Developers keen to snap up distressed hotels in Covid’s wake

Many of these developments have been deferred and with no end in sight for border closures, developers are now looking to turn distressed hotel assets into apartment blocks.

Over 5.2 million international visitors came to Australia in the financial year to June 30, 2010, and by the 2019 financial year that number grew to more than 8.6 million international visitors, according to Austrade data.

In 2019, more international visitors arrived in Australia than in any past year and the contribution of the tourism industry to Australia’s economy hit a record high of more than $60bn, according to data from the Australian Bureau of Statistics.

With no signs of the sector slowing down, developers sought to capitalise on this growth, and Australia saw a substantial rise in the number of hotels in the development pipeline.

It has now been well over a year since Australia’s international borders were first closed and the conditions now faced by the tourism sector could not be more different.

Local Covid outbreaks resulting in state border closures have also dealt a major blow to domestic tourism, particularly as many of these closures have occurred with little notice during peak tourist seasons such as the school holidays.

While there has been some improvement in domestic tourism, local tourists are more likely to stay in regional areas compared with CBDs. Yet many of the new hotels under development are located in CBDs, a market unlikely to recover until international travel resumes.

The federal government predicts international arrival numbers are likely to remain low until at least mid-2022, when it is hoped that the majority of the Australian population is vaccinated.

Even after that time, only a gradual rise in arrival numbers is expected, so many developers have made the decision to defer or abandon their hotel developments.

These challenges have caused hotel occupancy rates to plummet and average daily rates that venues charge to decrease. The overall value of hotel assets has also fallen.

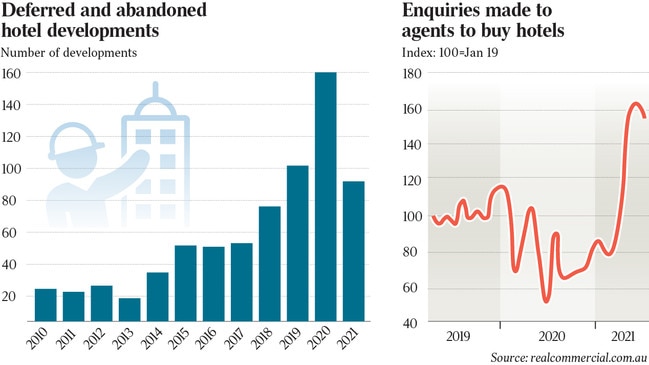

Since the closure of both the international and state borders in the first quarter of 2020, 116 hotel developments have been deferred and 134 have been abandoned.

Last year, the volume of inquiries from those looking to purchase hotel assets collapsed and there was a corresponding decline in the volume of hotels which have sold.

Since the start of this year, however, something unexpected has happened. The volume of inquiries for hotel and tourism assets listed for sale on realcommercial.com.au has skyrocketed and is now well above historic levels.

There are a number of factors that could be driving this growth. While some of this demand is likely due to investors looking to purchase hotels at a discounted rate, many of these buyers are developers looking for distressed assets to convert to residential properties.

In contrast to the hotel sector, demand for residential property has soared over the past year. Record low interest rates have made debt more affordable and a doubling in the household savings rate has enabled deposits to be saved faster. The result has been extremely strong price growth.

The general market consensus is that residential property prices have not yet finished rising, with the major banks all predicting double-digit growth this year. High buyer demand and the expectation of future price growth is driving more developers into the market, and there has been a significant rise in development activity.

Another key driver of price growth has been that demand from buyers is outstripping supply, with the same holding true in the market for development sites. Developers are therefore having to broaden their search, and distressed hotel assets represent an opportunity.

Hotel owners and developers are also looking to take advantage of the current heat in the residential market. One example is Meriton which halted construction of a hotel in Sydney Olympic Park and will now instead be delivering apartments.

“As a result of the coronavirus outbreak the entire tourist industry has collapsed both economically and socially,” Meriton said in a statement that was included in their application for the change of use.

While tourism will eventually recover, the expectation is that we will not reach pre-Covid conditions in this sector until at least 2023. Even with this timeline there is still a high level of uncertainty. Until confidence in tourism returns, we are likely to continue seeing hotels repurposed or developed into residential spaces.

Anne Flaherty is an economist at REA Group

Australia’s tourism sector had been growing before the Covid-19 pandemic but the border closures have had a huge impact on the hotels being built in this sector.