Trumped! US-exposed ASX winners and losers

The Trump era holds momentous but amorphous implications for our key stocks exposed to the land of the free.

Locally, it’s hard for bunny-in-the-headlight investors to know where to turn after the apocalyptic outcome, except to hope that president-elect Donald ducks on his more extreme isolationist and protectionist policies.

For our key stocks exposed to the land of the free — as long as you have a couple of hundred million to run a campaign — there are momentous but amorphous implications ahead of Trump assuming the iron throne in January.

Take Computershare (CPU, $10.23), which coincidentally held its annual general meeting on Wednesday.

Computershare derives just under half of its revenue from the US, including share registry, share solicitation in takeover situations and managing employee share schemes.

Activity is likely to remain subdued as the implications of the Era of Trump are absorbed.

With $14 billion of client funds held in trust, Computershare relies on interest earned on those billions and in recent times returns have been subdued.

The Trump victory subverts the current paradigm of a Fed Reserve rates rise by the end of the year, although we’ll know more about the bond market’s reaction on Thursday morning.

Macquarie Group (MQG $74.1) is another one to watch given its broad market exposure globally and US-specific activities.

The stock was slammed 4 per cent on Wednesday, but if anyone can see an arbitrage opportunity in market misery, the Macquarie guys can.

Likely reduced red tape bodes well for Wall Street jockeys and financial stocks such as Macquarie, as well as shale stocks such as BHP Billiton (BHP, $22.56).

With health, the likely disbanding of the ObamaCare health system will weigh heavily on US-oriented stocks, including CSL (CSL, $97.15), ResMed (RMD, $7.27) and Cochlear (COH, $122.80).

Demand for blood products, anti-snoring devices and hearing aids won’t vanish overnight: it’s just the government will be less likely to pay for them.

In the travel sector, there are negative implications for global stocks such as Flight Centre (FLT, $29.53) and the airlines, which are already under pressure.

We’re not implying folk will treat the US as a no-go zone — it’s not that bad — but the economic uncertainty could crimp discretionary travel.

One of Trump’s policies is to reduce non-discretionary spending by 1 per cent a year, but boost spending on defence and veterans.

A putative winner is military builder Austal (ASB $1.53), especially given Trump’s pledge to boost the size of the US navy to 350 vessels.

Combined with promised tax cuts, the promised rise in defence (and infrastructure) could be a boon for the domestic economy, especially as consumers shun Chinese and Mexican goods walloped with tariffs.

All that shines

Our gold stocks started out on Wednesday as laggards but ended up dominating the thin column of ASX gains, led by Saracen Minerals (SAR, $1.40), which surged 15 per cent.

Insofar as the Trump ascendancy will spark financial markets mayhem — at least temporarily — gold re-emerges as a classic safe harbour.

But bullion may have been in for a bounce no matter what happened.

According to ANZ’s exchange-traded funds team, gold rallied “sharper and for longer” after the past 11 presidential elections.

As Australia’s biggest producer, Newcrest Mining (NCM, $25.35) is the obvious exposure, but the sector is well served with other new and emerging producers.

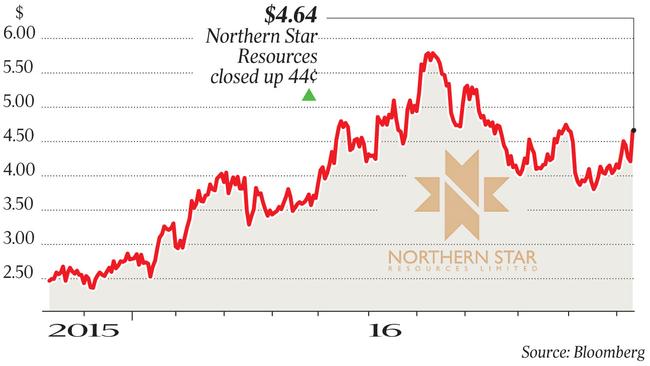

Earlier in the week, Citi rated its best buys as Newcrest and West Australian producer Northern Star (NST, $4.64) among the large caps, as well as New Zealand and Philippines producer OceanaGold (OGC, $4.15). But the tide of fear should lift any bullion boat.

White Rock Minerals (WRM) 1.4c

Given the election timing, White Rock chief Matthew Gill said the gold and silver developer thought hard about extending the retail component of its $5.7 million rights offer by a week (until tomorrow).

But the company, which has operations here and the Republican stronghold of Alaska, is likely to have little trouble filling the hefty retail shortfall.

“I’m biased but I would like to think we are in a unique position as a small producer,’’ the White Rock chief says.

White Rock’s most advanced ground, the Mount Carrington silver and gold project in NSW, is costed at $30m, with $100m of free cash flow over a seven-year mine life.

Crucially, the New York-based Cartesian Royalty Holdings has backed Mount Carrington with a $US19m facility in return for a share of the output. While gold has been the hero commodity over the past 12 months, silver (and zinc for that matter) has outperformed the yellow metal.

The Australian accepts no responsibility for stock recommendations. Readers should contact a licensed financial adviser. The author holds BHP and CSL shares.

So we won’t be seeing the inaugural First Bloke of the White House after all, with the Hillary and Bill show dispatched back to hometown Arkansas (where voters turned on them there as well).