Low rates, stock to push housing surge

House prices in Sydney, Melbourne forecast to keep surging next year by up to 10 per cent.

Property prices in Sydney and Melbourne are forecast to keep surging — up to 10 per cent higher — next year, after charging in the final week of auctions for 2019.

On the back of low interest rates, constrained supply and buyers still thinking they’re getting a bargain following the price collapses of two years ago, there is still room for values to increase markedly in the southern capitals, according to property economists and real estate insiders.

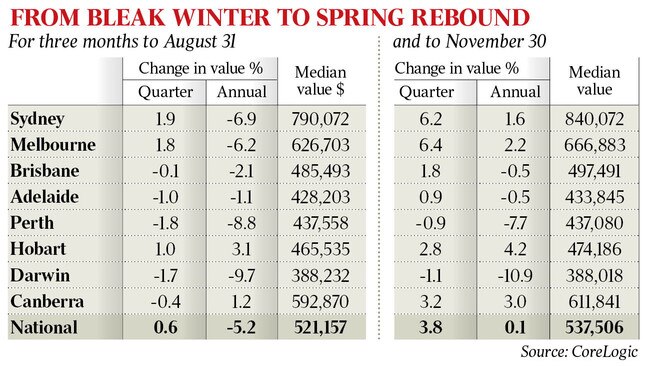

In the last quarter, property prices rebounded in Sydney (up 6.2 per cent to a median value of $840,072) and Melbourne (up 6.4 per cent to a median of $666,883), while Brisbane (up 1.8 per cent to $497,491) and Adelaide (up 0.9 per cent to $433,845) have experienced subdued growth.

The strength of the market continued to defy the usual pre-Christmas slump, with 2750 homes taken to auction in the nation’s capital cities last week, 14 per cent higher than in the same period last year.

Clearance rates slipped under 70 per cent — to 69.2 per cent — but were still much higher than this time last year, when only 40 per cent sold.

The high number of auctions recently follows a subdued start to the spring selling season, which took several weeks to heat up as sentiment returned.

Lethargic listing levels helped create a bottleneck in the market, which flowed on to rising prices.

Property economist Andrew Wilson of My Housing Market said he expected “quite strong” prices growth in Melbourne and Sydney for most of next year.

“It’s not unreasonable to assume we could get double-figure price growth in Melbourne and Sydney next year, given the lower interest rates,” Mr Wilson said.

“There’s still energy from this ‘catch up’ market, there’s more first-home buyers, and we’ll see investors coming back into the market next year.”

Century 21 Australia owner and chair Charles Tarbey, who owns 250 real estate offices around the country, had no confidence prices would rise as high as 10 per cent in the southern capitals.

“There was a quick uplift after the downturn, when prices needed to get back up to where they were pre-2017. They’re close to that now,” Mr Tarbey said.

“I don’t think any interest rate reduction is going to stir the market now; it has enough energy.

“Ten per cent is ambitious and I hope it does not happen. I think the market needed to stabilise … I’m hoping it continues to move forward slightly.”

Mr Tarbey tipped Brisbane as having “potential better upside than most of the market around the country” because of its shortage of housing stock.

Sellers in Melbourne are already gearing up for next year, with real estate agency Nelson Alexander kicking off auction campaigns in the first week of 2020, an unprecedented early start to the calendar year.

Nelson Alexander chairman Duncan McPherson said the pre-Christmas activity was encouraging for a strong start to next year.

“We’ve always avoided school holidays but we believe going earlier will be well received next year,” he said.

In inner-city Sydney, Angie and Ben Wain sold their Surry Hills terrace home for $2.3m in just three weeks, benefiting from the property market’s strong finish to the year.

Ms Wain said the couple began an off-market campaign for their house and held only one open-home before it was sold. The Agency property partner Sam Hosking, who brokered the deal, said traditional terraces were popular in Paddington, Surry Hills and Woollahra.

“We don’t have enough stock, it’s supply and demand. We’ll see prices increase through 2020,” Mr Hosking said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout