Like energy, at the heart of the problem is an artificially created supply shortage.

State and federal governments, local councils and banks have all played a disastrous role in creating the crisis.

There is no quick fix, but I am seeing encouraging signs starting to reverse decades of bad decisions.

Politicians, public servants and maybe even the banks are starting to understand what must be done – but it will not be easy because it requires reversing endless past mistakes.

My first encouraging sign is the fact that the NSW Productivity Commissioner Peter Achterstraat’s research is now being embraced at top levels.

I am a great admirer of Achterstraat as a result of the magnificent work he undertook in analysing what was wrong with the NSW and Australian education systems.

Naturally, initially, the politicians and public servants dismissed his ideas, but as violence rises among uneducated sectors in the youth community – partly caused by the failings of the education system – some of the Achterstraat solutions are catching people’s attention, including the NSW Deputy Premier Prue Car, who doubles as education minister.

Achterstraat is now looking at the rental mess, and he quickly grasped that the long-term solution involves increasing the supply of rental and indeed all dwellings.

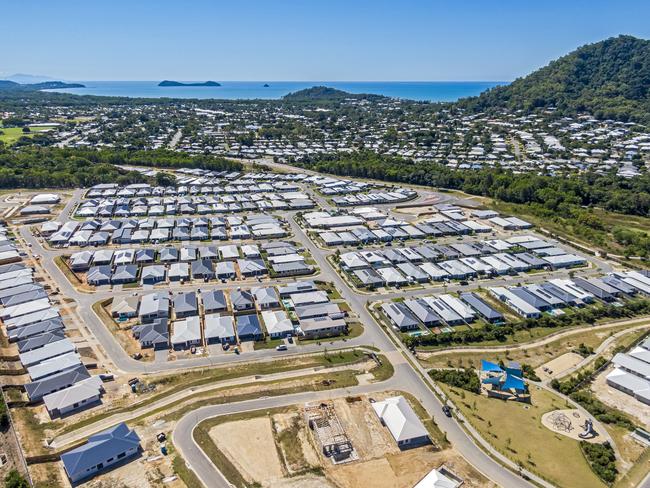

He believes for Sydney that means more apartments. Other cities like Melbourne and Brisbane may require both more apartments and suburban land developments.

In NSW and Victoria, the approval process to develop land for all types of dwellings is a total nightmare which takes years to navigate.

This not only substantially adds to the cost of dwellings, but dissuades developers from buying land and then suffering crippling bureaucratic delays.

Accordingly, this squeezes the supply and pushes up both dwelling prices and rents.

Hopefully the NSW deputy premier, having embraced some of Achterstraat’s teaching education solutions, will realise his solutions to the rental crisis are just as important.

On this front, there is another encouraging sign.

The Victorian government – after watching an apartment development on the city’s edge failing to get through the ravages of the development delay system – simply stepped in and overrode its bureaucracies.

If NSW and Victoria are not prepared to set clear approval rules and dismantle their bureaucracies, then that’s a kind of action required.

In NSW, the delay morass is made worse by an army of public servants who keep dreaming up changes to the building codes for little purpose except to increase building costs substantially.

For example, they refuse to follow Victoria and allow carparking in the lower apartment building floors and instead require digging huge carparking holes.

They restrict the number of carparks to make developments uneconomic, and for the same reason dream up a myriad of smaller ideas to add about $150,000 to the cost of each apartment.

The hidden bureaucratic agenda was always to stop development and restrict supply. Rents naturally skyrocket.

My next green shoot for rental accommodation will surprise many.

The federal government is damaging long-term confidence in superannuation, not by the 30 per cent tax on balances above $3m, but the absence of indexation on that cap and the draconian taxation of unrealised capital gains.

That means long-term savers are thinking elsewhere, and a large number are now considering negative gearing, which will boost the supply of rental properties.

This switch was encouraged in the budget via greater depreciation allowances.

Right now, the cost of building houses and apartments is usually higher than buying an existing dwelling and carries higher risk. That must be reversed to solve the rental crisis, and it can be done.

Part of the rent boosts in Queensland and Victoria were created by legislation that gave tenants enormous powers and forced many landlords to sell.

But rent supply shortages are creating competition to be a good tenant, neutralising some of the impacts of the legislation.

Governments are now encouraging both individuals and institutions to invest in build for rent projects, including “social housing”.

But all projects must be economic for investors and “social housing” must distinguish between “affordable housing” that extends to people like police, teachers, health workers etc who have been priced out of the ownership market and the large numbers of very low income people who will create a ghetto.

Ghetto accommodation must be financed by governments.

Banks are rarely linked to the causes of the rental crisis, but they played a big role.

The banks’ policy of demanding housing contracts be fixed price and attaching those fixed prices to amounts available to lend has virtually stopped home building in Australia.

Even those who get through bank hurdles are reluctant to build because they scared their builder will go broke in the middle of construction.

When it comes to apartments the banks’ requirements on presales makes it very difficult to get projects off the ground and in both sectors the owner instalments do not match the payments being made by builders.

It’s a cashflow disaster.

The nation is going to require a different approach to banking in the dwelling sector there are many models overseas, but the banks will fight them because it will impact their profitability.

The banks need to reflect on the fact that a key part of their mortgage lending supply chain are builders and subcontractors.

The banks’ requirement for mortgage financing to be based on fixed-price building contracts boosted profits but put too much risk on builders and subcontractors and destroyed vast numbers of them.

Just as state and federal governments and local councils must change their ways, so must banks.

The home rental crisis is not the biggest force driving Australia’s exploding inflation rate, but it has become the signature sign for all that is wrong in Australia’s battle to curb inflation and help its citizens.