Advance our wide brown obsession with property

Home buyers have shrugged off the pandemic to be back in the grand Australian game of chasing house prices ever higher.

We love a mortgaged country, a land of bricks and mortar, of ragged Wi-Fi networks, of patios and pool water.

Home buyers have shrugged off the pandemic’s shackles to be back in the grand Australian game of chasing property prices ever higher.

Ultra-skinny borrowing rates and a surprisingly robust recovery in the labour market due to a $251bn fiscal splurge from Canberra are driving the surge in residential sales and prices, especially for houses.

But this property obsession is laced with risks, not only for those who borrowed to the hilt when interest rates inevitably rise again, but in squeezing out other spending and productive investments.

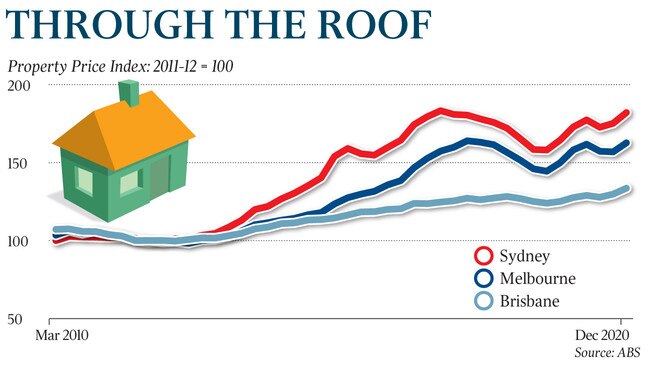

Figures released on Tuesday by the Australian Bureau of Statistics show residential property prices rose by 3 per cent in the December quarter, with the mean price of a dwelling now $728,500.

The ABS said the total value of Australia’s 10.6 million residential dwellings increased by $257bn to $7.724 trillion in the December quarter. This is the strongest growth since December 2016, with every capital city recording a price rise over a year battered by shutdowns, border closures and social-distancing measures.

ABS head of prices statistics Michelle Marquardt said the rise in property prices was consistent with a range of other housing market indicators.

“New lending commitments to households, auction clearance rates, and days on market all improved during the December quarter,” she said.

House prices soared by 3.9 per cent in Sydney and 3.7 per cent in Melbourne, while prices for attached dwellings, such as apartments and town houses, climbed by 1.4 per cent in Sydney and 2.5 per cent in Melbourne.

For residential dwellings in NSW, the mean price — for those not yet in the market, it signals something more sinister than “average” — was $939,700.

Driving up prices at the top end is a preference for more space and detached houses; while at the entry level, government schemes have helped young people buy their first homes. So far, investors have stayed on the sidelines, gawking and underbidding in the face of motivated buyers.

The market for apartments is decidedly cooler, with prices held back by the slowest growth in population in over a century and the first net migration outflows since the end of World War II. The inner cities usually house international students and temporary workers and they have been locked out of the country for the time being.

Surging property prices are a double-edged sword. They bring a “wealth effect” to existing homeowners, who are now more likely to feel confident to splash out on goods and services, or home renovations. But with incomes largely stagnant, falling home affordability can lead to a range of problems, such as mortgage stress and a diversion away from other consumer spending, which hurts the economy.

While the official cash rate of 0.1 per cent is likely to remain until early 2024, senior bankers have warned borrowing costs will rise as the economic recovery gathers steam, unemployment falls, and wage rises put pressure on inflation.

Figures from the Australian Prudential Regulation Authority on Tuesday show that higher-risk home loans were up significantly in the December quarter. The share of new home loans with a “high” debt-to-income ratio rose to a record level of 59.3 per cent, with “very high” DTI home loans at a record high of 16.9 per cent.

Boomers sitting in their castles, recalling variable home loan rates of 17 per cent ahead of the “recession we had to have”, are likely to say “talk to the hand” to Generations Y and Z bemoaning today’s price hikes amid such bargain borrowing costs.

Right now, the Reserve Bank is alert but not alarmed to rising asset prices.

According to the minutes of this month’s board meeting, also published on Tuesday, the RBA said “lending standards remained sound and that it was important that they remain so in an environment of rising housing prices and low interest rates”.

However, the central bank has warned that if lending gets out of hand it will act with other regulators to turn the screws in the cause of financial stability.

For now, though, there is little sign that the umpires are about to blow the whistle on our great national obsession.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout