Alarming rush of stockbroker floats

A sure sign we are nearing a market top is the queue of stockbrokers striving for investor attention.

Aside from the hoary old one about bellhops imparting share tips, the sure-fire sign of an impending bear market is when stockbrokers seek a public listing to share the dubious love.

Well it used to be, anyway. Wizened readers will recall that three brokers listed in quick succession in 2007, only to come a cropper after the market tumbled that November.

So we note with trepidation the recent listing of Evans Dixon, the amalgam of Melbourne blue-blood broker Evans & Partners and the self-managed super fund specialists Dixon Advisory.

It’s a case of so far so good, with the shares about on par with their $2.50-a-share debut price, having poked as high as $2.70.

And much has changed since the noughties, when brokers relied on trading commissions and fees from equity capital market activities.

Old-school brokers versed in wheeling and dealing might choke on their third post-luncheon port, but now brokers call themselves wealth managers and operate highfalutin investment platforms (generating annuity fees that don’t depend on the vagaries of the All Ordinaries index).

Evans Dixon also has considerable sums invested in the US Masters Residential Property Fund and solar-farm owner New Energy Solar.

Meanwhile the class of 2007 — Bell Financial Group (BFG, 77c), Wilson HTM and Austock — have morphed beyond recognition. The latter sold its broking arm to Intersuisse in 2012 and is now an investment bonds specialist Generation Development (GDG, $1.22).

The Brizzie-based Wilson HTM was subject to a management buyout of its securities arm in 2015. But its funds management arm Pinnacle lives on as Pinnacle Investment Management (PNI, $5.33).

Previously Bell Potter, Bell Financial Group is enjoying its best conditions in a decade, with funds under advice of $47 billion, 10 per cent of which enjoys recurring revenues. “These numbers clearly demonstrate we are not simply a traditional broker relying on day-to-day revenue from secondary market execution,” said managing director Alastair Provan.

The Perth-based Euroz (EZL, $1.20), which listed earlier, rides the ups and downs of the West Australian resources sector (currently more up and down now).

Once again, it has earnings diversity through $1.43bn worth of funds under management and two listed investment companies (Westoz Investment Company and OzGrowth).

As with so many other professional service plays including real estate (McGrath) and accounting (Harts and Stockfords), broking was not amenable to the listed model.

One reason is that the brokers were more like independent deal-chasers working under the one shingle.

Many were also unable to be herded into a corporate structure because they were eccentrics and-or permanently out to lunch.

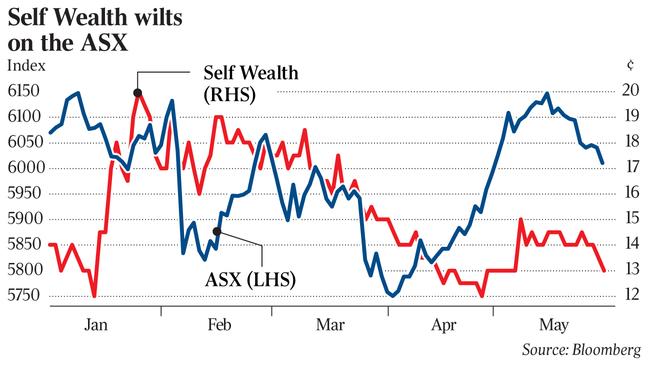

Self Wealth (SWF) 14c

Who needs the help of brokers when you’ve got the collective investment wisdom of the masses, a la Wikipedia?

That’s the unusual premise of Self Wealth, which is best known as a discount online broker but is also developing a line in peer-to-peer stock selection.

Self Wealth has analysed the performance of 35,000 investor portfolios to create the SW200 index, which incorporates stock selections from the best 20 portfolios.

It’s a case of so far so good, with the SW200 outperforming the ASX 200 by 76 per cent in the six months to January.

Founder and chief executive Andrew Ward honed the concept after a 20-year stint in the financial services industry, including the fledgling First State (now the Commonwealth Bank-owned Colonial First State).

Even then, Ward didn’t like what was going on from a “moral and values” perspective and sought to create an online broker with a traditional service model.

That didn’t quite come off, but it formed the basis for the current self-directed platform. “It dawned on me I could use the best investors to create a portfolio,” he says.

Self Wealth’s business model entails either traders availing of its $9.50-per-trade flat fee, or punters signing up for a $20-a-month “premium service”. The latter allows subscribers to track top-performing or like-minded members and receive alerts whenever they trade.

Seeing you asked, exchange-traded funds account for seven of the top 10 investments held by the best 10 investors.

The others are CSL, BHP Billiton and Rio Tinto. Macquarie Group also features, while not surprisingly the big four banks have slipped in popularity.

Sadly, Self Wealth investors are yet to benefit from the wisdom of the masses, with the shares well below their November 2017 listing price of 20c apiece. As usual, profit-taking, pre-IPO investors who got in at a much lower price, appear to be to blame.

“As we’re a microcap, investors are waiting to see our track record. About 20-30 funds say they like the story, but they won’t get in yet.”

Self Wealth’s next step is its own ETF for self-managed super funds, based on the portfolios of the 200 top-performing SMSFs distilled from 30,000 portfolios.

In the company’s favour, it’s backed by BGL, Australia’s biggest SMSF administrator and this provides a channel to attract business.

The catalyst for a rerating is a decent set of full-year numbers, due in August. Until this happens, Self Wealth is consigned to the “concept stock” category.

Tim Boreham edits The New Criterion.

Evans Dixon (ED1) $2.49, and other listed brokers