Modest cuts won’t buoy economy

Interest rate cuts will still be needed this year economists say, and the budget won’t give enough of a boost to the economy.

Interest rate cuts will still be needed this year according to economists, who say the federal budget won’t give enough of a boost to the economy after a sharp slowdown since mid-2018.

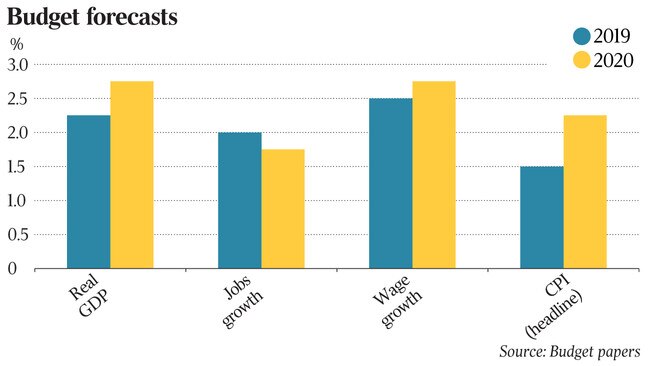

At the same time some questioned the budget’s “optimism” on real economic growth and wages, which could undershoot Treasury’s forecasts.

A smaller than expected budget stimulus has increased the chance of “earlier and larger” rate cuts from the Reserve Bank, according to UBS Australia chief economist George Tharenou.

“Household tax cuts and handouts were much smaller than expected, while infrastructure and public demand slow down sharply,” he said.

“With credit tightening causing the largest housing downturn in history, and a negative wealth effect, a significant share of modest tax cuts will likely be saved or used to repay record debt.”

He said the budget reinforced his view that year-on-year economic growth will slow to 1.9 per cent in 2019 after the average quarterly growth rate dived to a 1 per cent annualised pace in the second half of 2018, from 4 per cent in the first half.

The RBA is forecasting 3 per cent growth for 2019.

While expecting the RBA to wait for March quarter economic growth data in June to confirm if the slowdown continued this year, before cutting rates in July and August, Mr Tharenou said the Reserve Bank would likely shift to an explicit easing bias next month.

“The lack of material stimulus raises the risk of earlier and larger cuts [in interest rates],” he said.

The dollar regained US71c yesterday on stronger than expected retail sales and international trade data, as well as optimism about US-China trade talks in Washington.

The S&P/ASX 200 share index rose 0.7 per cent to a seven-month high of 6285 points.

NAB chief economist Alan Oster said mooted tax cuts in this budget would provide a welcome boost to household incomes at a time of weak income growth and weaker consumer confidence resulting from high debt levels and other constraints.

But they are “small” and “unlikely to impact significantly upon the household sector dynamic”.

Because of persistently weak inflation — primarily a result of weak growth in labour costs — and with a weaker growth outlook seeing little further improvement in the labour market, he expected the RBA to cut the cash rate to a new record low of 1 per cent this year from 1.5 per cent currently.

Mr Oster also questioned the budget’s “optimism” on real economic growth and wages.

“Fundamentally, we are a touch more pessimistic than the Treasury on the real economy in the out years,” he said.

“Beyond the current year we see the economy as tracking around 2.25 per cent. Treasury however sees growth around 2.75 per cent in the out years.

“We see higher unemployment and significantly weaker wages growth. So in our view the budget is not as stimulatory as it seems to be — or is being sold as.

“It does not change our view on the economic outlook and how consumers will see their expenditure decisions. Nor would the outlook of the RBA be much affected.”

Consumers will continue to struggle with cash flow, and hence discretionary spending, and house price falls will see construction activity fall another 20 per cent over the next two years.

Westpac chief economist Bill Evans said that while the stronger fiscal position gave the budget scope to stimulate the economy, it had done so modestly, with a $9.9bn boost over four years.

“This is a relatively modest boost to spending across four years in the context of a $2 trillion economy [and] risks to the economic and fiscal forecasts abound,” he said.

While the forecast fall in the iron ore price to $US55 a tonne from $US90 “appears to be overly cautious” the budget’s economic forecasts may still be optimistic.

“They assume real GDP growth is above trend, year-in year-out, until the output gap is closed,” Mr Evans said.

And the upcoming federal election represented a risk to the budget outlook with the potential for a “bidding war”.

While the budget should provide a boost to household finances and confidence, the potential uplift to the economy and household income was “relatively modest” and uncertainty around its timing and details may dampen any positive announcement effect, said AMP Capital’s head of investment strategy and chief economist, Shane Oliver.

“While it will help the economy it’s not enough to change our view the RBA will cut interest rates twice by year end, taking the cash rate to 1 per cent,” he said.

Dr Oliver said the main risk was that the revenue boost was not sustained and the budget had relatively optimistic assumptions regarding wages growth.

Citi Australia chief economist Paul Brennan said a moderate stimulus from the budget should buy the RBA more time to gauge the outlook and risks to its central case of gradually lower unemployment and a return of inflation to target.

He noted the forecast shift from deficit to surplus in 2019-20 implied the budget was “mildly contractionary” by around 0.5 per cent of GDP.

At the same time, he said new policy announcements of $2.8bn in 2019-20, including $1.1bn in lower revenue, understated the stimulus from the increase in the low and middle income tax offset, as the MYEFO (mid-year economic and fiscal outlook) in December included provisions for tax decisions, accounted for but not announced, of $9.2bn.

“The government has not provided voters with a significant upgrade to spending compared to the December 2018 MYEFO,” Mr Brennan said.

“With the election likely to be announced this week, the government is delivering larger tax relief via the low and middle income tax offset.

Mr Brennan said Labor would have its own budget priorities, which it would aim to implement within a few months via a mini-budget or major economic statement, should it win the election.

ANZ’s head of Australian economics, David Plank, said the tax cuts and cash payments could boost household income by a “meaningful” 0.8 percentage points in the second half of 2019.

The government had also left room for more spending during the election campaign.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout