Fundies earn place at the top dining tables

AS National Australia Bank’s top brass were grilled yesterday, BT showed the virtues of being a pure-play beast.

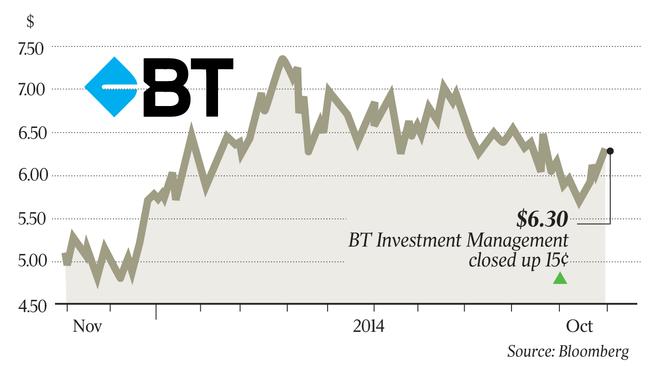

BT Investment Management (BTT) $6.30, Perpetual Limited (PPT) $45.68

AS National Australia Bank’s top brass were grilled yesterday on the absence of life insurance writedowns among other matters, funds manager BT showed the virtues of being a pure-play beast one step removed from the bankers.

Given the mess the banks have got themselves into with their acquired wealth-management ops, Westpac’s decision to spin off BT ahead of the GFC in 2007 (while still holding 60 per cent) looks inspired. BT’s 137 per cent earning surge for the year to September (to a record $121.5 million) comes in the context of the key market sectors to which it’s exposed to gaining an average 11 per cent.

Given the breadth of BT’s offshore revenues, a 14 per cent decline in the Aussie dollar also conferred a free kick.

But don’t assume BT’s fundies have merely been riding the buoyant markets, pressing the “buy” button in between chowing down at Rockpool or Silks.

Much of the earnings increment stemmed from performance fees, which soared 180 per cent to $121m (overall fees climbed 62 per cent to $420m). “It’s all about relative performance,’’ CEO Emilio Gonzalez says.

“Given our boutique style and smaller team, we tend to focus our energy on areas where there is less research, such as mid caps.’’

While fellow fundie Perpetual struck a bum note with its Dublin-based global funds management foray, BT had had more luck with its 2011 purchase of the British-based JO Hambro, for $314m.

Hambro’s funds under management grew from $12.3 billion to $28.2bn during the year — and also drove performance fees.

The only downside to doing well is that the gun staff demand more reward, with salary costs rising 40 per cent. And they’re a loyal bunch. “We have not lost a single staff member to a competitor over the last seven years,’’ Gonzalez says.

Meanwhile, Perpetual chair Peter Scott yesterday reported a positive start for the year for its Perpetual Investments arm, an eager investor in Aussie equities.

Scott reports net inflows of $1.1bn for the first quarter, the fifth quarter of such growth.

With trustee and financial planning businesses, Perpetual is more broadly exposed to the local market. Having launched a global fund in August, Perpetual has an “ambitious and simple” target to manage $1bn of offshore equities within three years.

Perpetual is a hold and BT is a long-term buy, subject to market conditions of course.

National Australia Bank (NAB) $34.63

SO far this millennium, National Australia Bank investors could be excused for thinking they’ve backed the wrong horse and should invest in a Cup Day roughie instead.

Veteran analyst Brian Johnston wasn’t sparing management’s feelings yesterday. “In 2000 NAB had earnings per share of $2.15,’’ he said. “Today we sit here and it’s $2.16 a share. I think on any measure this is well short of woeful.’’

Under new CEO Andrew Thorburn, management is cognisant of NAB’s lagging return on equity and its uncanny tendency to find trouble.

At yesterday’s results, Thorburn dwelled on remedial measures to boost the bank’s lagging return on equity.

But he really only needs to do one thing to be cast in bronze and hoisted as a bank hero in Martin Place — sell the British (Clydesdale Bank) operations.

With Clydesdale’s performance improving and overall British conditions looking much better, a whiff of opportunity is emerging.

Thorburn yesterday hinted at a public listing, presumably a gradual sale along the lines of its Great Western Bank hiving-off in the US. Lest anyone get overly excited, there’s still the issue of the regulatory response to the industry problem of the mis-selling of insurance and interest rate hedging products.

The remediation costs were a large chunk of the bank’s $1.34bn of writedowns that blighted yesterday’s headline result. While management believes the bank has adequately provided for the problems, there’s still a “what-if” in terms of further liabilities.

The Nabsters wouldn’t be drawn on whether head office would be willing to provide an indemnity to future owners of a stand-alone Clydesdale, which Lloyd’s Bank did when it recently floated off TSB. “There are obviously a number of issues we have to address to exit (Britain),’’ numbers man Craig Drummond says.

Still, the odds are firming that investors no longer will cry Rue Britannia — but the retreat won’t be overnight.

Otherwise, NAB’s numbers were messy but pretty much as flagged. In the words of Shaw Stockbroking: “No real surprises: margins better, bad debts better, volumes a little light, non-margin income a little light.’’

Long-term buy.

The Australian accepts no responsibility for stock recommendations. Readers should contact a licensed financial adviser. The author owns NAB shares.