Housing price downturn could be longest in decades, UBS warns

Housing prices could fall 10pc as banks crimp riskier lending and the ALP plans to limit negative gearing tax breaks, warns UBS.

Housing prices could fall 10 per cent as banks restrict the number of loans made at very high debt to income ratios and as the federal opposition plans to limit negative gearing tax breaks, UBS research shows.

The number of home loans granted could drop 30 per cent as credit tightens and the economy could be set for a record long house price downturn, raising the risk of a reverse wealth effect and credit crunch, the investment bank warned.

The predictions come amid a regulatory clampdown on lending to investors and riskier borrowers and a cooling housing market where national dwelling prices have been falling for several months and banks have started to lift mortgage rates.

UBS highlighted borrowers with “very high” mortgages of more than six times their incomes, which it estimates makes up 33 per cent of the value of all housing debt.

But APRA may want the share of loans made at very high debt-to-income ratios to fall to only 10 per cent, researchers George Tharenou, Carlos Cacho and Jim Xu wrote.

Even though most borrowers contribute an initial deposit, the clamps on very high mortgages come as the national dwelling price to income ratio is near a record high of about 6.5 times — and about 9 times in Sydney and 8 times in Melbourne, UBS said.

New comprehensive credit reporting rules from mid-next year could reduce borrowing capacity by about $100,000 for many households, as credit card limits and other debts are taken into account, the bank said.

Meanwhile, the bank noted the federal opposition’s plan to limit negative gearing tax concessions for future purchases to new housing and halve the capital gains tax concession to 25 per cent.

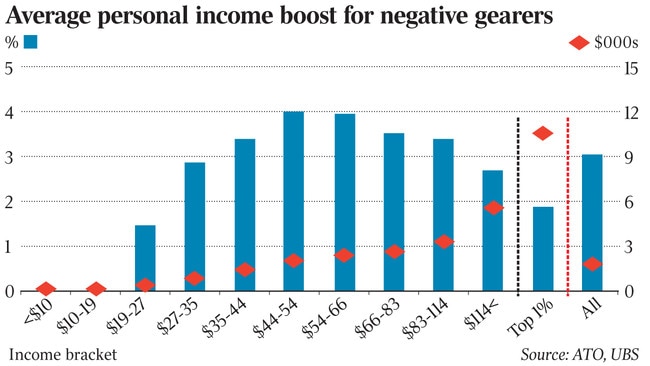

The average increase in individual income from current negative gearing arrangements is highest for middle income earners at a 4 per cent boost.

But the benefits are largest for the top 10 per cent of income earners — although their income rises by just under 3 per cent through the concession, this group captures a 48 per cent share of the total dollar benefits of the tax break, UBS found.

When negative gearing arrangements were limited in 1985 and a capital-gains tax was introduced, the value of investor home loans dropped by 30 to 40 per cent — likely amplified by the Reserve Bank hiking interest rates at the same time, UBS said.

As the investor share of home loans has since tripled from about 13 per cent to 40 per cent now, the impact of any curbs on the broader housing market could be magnified, according to the research.

UBS has previously warned the value of home loans written could drop 20 per cent and housing prices could fall 5 per cent, but says risks are now “tilted to the downside” for home loan falls of up to 30 per cent and price drops of up to 10 per cent.

“Positively, the economy and labour market remain solid for now,” UBS wrote.

“But despite this, our ‘credit tightening’ thesis is still playing out … We expect further credit tightening, and the RBA’s lack of willingness to cut rates this time, to see the longest house price downturn in decades.

“If this weakens previously resilient sentiment and demand, seeing larger home price falls than expected (that is, 10 per cent plus), it could see the reversal of the big boost to consumption in recent years from the household wealth effect and hence raise the risk of an economic downturn and a ‘credit crunch’.”

UBS last year warned that $500 billion of “liar loans” had been written to borrowers who had not been completely factual and accurate on their home loan application.