Council delays behind spiralling rent and house construction stagnation, says Harry Triguboff

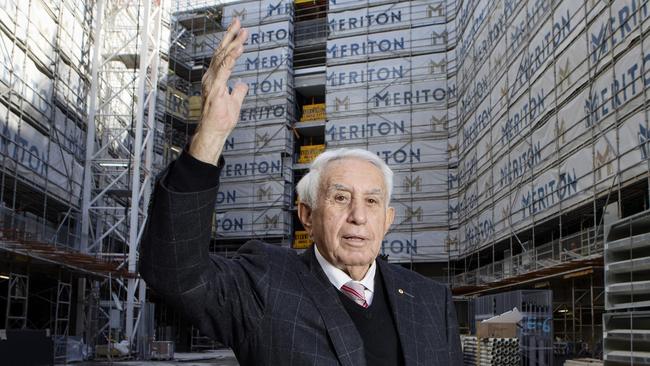

Multibillionaire Harry Triguboff is building fewer apartments than he was three decades ago and wants the NSW government to reform the sedentary council planning approval process.

Multibillionaire Harry Triguboff is building fewer apartments than he was three decades ago, despite the fact NSW is facing a major shortage of housing after the number of apartment starts collapsed by 54 per cent and rents hit record highs.

“I could build four times more apartments than I am now building. I am now building the same number as I was 30 years ago because I can’t get planning approvals,” Mr Triguboff, founder and managing director of Meriton Apartments, said.

The veteran developer, 90, who has been predicting a housing shortage for many years, said the lack of housing was not the fault of property developers. Instead he blamed sluggish wait times developers endure for governments to provide planning approvals.

As a perfect storm of rising material costs, supply chain disruptions and skilled labour shortages hit builders, dozens of contractors have hit the wall. And Mr Triguboff is not surprised.

These include Porter Davis and EQ Constructions. Initial reports suggest the company owes $40m to $50m. One of its more high-profile projects is Waterbrook, a luxury retirement home, at Bowral in the NSW Southern Highlands.

“This lack of housing is not the developers’ fault; they have all gone broke,” Mr Triguboff said. “The Japanese and Chinese developers have left, and if I buy land today I am buying it from a Chinese vendor.

“It takes three to four years to get planning approval, it should not take more than six months, it’s nonsense.”

Mr Triguboff is building 11 apartment towers in Sydney and the Gold Coast plus a couple of serviced apartment blocks in Canberra and Melbourne.

He has called on the newly installed NSW state government to reduce the time it takes to approve apartment block approvals of more than 100 units from four years down to just six months. This, he believes, would ease the state’s housing crisis which was driving up rents.

“We would like the new NSW government to tell us that we will get approvals quicker, such as within half a year not four years,” he said.

This week the Urban Development Institute of Australia called on the NSW government to urgently address the decade-low apartment commencements and completions.

“New dwelling commencements in NSW for the 12 months to December 2022 have recorded their lowest figure since June 2014, dipping to below 49,000,” the UDIA said. “ … this has been explicitly led by the apartment market, with annual commencements collapsing to below 10,000 for the first time in over a decade.”

Some industry players say rents have risen 25 per cent in NSW, while others say the spike is as high as 49 per cent.

Meanwhile, Mr Triguboff was happy to divulge the daily planning issues he faces with certain councils.

Citing two proposed apartment blocks in the Sydney suburbs of Epping and Rhodes, Mr Triguboff said that after he received approval – which had taken years – he wanted to add more garages to the existing designs due to changing purchaser demands.

In the case of the City of Canada Bay (which looks after the suburb of Rhodes) it has taken an additional 18 months to get approval to add more garages to the apartment tower design and it has still not been determined four years after Meriton first bought the land.

In Mascot, Mr Triguboff’s Meriton Apartments wanted to change the shop layout at his serviced apartment complex. “(But) you put in an application and you don’t know if they will approve it for many years,” he said.

“But to be fair the new guys (the Minns government) have not said anything yet. Let’s see how they are going to change the system. They have to discuss it. We don’t know what they want. There must be communication.

“I have not met with the new planning minister, I don’t think anyone has.

“Their idea of communication is to talk to people like the Urban Taskforce and the UDIA; that is wrong. They must talk to the person who builds it. We all have to get together.

“The new government says that owners of apartments and renters have to get together to work out a compromise with rents. This is wrong. We have no apartments.

“The stock is diminishing. The government must learn to help. When we build the government gets stamp duty, GST and rates forever.

“When the virus was here, we helped the offices, but not the apartment owners. We must help wherever necessary.”

Mr Triguboff said building apartments rather than houses was more cost effective. He said apartment towers needed less infrastructure such as roads, water and sewage. “These are tremendous costs and somebody has to pay for it,” he said.

“It makes sense to build when you have so many people coming here you have to build.”

But ahead of the expected influx in foreign arrivals Meriton wants the government to re-examine its discouragement of overseas investment in the form of higher state and federal taxes for foreign buyers.

“We must understand the crucial role foreign investment plays in the apartment pipeline,” he said.

“By discouraging investment from overseas, many apartment developments cannot achieve the important early pre-sales needed to secure financing and this is stifling supply when it is needed most. Interest rates have now paused, the value of apartments is rising and rents are skyrocketing, yet local investors are not buying in the numbers required.

“Traditionally, overseas buyers were able to fill the gaps and contribute to the apartment

supply by entering into sales contracts as ‘off the plan’ investment pre-sale buyers. Their

investment into the Australian property market enabled thousands of apartments to be

built which in turn provided rental accommodation.

“In a bid to stifle a buoyant property market in 2016 and appease minority groups who

believed overseas investment was to blame for locals not buying, state governments across the country rushed to introduce foreign buyer taxes and surcharges which immediately discouraged overseas buyers.”

Mr Triguboff said it was obvious that the local investment this surcharge was meant to encourage has not happened, creating a huge hole in the investment property pipeline.

An overseas buyer who wishes to buy an investment property for $1.1m in NSW will pay 15.5 per cent of the purchase price in taxes and surcharges of $171,100.

The charges include stamp duty of $44,700, a foreign surcharge of $88,000, a FIRB application fee of $26,400, and a state annual foreign land tax surcharge of $12,000 (assuming the land value is $300,000).

“Although sales of Meriton apartments are improving every week, mainly due to a lack of supply, values have a long way to go before future development is commercially viable.” Mr Triguboff said.

“The government has to seriously consider what plans it has for our sector and announce them immediately so we can plan for the future,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout