NW Shelf shake-up looming: Voelte

Former Woodside Petroleum boss Don Voelte says Chevron’s decision to sell out of the $34bn North West Shelf LNG plant may spark a bigger ownership reshuffle.

Former Woodside Petroleum boss Don Voelte says Chevron’s decision to sell out of the $34bn North West Shelf LNG plant may spark a bigger ownership reshuffle, with energy giants BP and Shell potentially in line to follow the US major by exiting Australia’s biggest gas export facility.

Mr Voelte — who described the gas hub as a “great money-maker” during his seven-year run in the top job until 2012 — said a new model for the West Australian LNG plant in which it would process gas from other companies would not be a natural fit for some of the six joint-venture partners which own the facility.

“Now that it’s gone over the cliff and into the downside, it’s obviously getting harder and harder to develop and that means less and less margin,” Mr Voelte told The Weekend Australian. “That’s not going to be to everyone’s liking. I suspect once Chevron goes, BP and Shell would rethink their situation too. Ultimately they would have the same problem with this type of tolling model that they’re moving to.”

Woodside operates the facility in a joint venture with BHP, BP, Chevron, Shell and Mitsubishi with Mitsui. A “clean up” scenario may develop where the energy majors look to sell out of lower-earning assets as part of a broader reweighting of their global portfolios and to bolster their balance sheets. Still, landing a big payday may be more problematic given the oil crash this year. “I wouldn’t be surprised if there’s more selling of assets by these majors. You’re seeing that with Exxon and the Bass Strait. Asset sales have always been part of the majors’ strategy and they constantly do it. The problem is you’re not going to get as much for your assets as you would have two years ago,” Mr Voelte said.

“All of these big companies are borrowing money to pay dividends. But I’d question whether you can continue to borrow and I think for these guys one of the last things they can do is cut their dividends. That’s a death knell for them.”

BP and Shell declined to comment. Woodside said on Friday it would consider thwarting any third party looking to buy Chevron’s $5.8bn stake by flexing its own pre-emptive powers as it weighs whether to double its share of the plant.

The Perth-based producer confirmed it holds rights to match a deal from any external buyer pursuing Chevron’s one-sixth share of the plant.

“The North West Shelf joint venture agreement has pre-emption provisions relating to divestment of an interest in the North West Shelf,” a Woodside spokeswoman said. “If a North West Shelf venturer was to propose a transaction coming within the pre-emption provisions, Woodside would consider the transaction in the normal course.”

Woodside was already likely to be one of the bidders, Macquarie said, after Chevron indicated it had been approached by credible suitors.

“All partners have pre-emptive rights, allowing Woodside and potentially its joint venture partners as well to match an outsider’s bid in proportionate share,” Macquarie said. “Woodside’s target gearing range is 15-35 per cent, and while currently below range, we expect it would raise equity for an acquisition of this size, given development capex that lies ahead and the importance of a dividend.”

PetroChina, which owns a stake in the Browse gas project, could emerge as a frontrunner with China’s CNOOC also a lead contender, Credit Suisse said.

With four NW Shelf partners also owners in the Browse project, Chevron’s move could pave the way for the long-delayed Browse development to get off the ground after it was deferred earlier this year due to the oil crash, Goldman Sachs said.

Browse gas was in line to be processed through NW Shelf, with the plant facing the depletion of its gas reserves in the next few years, forcing the facility to move to a new tolling model where it will process gas from third parties for the first time.

Chevron and BHP were named last year by Woodside chief executive Peter Coleman as the two NW Shelf companies not aligned with the plan to pipe Browse gas to the plant, meaning Chevron’s exit might smooth a path for Browse.

Woodside, BP, Shell and Japan Australia LNG all hold stakes in both NW Shelf and Browse, while Chevron and BHP only have ownership in the NW Shelf. “The sale of Chevron’s stake may provide a pathway toward alignment on the Browse development.

“If Woodside or Shell were to increase their NWS share, this could represent the first step of unitisation between upstream and downstream,” Goldman Sachs said.

Adding to the equation, Woodside and BHP are also partners in the remote Scarborough project, which is in line to supply a planned expansion of Woodside’s Pluto LNG plant.

Woodside may be forced to tap shareholders for equity if it decides to buy Chevron’s stake in the North West Shelf LNG venture, raising the question of whether it should still proceed with a $US1.5bn expansion of its neighbouring Pluto plant, Citi said.

Analysts have been running the numbers on Woodside making a play given it controls the Scarborough and Browse gas projects which could both use the plant to process their supplies.

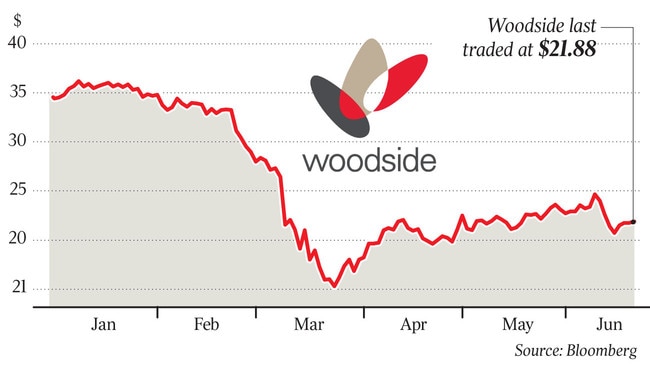

Woodside shares rose 0.6 per cent to $21.88.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout