Elanor Investment Group to check out of luxury hotels in fight to stay afloat

The financial woes of little-known real estate fund manager Elanor Investment Group could mean some of the country’s best-known luxury properties are put on the block.

The financial woes of little-known real estate fund manager Elanor Investment Group could mean some of the country’s best-known luxury properties, including Cradle Mountain Lodge, are put on the block, and they are a pointer to the still tough environment for commercial real estate.

The group, which was suspended from trade on the Australian Securities Exchange on Friday as it sought time to refinance debt and consider its corporate future, has found itself in trouble as investment values have fallen, particularly for more risky properties.

The company was founded in 2009 in the shadow of the global financial crisis by former Macquarie Bank property chief Bill Moss – though he has been out of the business concentrating on his own affairs for some years – and it had a rise that some dubbed meteoric in getting to just over $6bn of assets.

Its empire spans offices and shopping centres – which have fallen heavily in value in recent years – as well as forays into the hot sectors of logistics and healthcare property.

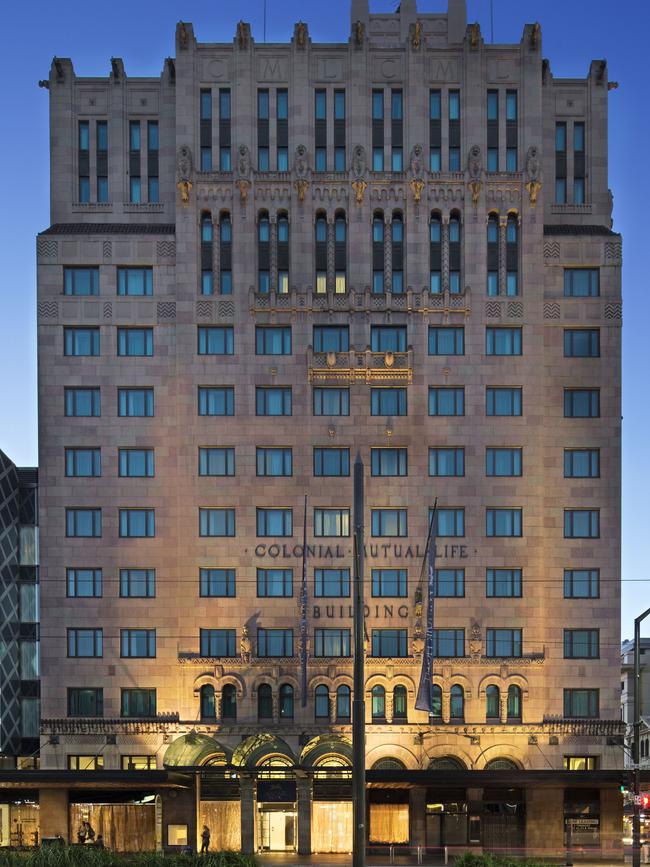

But it is a fund manager, rather than owner of assets, and needs to ensure that the vehicles it runs performs well. Its exposure to its flagship hotel fund, which owns famed properties such as the Tasmanian lodge, as well as the Mayfair Hotel Adelaide, Chateau Yering in Victoria’s Yarra Valley and Wildes Boutique Hotel in Kangaroo Valley, NSW, has partly brought it unstuck.

Many of the hotels are branded with Accor Group names such as ibis Styles, Mantra and Peppers, making them attractive to buyers even as their income has been hit by the cost-of-living crunch that has swept through regional hotels in the wake of the pandemic.

Elanor on Friday decided to ask for the suspension on the ASX as it works out ways to pay off just over $100m worth of balance-sheet debt and to address its underperforming funds empire.

While it signalled it would fight to stay afloat, big changes are afoot and it will put about $500m worth of hotels that are held in its flagship fund up for sale. The trust manager said it had kicked off the “orderly divestment” of the hotel assets in the Elanor Hotel Accommodation Fund, with two small properties already being offered, and it will exit the volatile hotels, tourism and leisure sector entirely. It has also cancelled its planned dividend to help stabilise its financial position in a sign of its tough position.

The group had grown an empire across almost all commercial property sectors, and it last year bought Challenger’s real estate funds business, with that group emerging as a backer of the listed funds manager.

Elanor is now exploring refinancing options via debt arranger MA Moelis and with investment bank Citi as its financial adviser. It could pursue options ranging from bringing in new lenders to recutting loans with existing backers.

Although the debt it carries is relatively small, it could have greater reverberations as the company is now weighing up options ranging from an outright takeover to rival groups picking off the best parts of its empire.

While the group has been weighed down by its exposure to its unlisted hotel vehicle, in which it has a 27 per cent stake that was worth about $64m in December 2023, the problems are reflected across much of its business.

Under the funds management model its stakes in funds are partly debt funded, putting the manager under pressure as valuations across the commercial sectors have fallen. Elanor has also levied management fees on some funds but is yet to be paid because they are stressed.

If it is able to solve its problems at a corporate level, Elanor could focus on stabilising its holdings in institutional real estate where it has about $2.5bn apiece of retail and office assets, though these portfolios may also need some surgery as they are lower-grade assets.

The smaller mandates it has in healthcare and industrial property will likely be chased by rival managers, and Elanor said that it was considering the sale of other assets.

The pick-up in asset markets which rival funds managers called out this week at their results could help save a fund manager that was once on the rise, but Elanor’s future is clouded unless it can find a way out from under its debts.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout