Oil price volatility driven by India, China, Iran, US and Europe: Robert Gottliebsen

After its sharp price rise, oil has fallen almost 30 per cent and the fall is conveying to the world much clearer messages than the confusing reports coming out of the current Ukraine turmoil.

In world history, oil has often played such a role but the current roller coaster has few parallels.

Before we look at the fundamental messages being conveyed via the oil market, it’s important to underline that oil is one of the most actively traded commodities in the world.

At the moment the world is awash with liquidity so from time to time when a situation like the current oil game erupts, trading money pours in multiplying the demand and supply forces. When the bullish sentiment fades that money pours out with a similar rush.

And almost certainly in this case the shorters have sold oil they did not own further driving down the price. In time their covering will spark at least a partial recovery.

But the messages from the oil fall are much more significant than simply trading and they come from India, China, Iran and, of course, the US and Europe.

Let’s start with a country that markets often overlook – India. It’s set to be the largest populated country on earth so it’s importance is going to rise. India is a member of the “Quad” that Australia helped put together to contain China. (The other members are Japan and the US).

India relies on Russian arms in its regular battles with Pakistan and it is, of course, very wary of China.

In exchange, India buys oil and potash from Russia. The Russians offered Prime Minister Modi discount oil and he accepted the offer. I suspect Russian President Putin also discounted potash, which is essential for Indian food production. It’s easy to criticise Modi for breaking the embargo but Europe is still taking gas and Modi faced a humanitarian disaster of great magnitude.

Nevertheless, India’s actions were an important signal to the markets that the oil embargo would have limits, particularly in Europe.

One of the major changes in US policy under President Biden is American attitudes to Iran. For many months there has been a negotiation to reduce sanctions on Iran in exchange for a nuclear deal. They were very close to success when Russia suddenly put US sanctions on the table and the deal immediately stalled. Now Russia has pulled back and it looks like the world is about to see substantial flows of Iranian oil.

China has locked down important cities in its new battle to contain Covid. It believes the Chinese population is far more vulnerable to the new strains of Covid then many Western nations.

The lockdowns mean that supply chains are going to be once again interrupted and world economic activity – and therefore oil usage – is going to once again slip back. Chinese shares fell sharply.

When any commodity rises a strongly as oil has done it immediately boosts supply. Producers all around the world are planning to extract their higher cost oil to take advantage of the bonanza.

Nowhere is that more evident than in the US where, under the encouragement of President Biden, as much fracking as possible is taking place to lift production. The Presidential vows in the election campaign have been thrown out the window. Oil producers using fracking technology can ramp up production rapidly.

At the same time it is clear that, like our Reserve Bank, the US Federal Reserve now understands that it has a clear inflationary problem. Thank goodness. The Federal Reserve has only has one weapon, higher interest rates, and it will start using it this week and the higher rate trend will continue. Those holding oil as an investment thought it was time to bail out.

Casting a shadow over the whole oil situation is the Ukrainian war. The failure of the US to allow Poland to send MiG jets to Ukraine means that Russia can now destroy Ukraine. But it has not yet started carpet bombing perhaps having humanitarian feelings about the millions of people it would kill.

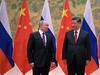

Meanwhile, China is looking for a peaceful solution via the United Nations but it is also very close to sending arms to Russia which will almost certainly cause a war escalation and embargoes on China. There are also peace talks taking place directly between Ukraine and Russia.

And Russia is very close to being forced to renege on its bonds. These are all ingredients in a very volatile mix. But the oil market is telling us that there may be a solution in sight.