Brian Hartzer’s upbeat story warms Westpac investors

Westpac chief Brian Hartzer holds an upbeat view of local conditions. And investors love this good news story.

Pending Commonwealth Bank’s first-quarter update at today’s AGM, investors have judged the big banks’ full-year results as better than feared — albeit for different reasons.

Investors yesterday pushed Westpac(WBC $30.50) shares up 2.6 per cent, despite a revised return-on-equity target and despite cash earnings of $7.822 billion (and the final dividend of 94c a share) being predictably flat. One reason for the outpouring of joy was Westpac chief Brian Hartzer’s upbeat view of local conditions.

“The transition to a service economy is happening and the drag from mining has largely rolled through,’’ he says.

As with National Australia Bank’s numbers last week, Westpac has its bad debts well under control and Hartzer expects this will remain the case despite pockets of weakness in mining regions, residential development and NZ dairy.

At face value, Westpac’s full-year bad debt charge blew out an alarming 49 per cent, to $1.124bn, from $753 million previously.

But the pain was felt in the first half through a small number of non-recurring large corporate exposures. In contrast, the second-half charge fell 31 per cent to $457m, from $667m previously.

As with NAB, which also held its dividend steady, there’s a question mark over whether Westpac can sustain its largesse.

Hartzer confides the dividend payout is “a little more than what we would consider sustainable over the long term”.

But with the bank holding more than enough tier-one capital and oodles of franking credits, the yield lolly shop will remain open for some time to come. Long-term buy.

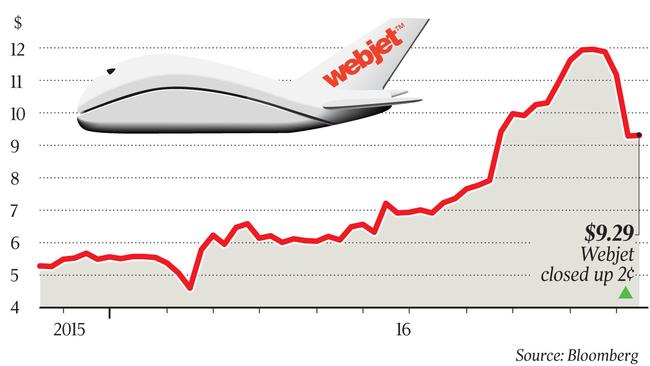

Webjet (WEB) $9.29, Flight Centre (FLT) $30.28

The travel booking stocks were notable no-shows on the Hillary Express yesterday, although a late rally prevented Webjet from booking its seventh consecutive day of losses.

Flight Centre shares nosedived on Friday after the company warned that cheap airfares — especially rock-bottom international deals — were affecting margins.

Attention turns to Webjet, which presents at a UBS shindig today and holds its AGM on November 29.

With shares in the high-multiple Webjet off 17 per cent over the last week, it would have been opportune for management to reassure the market that all was well, or else fess up to any bad news.

We’ll presume the former.

In theory, Webjet should be doing better than Flight Centre because it is more exposed to domestic airfares, which haven’t been as hard hit by discounting.

Webjet has also diversified its revenues from airfares to hotels and now to car, motor home and cruise bookings with the recent purchase of the New Zealand-based Online Republic.

Holders who participated in the $72m rights offer at $5.60 apiece to fund this shebang are still well ahead.

Flight Centre is a long-term buy on the premise that airfares can’t get much lower than a $400 return jaunt to Hawaii.

Webjet shares still look toppish so we’ll avoid them pending clarification of the company’s fortunes.

UGL (UGL) $3.15

With a rebel yell, dissident UGL director Robert Kaye SC has cast his legal eye over CIMIC’s $3.15-a-share offer and cried “more more more”.

Putting himself at odds with the contractor’s four other directors, the learned silk decrees CIMIC’s unconditional offer as opportunistic and not reflecting the true value of UGL’s core business (anything but the group’s troubled Ichthys LNG contract). Kaye notes that the offer price is at the lower end of independent expert’s value of $3.11-$3.94 a share.

We love a rebel with a cause — even if they don’t wear leather and drive Aston Martins — but we’ll defer to the majority view. On balance, UGL holders should accept the offer at a 47 per cent premium to the pre offer value of $2.14. No rival offer has emerged since CIMIC’s off-market takeover announcement a month ago. The offer is final and one doesn’t need to be an SC to know that legally it can’t be raised.

Because the off-market offer is unconditional, CIMIC may not end up with full control, which means the refuseniks can hang in there in the hope of being mopped up at a higher price. A precedent is Warrnambool Cheese & Butter (WCB, $6.75), which remains listed despite a three-way takeover battle in 2014 that saw Canada’s Saputo win control.

But Saputo only got to 87 per cent — short of the 90 per cent compulsory acquisition threshold — after 10 per cent holder Lion Group refused to sell. Remnant holders on the illiquid register have seen the value of their investment fall by 25 per cent.

CIMIC, by the way, used its 14 per cent UGL stake to defeat UGL’s remuneration proposal at UGL’s AGM yesterday.

And it’s supposed to be a friendly offer …

The Australian accepts no responsibility for stock recommendations. Readers should contact a licensed financial adviser. The author holds Westpac shares.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout