Dexus lifts distribution guidance after half-year net profit jumps 37pc

Dexus lifts distribution guidance after half-year net profit improves 37 per cent.

Office sector heavyweight Dexus has defied fears of softer economic conditions and upgraded earnings on the back of stronger demand from white-collar industries for office space.

The company said demand was coming not only from big name groups like Atlassian, Salesforce and Amazon but also from existing companies launching technology operations.

Office towers are also benefiting from the overall outlook for the global economy that Reserve Bank Governor Philip Lowe said this week “remains reasonable”.

Dexus chief executive Darren Steinberg said that bushfires and the coronavirus had increased uncertainty about the short-term outlook but argued there were “reasons to be positive about the white-collar industries which underpin office demand”.

“Conditions in the technology, finance and business services sectors are much more positive than in many other sectors, and interest rates are expected to remain lower for longer, supporting investment demand for real estate,” he said.

Dexus delivered a strong first-half resulted and boosted its guidance for distribution per security growth from about 5 per cent to about 5.5 per cent for this financial year.

Mr Steinberg said the office group was stepping up its development workbook along the east coast as the value of city towers soars, while its underlying business was performing well on the back of higher occupancy, retaining more tenants and completing developments.

Dexus is also planning new projects in Melbourne’s Collins Street and at Sydney’s Circular Quay.

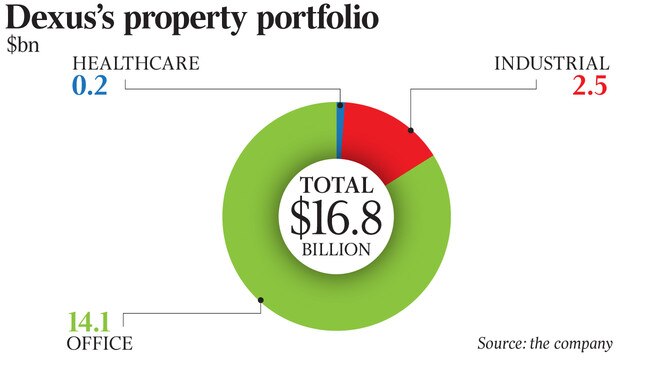

The company has also built up a $17bn funds management operation, giving it capacity to bid for major projects, including logistics and office portfolios, as it has support from top European and US investors.

Dexus Wholesale Property Fund raised about $180m of new equity and Singaporean group GIC lifted its stake in a logistics trust.

“Our funds business has seen a significant increase in interest from offshore investors seeking to invest directly in quality office properties,” Mr Sternberg said, citing a series of high-price office deals struck and his belief in the “lower for longer interest rate environment”.

Dexus had net profit after tax of $994.2m, a 36.9 per cent jump, mainly on the back of $724.4m in valuation gains. Underlying funds from operations per security was 31.9c, a 1.9 per cent lift and the distribution per security was held steady at 27c.

The company completed the 240 St Georges Terrace development in Perth and advanced its $11.2bn development pipeline and realised $27.8m of trading profits, driven by the sale of an Elizabeth Street tower.

Valuation gains were the primary driver of a 5.9 per cent increase in net tangible asset backing per security to $11.10.

The distribution per security for the half was 27c, with the distribution payout remaining in line with free cash flow.

Although underlying FFO per security increased by 1.9 per cent, adjusted funds from operations per security reduced to 26.9c as a result of lower trading profits. These are expected to pick up this year.

The company is capturing upside in the Sydney CBD market, achieving 18 per cent re-leasing spreads. Up to the end of fiscal 2022, it has the opportunity to reset more rents and also struck deals at record levels in Melbourne.

The office portfolio achieved like-for-like income growth of 8.9 per cent, enhanced by major deals at Sydney properties like Australia Square and the MLC Centre.

Dexus shares dropped by 1c to close at $12.88.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout