-

Inner city primacy

From the aftermath of the last recession (say, 1993) through to the coming of the coronavirus (2020) Australia’s biggest cities, and some smaller cities too, evolved around a single unshakeable principle.

And that was that 20-somethings would gravitate from the suburbs and the regions to the city creating a distinctive inner-city community that would eventually be known as knowledge workers and/or as hipsters.

The high priest of this movement, this pilgrimage, this antipodean Camino de Santiago, was an unassuming Canadian academic called Richard Florida with his book The Rise of the Creative Class (2002).

Florida’s thesis was that density delivers not so much congestion but rather an entire ecosystem supportive of creative skillsets and of entrepreneurship. Start-ups, computer programmers and dance companies were all part of this frenzied fusion of a new creative class.

Indeed the thinking was that the frisson of creatives and knowledge workers all jollily jumbled together in the inner city would create a kind of primordial soup from which would emerge job- and prosperity-generating opportunities.

The inner-city hipster was merely a by-product of a lively creative-class ecosystem.

And indeed for many years Florida’s thesis seemed to be precisely en pointe. However, perhaps unwittingly, his thesis was underpinned by powerful demographic forces.

The post-baby-boomer generations, the Xers (1965-1982) and the millennials (1983-2000) changed the narrative of urban life: postpone marriage and mortgage from early- to late-20s, complete tertiary education and training, travel and work overseas, and then commit to household formation much later in the life cycle.

This model underpinned demand for inner-city apartmentia which was a somewhat edgy counterbalance to traditional versions of suburbia.

-

And now there’s Covid

But then along came the pandemic and not for just a few months but for two-plus years! Suddenly, the allure of the inner city – the idea of density delivering frisson – dimmed.

Workers recoiled en masse to their homes in the suburbs and in the regions and set about learning how to work, shop, study and be entertained from the confines of a traditional family home.

The suburbs-to-the-CBD commuting rhythm that had delivered prestige and a kind of fealty to the inner city waned with the arrival of a communicable and potentially deadly disease.

In some ways the primacy of the CBD and its adoring inner-city suburbs was an anomaly in Australia.

The idea of commuting from the suburbs to a central workplace demands a kind of deference that rankles with our egalitarian values.

Then again this is a concept that very much aligns with our colonial mindset: that only the inner-city can harbour the best jobs, arts and cultural assets and restaurants.

And so it is against the context of this pre-Covid apartmentia-versus-suburbia world that a new lifestyle, and new housing demands, must be imagined.

-

Rise of the upgrader

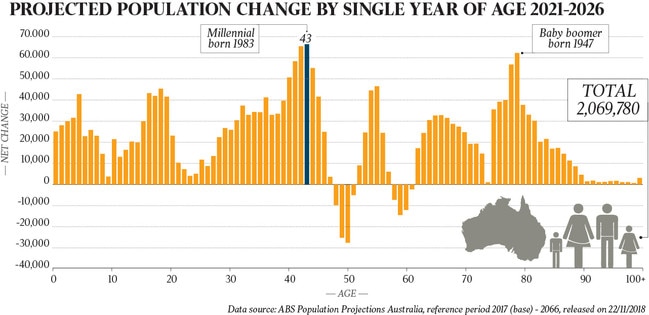

In order to conceptualise what might lie ahead let us consider the net change in population by single year of age between 2021 and 2026.

This perspective is drawn from ABS population projections released in November 2018 and so do not consider the diminution of immigrant and student flows from March 2020 onwards.

However, I argue that it is the shape (rather than the quantum) of the outlook that is important to the property industry.

What stands out is an imminent surge in 43 year olds as the first wave of baby-boomer children (aka millennials) is moved by the conveyor belt of life past their carefree early-30s onwards to their late-30s and early-40s headed of course by a thick crust of 43 year olds (born 1983).

This chart captures an important transition within the modern life cycle. By late-30s/early-40s most Australians have partnered up, have one or two kids, are both working; many have had success in the workplace.

At this point in the life cycle (ie age 43) housing needs change: out with the compact minimalist apartment, in with a fulsome separate house on a separate block of land. Suddenly there’s a spiritual connection between millennials morphing towards middle age and the thinking of suburbia’s uncrowned king, Daryl Kerrigan (The Castle, 1997).

The projected 43-year-old population for 2026 is with us in 2021 as a cosy coterie of 38 year olds. I argue that by 43 most Australians are in the home upgrader stage of the life cycle, and know they have 20+ years in the workforce to repay what might be considered a large mortgage.

But it’s not just 43 year olds heading our way, it’s an entire wave of late-30s and early-40s millennials on the move migrating from youth towards the kingdom of the middle age.

And so it is the “home-upgrader” segment of the residential market that should surge over the next five years. This means more demand for three-bedroom, two-bathroom houses with a front garden and back yard and with scope for a #WFH Zoom Room.

And if these late-30s/early-40s millennials ain’t upgrading to a bigger/better property then they’re embellishing their existing property to accommodate a growing brood and their lifestyle expectations. This logic would trigger a bit of a frenzy in consumer spending on home furnishings, appliances, technology and furniture, wouldn’t it?

This imminent demographic shift suggests there will be (or is now underway) a shift in demand for residential property from inner-city rental apartments to suburban (and regional) house and land property.

This means that in the immediate future, demand for residential property is less likely to be driven by immigration and studentifcation but by millennials looking to either enter the market as buyers, or as upgraders, or as home improvers looking to update appliances and furniture.

Toss in an assortment of baby boomers looking for downshifting and sea-change opportunities, the rush-to-the-regions by city exiters (the so-called VESPAs or Virus Escapees Seeking Provincial Australia), and an era of low interest rates and you have all the makings of a rocket-fuelled residential property boom.

-

The hipster shifter

So, what happens when property demand shifts from the 38-year-old and younger cohort to the 43-year-old and younger cohort?

Together with data scientist Hari Hara Priya Kannan I examined the 2016 census to see if there is a geographic and lifestyle shift between the ages of 38 and 43, the so-called upgrader market in residential property.

At the last census there were 304,000 people aged 38 living in Australia and a further 322,000 aged 43 which equate to a ratio of 13/14 per 1000 total residents. Hot spots for 38 and 43 year olds typically have more than 20 people aged 38 or 42 per 1000 in a suburb.

In Melbourne, 38-year-old hot spots include inner-city enclaves like Yarraville, St Kilda and Fitzroy. In Sydney, the equivalent 38-year-old hot spots include Alexandria, Leichhardt and Bondi. In Brisbane, the equivalent is Holland Park, while for Perth it is Leederville.

There are of course 38 year olds scattered across the metropolitan area, but many appear to be very much committed to the inner city and to the lifestyle and housing that such choices entail.

However by the age of 43 a transition seems to take place. Melbourne hot spots for people of this age include outer suburban suburbs like Taylor’s Hill and Caroline Springs and the middle-distance suburb of Cheltenham.

Sydney’s 43 year olds cluster in places like outer Rouse Hill and middle-distance Seaforth. Brisbane’s 43 year olds like Camp Hill while in Perth this group gravitates to Iluka on the northern beaches.

I argue there’s a life cycle transition that takes place across the late-30s and early-40s which is underpinned by the advent of kids heading towards the teenage years. Suddenly chic minimalist Bondi or St Kilda or Leederville apartments don’t fit the needs of a growing family. And especially now that one of the bedrooms has been reimagined as a Zoom Room.

This is important because Australia’s underlying demographic forces will push today’s 38 year olds towards 43 over the next five years.

Toss in low interest rates, the need to find a home that enables work from home, and there’s a preference shift in the demand for housing.

Less inner-city hipster chic; more middle and outer “garden suburb” family pragmatism.

The truly curious aspect of all this demographic speculation is whether the relatively recent cult of hipsterism will be reinvented in order to accommodate the parents of teenagers as somehow being cool?

Or will the prevailing natural order of generational change demand that the once-hip millennials morph into daggy parents like every preceding generation of parents of teenagers? I suppose only time will tell.

Bernard Salt is executive director of The Demographics Group; research by Hari Hara Priya Kannan

For more than a quarter of a century a single driving force has shaped demand within Australia’s residential property market.