Greedy banks leave home buyers settling for second best

What if the banks, instead of holding on to a portion of the RBA’s cuts, had passed them on in full to customers?

Everyone in Australia’s property market has a “what if?” story. Or an “if only” moment.

Well consider this. What if the banks instead of holding on to a portion of the RBA’s rate cuts had passed them on in full?

And what if they had stayed in lock-step with the central bank since 2007, when this cycle of interest rate conscious uncoupling began?

It might mean consumers now being able to take on a mortgage that crucial bit more for the house of their dreams. It might be the difference for a Melbourne buyer between this do-upper single-storey terrace in Fitzroy North, on the market for $1.04m, and the already done-up double-storey home in nearby North Melbourne, set to sell for about $1.25m.

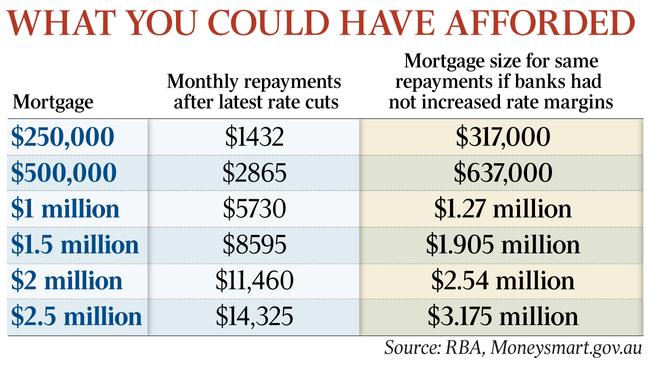

Analysis by The Australian finds a consumer with a $250,000 principal and interest mortgage on a 25-year term could today borrow $317,000 for the same monthly repayments of $1432 had the banks passed on all the RBA’s rate cuts since the end of 2007.

For a $500,000 mortgage on the same terms, a homebuyer could be looking at a $637,000 mortgage, and for a $1 million loan, they would have an additional $270,000 to factor into their purchasing decision.

After the RBA’s decision on Tuesday to cut the official interest rate by 25 basis points to 0.75 per cent — and despite the urging of Josh Frydenberg to pass on the full amount to borrowers — the big four banks all refused. Within hours, the Commonwealth Bank passed on a cut of 13 basis points to its standard variable mortgage rates and the National Australia Bank cut by only 15 basis points. Westpac followed on Wednesday with a 15 basis-point cut, and ANZ passed on a cut of 14 basis points.

The failure to pass on the full cut to the official cash rate is just the latest in a series of moves since January 2008 that have built up the difference between the average standard variable rate of the big banks (now 4.8 per cent) and the official cash rate (0.75 per cent). The margin of 4.05 percentage points compares with 1.8 percentage points in December 2007, the same it had been since July 1999.

Master Builders Australia chief economist Shane Garrett said passing on RBA cuts in full would have generated confidence in the market and greater construction activity. “The mortgage repayments would be considerably lower now than they actually are, and this would allow borrowers to pay off their loans more quickly and in turn boost confidence,” Mr Garrett said. “From the point of view of residential building activity, an environment of full rate pass-through would have provided greater stimulus to new home building activity — and (would) have helped soften the impact of the current downturn under way in building.”

Housing think tank AHURI’s executive director, Michael Fotheringham, said not passing on the full rate cut was a lost opportunity to stimulate the economy more broadly. “Families with mortgages might be on their financial limit, and rather than receiving some relief from a bigger rate cut, they must continue to spend their money on their housing and not on other goods and services,’’ Dr Fotheringham said.

Andrew Wilson, chief economist at My Housing Market, said the difference between the official rate and mortgage rates had been getting “bigger and bigger”.

“The threat from the RBA has always been that if rates are not passed on in full, they are just going to keep cutting — that might not work anymore,” Mr Wilson said. “If rates had been passed on in full, we might not be in the position we are in now.”

An Australian Banking Association spokesman said the banks had to source funds to lend, and the cost of those sources of funds fluctuated. “There are three different places a bank needs to find the money that they lend,” the spokesman said. “First, from deposits with that bank here in Australia. Second, borrowing from other Australian funds, which is tied to the RBA cash rate. Third, from overseas investors. All three sources come at a different cost, which influences the borrowing cost on your mortgage.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout