Housing market hit hard: AV Jennings

Tighter credit markets, an apartment oversupply and the fall in foreign investment have to hit confidence in housing market.

The tightening of credit markets, an apartment oversupply in certain areas and the fall in foreign investment have combined to hit confidence in the housing market, according to Simon Cheong, the veteran chairman of building company AV Jennings.

“This is undoubtedly a challenging time for the residential real estate market and we are not immune,” Mr Cheong told the company’s annual meeting yesterday.

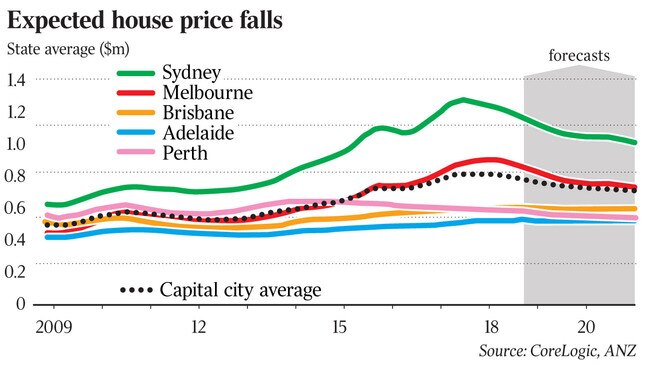

The comments come as a raft of economists downgrade their housing price forecasts, with ANZ this week heavily marking back its outlook.

The bank’s economists recast their September figures of a 10-15 per cent fall in Sydney and Melbourne, peak to trough, to a 15-20 per cent drop.

Investment bank HSBC also cut its outlook this week, predicting home prices could fall up to 16 per cent, peak to trough, in the two capitals, while Macquarie Securities and Morgan Stanley also have also come out with dour market outlooks.

However, high-profile Sydney real estate agent John McGrath yesterday said the worst of the housing downturn had passed with most of pain in price falls already over.

Mr McGrath told the listed agent’s AGM that prices would fall only a few percentage points further.

AV Jennings managing director Peter Summers said there had been a need for the housing price correction.

“The issue of affordability is real, and sooner or later pricing cannot keep going up, particularly in the face of a period of stagnant wages growth,” Mr Summers said.

“The restrictions to banks lending and the uncertain political outlook with elections in Victoria this weekend and next year, a state election in NSW and, of course, the federal election in 2019 have contributed to the uncertainty.

“There is no doubt that the impacts of these factors has been greater than expected in the short-term.”

The effect of home lending restrictions had been heavier than anticipated while the impact of the banking royal commission had also been significant, he said.

However, Mr Summers said these were not structural changes and the underlying factors affecting the market remained strong, including low unemployment, a solid economy, a shortage of detached dwellings, townhouses and apartments.

While immigration was seeing renewed scrutiny, it was likely to support growth in the medium term, he said.

ANZ head of Australian economics, David Plank, said that if the banks’ forecast of a 15-20 per cent downturn in Sydney and Melbourne was realised, it would mark the sharpest downturn experienced by the those cities.

However, he said prices would only be back at 2015 levels, and the downturn had followed the biggest boom that those cities had experienced.

Prices in Sydney surged more than 70 per cent in the five years to mid-2017 while Melbourne saw a near 60 per cent run-up, according to researcher CoreLogic.

“Most people will be ahead,” Mr Plank said. However, he noted that there would be small pockets of negative equity.

This housing correction was credit-led, which differed from past downturns where rising interest rates had prompted the downturn, Mr Plank said.

In a research note on Thursday, ANZ said it saw no evidence that the price falls were easing.

The drop in Sydney housing prices was already the largest in many years, the bank noted.

Prices were 9 per cent below the June 2017 peak, a larger correction than the 8 per cent fall in 2010-11 and in the three earlier downturns. Prices were unlikely to stabilise until early 2020.