Sydney’s largest apartment owner and developer Harry Triguboff has confirmed that this is happening and that by rescinding the contracts the Chinese lose their deposit and the agents must return the commissions.

While there have been isolated incidents in the past, never before has Triguboff’s Meriton experienced such an event. In the past, the Chinese have always honoured their contracts.

And given Chinese are rescinding contracts in Sydney the amount of apartments in Melbourne likely to be affected will be much greater because that’s where huge numbers of one-bedroom apartments were bought off the plan by Chinese investors based on a 10 per cent deposit.

But we’ll get back to that later. Triguboff’s Sydney story has a surprising twist.

The global attraction of Australia and Australian apartments to Asian investors has combined with a rising demand from Australian investors to create an amazing offsetting trend in Sydney. Harry Triguboff can hardly believe what is happening.

On the one hand Chinese are rescinding but they are being replaced by other investors of Asian origin plus Australian investors.

Yesterday, I detailed how the Chinese government was really clamping down on money leaving the country for real estate investment and this is the reason for the Chinese turning their backs on their Australian contracts — the local banks will not help and the investors can’t get their money out of China. The same problem is affecting real estate markets in North America (Real estate rattled as Chinese capital flows ebb, August 3).

If the Chinese who are rescinding contracts can’t get the money out of China then how are their replacement Asian buyers finding the money?

We don’t know exactly how the new purchasers expect to fund the apartment settlements but, almost certainly, part of the demand is coming from Hong Kong where the local population has become alarmed at the aggressive stance of the mainland Chinese (Melbourne’s apartment bust escape route passes through Hong Kong, May 24).

At the moment, they can get money out of Hong Kong but that might not continue.

In addition, some Asian investors may have already extracted money from China while others may have devised money extraction schemes that the Chinese government has not yet discovered so has not blocked.

Meanwhile, Meriton has pocketed the forfeited deposits and agent commissions and is then selling the apartments at the same or greater price than the Chinese had originally agreed to purchase.

Normally contracts are only rescinded when the price falls but this time it’s because of the inability of the Chinese to fund their contracts.

In Melbourne, the supply of inner city apartments, particularly one-bedroom apartments, is much greater than in Sydney. So, as the Sydney trend for the Chinese to rescind contracts spreads to Melbourne, the intensity of selling will be much greater.

Accordingly, it is going to take many more Hong Kong and other Asian investors to absorb the likely volume of rescinded contracts than is required in Sydney.

Already in Melbourne there is a two-tiered market where local investors buy “used” apartments at lower prices than new apartments.

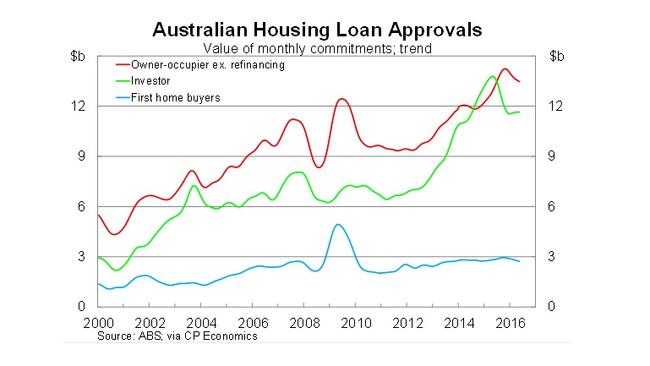

The Australian banks have stopped funding Chinese investors in apartment deals but they also have quotas for financing local investors which have been imposed by APRA. At the same time, they slug local investors with interest rates that are 0.25 or 0.3 percentage points higher than buyers who plan to live in an apartment.

The graphs below shows the division of bank lending between investors and residential dwellers.

It is impossible for most first home buyers to purchase a dwelling in most parts of Sydney and Melbourne without a huge mortgage or parental help. But the interest deductibility, the rental income and the depreciation allowances in investment, make investment property much more feasible for first home buyers. And apartments are often simpler to buy than houses.

If APRA prevents local investor funding of at least Melbourne apartments — assuming the loans are properly income covered and so the banks are safe — then APRA is in grave danger of creating a recession where developers, builders and subcontractors are sent to the wall by an overzealous regulator. Banks who funded the developers will also lose money.

The latest withdrawal by the Chinese is a vital turning point for Australia but the fact that other Asian buyers are prepared to invest shows just how attractive our nation has become.

The unthinkable has started to happen. The mass of Chinese property buyers who snapped up Australian apartments “off the plan” on the basis of a 10 per cent deposit have started to walk away from their agreements in Sydney.