Dexus offers up stakes in Macquarie Centre and Pacific Fair on retail rebound hopes

The sale of slices in the Macquarie Centre and the Pacific Fair Shopping Centre will be a guide to the consumer spending come back as lockdowns are lifted.

The strength of the coming retail rebound will be tested as the country’s biggest landlords line-up for a slice of Sydney’s landmark Macquarie Centre and the Pacific Fair Shopping Centre on the Gold Coast.

The stakes – a quarter interest in the Macquarie Centre and a 20 per cent interest in Pacific Fair – should earn about $700m for the Dexus fund.

Dexus picked up the interests when it merged its wholesale fund with an AMP Capital-controlled vehicle and it has pledged to sell assets to fund redemptions.

The sale will test the appetite of local shopping centre operators.

Buying a slice of the properties would give big operators, such as Scentre, owner of the local Westfield empire, listed rival Vicinity Centres, Lendlease, or industry stalwarts like the Queensland Investment Corporation or ISPT the chance to bid for the management of the $3bn-plus assets.

Another AMP Capital-run trust, which also owns a stake in the centres is also in play, and investors may back a new manager.

It would be a coup to grab control of the super regional centres while the retail property cycle is at a low point. The country’s largest shopping centres have been battered by the coronavirus crisis but the biggest writedowns came last year when the industry was crunched by the pandemic.

Anchors such as department stores are also cutting space, smaller retailers have struggled to survive and even some mid-size fashion chains are in trouble.

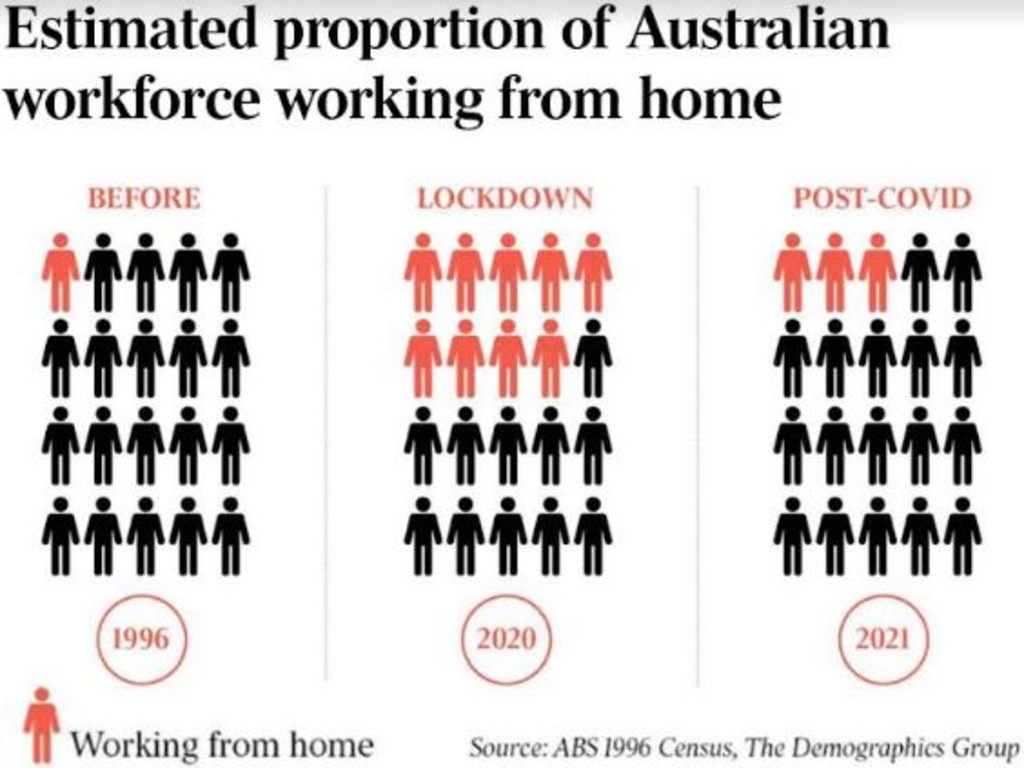

However, the strong retail recovery from the first set of lockdowns has spurred confidence that centres will come out of the crisis, even though tenants are now struggling with restrictions in Sydney and Victoria.

In addition to the existing shopping centre players, the offer could bring a new entrant into the sector, with international groups keen to buy into Australian retail as their home markets have already recovered.

CBRE’s Simon Rooney and JLL’s Nick Willis and Sam Hatcher are running the expressions of interest campaign. They said there was significantly enhanced investor demand for core retail assets and there had been a run of sales of smaller and mid-size centres.

“The positive turnaround in institutional investor sentiment and capital reallocation back to retail is in its early stages, but clearly evident and is centred on assets which are considered the best of the best – criteria clearly met by Pacific Fair and Macquarie Centre,” Mr Rooney said.

“We have seen a material rebasing in retail asset values over the past 12 to 18 months, together with a ‘mark to market’ rental reset. This, combined with monthly sales and traffic growth and the historically attractive retail yields on offer, is clearly compelling – presenting a real window of opportunity for major domestic and offshore investors.”

Mr Willis said the centres were two of Australia’s leading retail destinations and pointed to mixed use potential, particularly in the Sydney asset.

“They are more than just shopping centres – their scale and integration in the market make them core pieces of infrastructure that shape their respective markets,” he said.

“Retail has performed well coming out of lockdowns, and the best quality assets will continue to outperform.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout