CLSA tips Charter Hall’s David Harrison for Lendlease

CLSA analyst James Druce casts an eye to the future leadership of Lendlease.

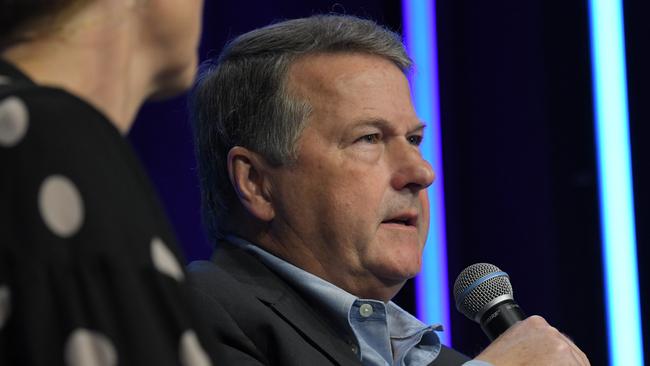

Could Charter Hall boss David Harrison be destined for bigger things? That’s the question that CLSA analyst James Druce has posed to investors and he has a clever solution: Harrison should run global developer and builder Lendlease.

The two companies have made news this week for very different reasons. Lendlease for its exposure to the troubled Melbourne Metro project. Charter Hall for striking yet another deal, this time buying $1.25bn worth of assets.

Druce casts an eye to the future as Lendlease still needs to find a way out of the engineering quagmire and Charter Hall appears to be running up against limits locally.

Lendlease would be a much bigger playground for the deal-loving Harrison and give him the chance to take his skills offshore, helping unlock Lendlease’s much vaunted $100bn project pipeline.

“Charter Hall’s chief executive David Harrison would be an inspired choice in our view. While the board no doubt favours an internal candidate, we make a strong case for Harrison, who has done an exceptional job since Charter Hall’s IPO in 2005. He is the key to unlocking Lendlease’s vaunted $100bn development pipeline as a fantastic deal doer and the most talented manager of capital partners in the property sector,” Druce told clients.

Not a smooth course

Veteran Lendlease head Steve McCann is nearing the end of his tenure and may exit once the company’s troubled engineering business is sold off.

But it is not a smooth course, with costs expected to blow out with the market pricing in about $1bn exit fees, but the CLSA analyst warning that $1.5bn would be a safer guide.

Druce said Harrison would be a superior candidate to Lendlease’s own talented executives on the basis he has transformed Charter Hall since it listed in 2005 into a $40bn property funds management machine.

A shift to Lendlease could keep Harrison active for another period and may also be a harbinger of corporate activity between the two companies.

CLSA initiated coverage of Lendlease with an “underperform” recommendation and a $17.40 target price, warning it was improbable that there would be a clean sale of the engineering and services business, which will disappoint the market.

He also called on Lendlease to accelerate production of its $100bn development pipeline, bring development into its funds management business, sell-off its retirement unit, drop its payout ratio and consider cheap funding sources such as US Military Housing.