Vancouver, Sydney and Melbourne are, in a strange way, “sister” cities because all three have been subjected to unprecedented Asian buying of domestic real estate, which has sent prices so high that young locals are being priced out of the market.

So, what has happened in Vancouver in the last three months is of vital interest to the Sydney and Melbourne real estate markets.

But first, a new development in Sydney.

Readers will remember that Chinese buyers have been rescinding their off-the-plan buying contracts, although these are being replaced by other Asian investors and a lift in local buying.

Unlike Vancouver and Melbourne, the Sydney apartment market is dominated by one man — Harry Triguboff and his Meriton group.

Apartment prices have fallen marginally in Sydney in the wake of the Chinese exodus which was caused by local banks backing away from the funding of such purchases and also because it has become much harder to extract money from China.

So “The Bank of Triguboff” is now moving in and offering to fund Chinese buyers of Meriton apartments who can’t raise the cash.

Triguboff sold apartments when the market was hot, so Australia’s biggest apartment owner had no debt when the downturn started.

Australia’s big banks will scramble to loan Meriton money, so “The Bank of Triguboff” can on-loan to Chinese wanting to continue their Meriton apartment purchases.

And, as word that the Chinese were being funded by Harry spread around the Sydney market at the weekend, it reinforced confidence.

There is no such “bank” in Vancouver or Melbourne.

So, back to Vancouver.

Here I am indebted to Zero Hedge.

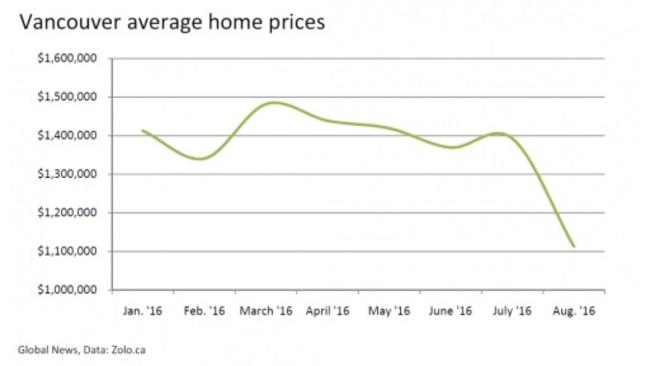

Two blows have hit Chinese buyers of Vancouver real estate — the increasing difficulty of moving money from China and the implementation last month of a 15 per cent property tax by the provincial government of British Columbia.

Both Victoria and NSW have imposed property taxes on foreign purchases but nothing on the scale of what was imposed in Vancouver (in Sydney it is being levied at 4 per cent of the purchase price).

Before the tax came into effect, Vancouver experienced the same developments that we saw in Sydney and Melbourne — such as deals falling through as foreign buyers forfeited deposits on binding deals.

Then the Vancouver market received an extra blow — local buyers began withdrawing offers in expectation that the market would soften. Volume slumped dramatically. While August is typically one of the slowest months for real estate transactions in Vancouver, the number of homes sold during the first two weeks of August in Greater Vancouver dropped by 85 per cent on average.

Solo, a Canadian real estate brokerage house, reports that the City of Vancouver currently has an average apartment price of $1.1 million, down 20.7 per cent over the last 28 days and down 24.5 per cent over the last three months.

By contrast, and significantly for Australia, the average Vancouver detached home is $2.6m, down only 7 per cent compared to three months ago.

In Vancouver there is a fear that they may be seeing a repeat of the 1980 housing crash, when prices dropped by 40 to 60 per cent within a year and took six years to recover.

While that may be too alarmist, real estate experts say that the foreign buyer tax has certainly stopped speculative buyers. This has caused many other buyers to take a wait-and-see approach, which has essentially frozen the market.

Australia is not experiencing such a development but if the Vancouver slide continues, it should raise property alarm bells around the world.

As buyers returned to the Sydney dwelling market over the weekend, taking auction clearances to a one-year high, on the other side of the Pacific in Vancouver, prices are down 20 to 30 per cent.