Debt worry as property market poised to turn: Moody’s Analytics

Another rate cut could help housing but pose questions about Australians’ heavy debt.

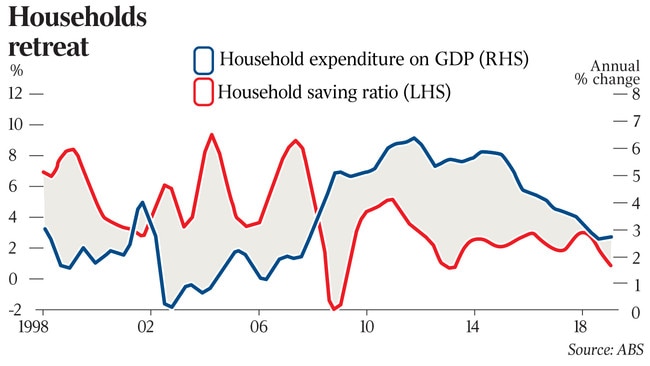

Australian’s high levels of household debt could balloon as an unintended side effect of perceived housing affordability as the market reaches its floor, according to financial intelligence firm Moody Analytics.

Following the Reserve Bank’s decision to slash the interest rate by 25 basis points earlier this month, economists are increasingly expecting a complementary second cut later this year. Moody’s Second-Quarter 2019 Housing Forecast Report on Monday said further rate relief could breathe life into the housing market and force the market to bottom out in the third quarter of the year.

Moody’s noted a high possibility of rate cuts totalling 75 basis point in 2019, particularly if the major four banks do not pass on any potential future cuts in full.

However, a greater borrowing capacity teamed with banking regulator APRA’s decision to loosen lending criteria in May could see Australians saddle themselves with higher amounts of debt.

“Expectations of further lending reductions flowing on from RBA cash rate reductions will also breathe life into the property market and add weight to our view that the national housing market will reach a trough in the third quarter of 2019 and gradually improve thereafter,” the report said.

“This could see the household leverage-to-GDP ratio climb, making Australia stand out further among its peers.

“This is an undesirable position to be in, particularly given the questions around sustainability of the potentially rising debt load.”

Property is one of the primary reasons why Australians are among the most debt laden households in the developed world.

Despite affordability appearing to improve since the 2017 peaks, it has not seen a material change: national housing prices are still 20 per cent higher than they were at the start of 2013.

Value declines have been sharper in houses compared to apartment. House prices have fallen almost 11 per cent from their peak in mid-2017, while the cost of apartments has dropped almost 7 per cent from the peak.

National house prices were set to fall a further 7.8 per cent in 2019, Moody’s said, with Sydney acting as a key driver of the slowdown due to its high peak prices. But a recovery was slated in most markets, excluding Hobart, in 2020 and 2021.

Sydney was forecast to fall a further 9.6 per cent in 2019 after home values fell 5.5 per cent in 2018. Anticipated 2019 falls were likely to be greater in Melbourne, dropping a further 10.8 per cent this year.

Brisbane’s apartment market is set to outpace its houses in the medium term, with respective falls of -0.7 per cent and -1.8 per cent this year, before a pronounced recovery in 2020. Canberra was also holding relatively steady, with no forecast declines in 2019.

House values in Perth were set to decline 6.9 per cent in 2019 as the downturn gets a second wind, followed by a small recovery in 2020, Moody’s said.

On the other hand, Hobart was set for a correction in 2020 and 2021 after reaching market peak earlier this year.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout