‘Chronic’ housing crisis set to drag on: Oxford Economics

Australia’s housing supply and affordability crisis is likely to deepen, Oxford Economics says, warning we will fall well short of the Albanese government’s ambitious target.

Australia’s housing supply and affordability crisis is likely to deepen and will remain a “chronic” issue, according to Oxford Economics, which is predicting we will fall well short of the federal government’s ambitious plan to build 1.2 million homes over the next five years.

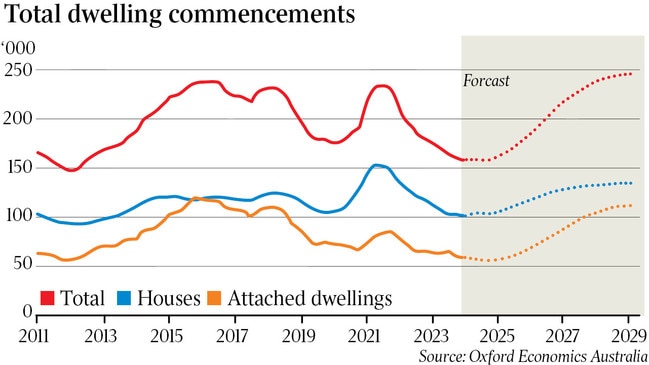

A new report, Building in Australia, released on Monday, forecasts just 960,000 new homes will be built between now and 2029, well short of the 1.2 million target in the government’s National Housing Accord.

The figures underline industry fears that it will struggle to keep up with a predicted population surge fuelled by a wave of new arrivals, as labour shortages, dysfunctional planning systems and high costs crimp activity across the sector.

Report author Timothy Herbert, Oxford Economics head of property and building, said while new housing construction would reach record levels by the end of the decade, it wouldn’t be enough to keep up with a surge in demand.

“While industry capacity is showing signs of improvement in areas, labour shortages remain that will place a speed limit on the early to mid stage of the recovery,” he said.

“While we will continue to experience a dwelling stock deficiency, activity will inevitably recover in the residential sector. All build forms will contribute, driving total dwelling commencements to a new record level by the end of the decade.

“Attached dwellings are forecast to join the upswing from FY2026 with support from falling interest rates, the upward rebasing of rents, co-ordinated social housing investment, and planning tweaks in key markets. Build-to-rent development has risen to around one-fifth of apartment starts and is expected to grow this share a little further through (the) late decade.”

The report estimates new home starts in the 12 months to June 2024 fell 10 per cent to 155,700. A small 2 per cent rise to 158,300 is predicted in 2024-25, before activity ramps up to 241,900 new homes in 2028-29, marginally above the record set in 2016. It forecasts the current 146,000 “dwelling stock deficiency” will increase to 164,000 by June 2027 as builders struggle to keep up with rising demand.

The government’s big build officially commenced this month, but industry fears are mounting that it is already slipping behind its five-year target agreed with state governments in August.

The Housing Industry Association this month warned the government would fall short of its housing targets by 64,000 properties in the first year alone.

To reach the 1.2 million target by the end of June 2029, an average of 240,000 homes need to be built each year. However, only 963,064 total new homes were completed over the past five years despite the pandemic HomeBuilder stimulus, which sent building levels to record highs.

The HIA is calling for tax relief, planning reforms and incentives to attract more workers to the industry in order to avoid what it predicts will be a 180,000-home shortfall over the next five years.

Government-appointed independent advisory body the National Housing Supply and Affordability Council, led by former Mirvac chief executive Susan Lloyd-Hurwitz, has also shot down the government’s targets, estimating a near 300,000-home shortfall. It suggests the private market will only be able to supply 903,000 new homes to 2029.

While that would exceed the projected increase of 871,000 households, it would not be enough to satisfy housing shortages across the country, the council noted in its inaugural State of the Housing System 2024 report in May.

Meanwhile, in the non-residential building sector, Oxford Economics expects falling levels of activity to continue in 2024-25 after a 4 per cent drop in the year to June to $51.9bn. A further 4 per cent fall is predicted before a recovery ramps up from 2025-26.

“Private investment has slowed, with activity patchy by sector as higher borrowing costs continue to drag in combination with the upwards rebasing of construction costs,” the report says.

“As the impact of cash rate cuts and normalising build costs play through, a recovery is forecast to kick in from FY2026, with activity lifting to $58.15bn in FY2029.”

Construction across both residential and commercial sectors is expected to climb 39 per cent over the four years to 2028-29, reaching a record $169.3bn.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout