents in Australia’s capital cities have surged $80 a week on average in the past 12 months to sit at a weekly rate of $520 as vacancy rates hover at 1.5 per cent – half of what is considered a “healthy” level.

PropTrack’s director of economic research Cameron Kusher said it had become much harder for investors to park their money in property.

“Investors are charged higher interest rates, borrowing capacities have reduced quite dramatically because interest rates have risen so fast so quickly and it is generally less attractive for investors,” he said.

“Rental yields are rising but are generally still at low levels, property prices are falling and, with higher interest rates, risk-free returns are higher than they have been in a decade as well.”

Landlords have become the main target of government policies aimed at providing relief to tenants facing rapidly rising rents and intense competition.

National cabinet on Friday agreed to develop a plan with housing ministers from each state and territory to strengthen housing growth and rental rights across the country, while also increasing housing supply.

Founder of investment buyers agency Propertyology Simon Pressley said investors were sick of being demonised by governments and were choosing to put their money elsewhere. “Investing in real estate is an enormous financial outlay, so you’re not going to put out this big financial decision unless you’ve got confidence,” Mr Pressley said.

“We’ve had eight years of a heck of a lot of regulatory change, all of which has been targeted at causing harm to the investor.”

Real Estate Institute of Australia president Hayden Groves agreed that a strategically aligned approach to tenancy laws between jurisdictions was productive but urged an examination of supports rather than targeting landlords. “There’s been successive housing policies that are all looking to disincentivise this very, very important cohort of the investor pool that is continuing to supply Australians with homes,” he said.

The Greens put the removal of negative gearing and two-year rental caps back on the table this week by withholding support for the federal government’s $10bn housing bill. Over the past two years, state governments have sought to introduce rental reform. NSW will soon introduce no-grounds evictions, following Victoria, which introduced the same policy in 2021 alongside a suite of changes. Queensland also recently brought in once-a-year rental increases after rolling back proposed land tax changes.

Mr Pressley said: “We don’t go and punish the farmers because the cost of the produce goes up; the cost of rent has gone up because we don’t have enough supply of rental accommodation.”

Federal Housing Minister Julie Collins also announced on Friday that May’s budget would look to increase housing supply, with extra funds and taxation changes for the development of build-to-rent projects, which was supported by the Property Council of Australia and Master Builders Australia.

Governments have been selling off social housing stock for decades, said Mr Kusher.

In the 1981 census, a quarter of renters were living in a government-provided home, with that number falling to 8 per cent today. He said increased housing stock – whether privately owned or commercial – would help to ease the escalation in rent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout