Whitehaven coal production slumps

Whitehaven says thermal coal prices have stabilised after a 2019 plunge, and flagged a recovery for coking coal.

Whitehaven Coal says thermal coal prices have stabilised after 2019’s steep plunge as the sector comes under renewed investor pressure, and flagged a recovery for coking coal on the back of the first stage of the US trade deal with China.

The Australian coal producer delivered its December quarter production results only days after the boss of fund manager BlackRock, Larry Fink, flagged an exit from companies that make more than a quarter of their money from thermal coal.

But, while BlackRock’s 2.7 per cent stake in Whitehaven is likely to be one of those on the selling block, most of the questions on Thursday’s analyst update to Whitehaven managing director Paul Flynn were on flagging production at the company’s mines in the December period.

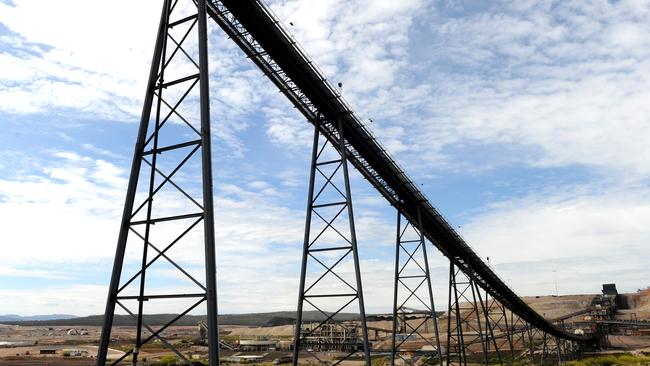

Whitehaven’s production slumped in the quarter, hit by labour shortages and bushfires at its flagship Maules Creek mine, and an eight-week outage at its Narrabri underground mine as the company moved longwall equipment.

Run of mine coal production fell almost 30 per cent, to 3.1 million tonnes, compared to the September period and slumped 58 per cent prepared to the December quarter in 2018.

While Whitehaven sold 4.5 million tonnes of coal in the period, down only 17 per cent a year ago, it leaned heavily on its coal trading arm and and stocks — which dipped to 975,000 tonnes at the end of December, from 2 million tonnes three months before — to maintain sales volumes.

Whitehaven flagged problems at Maules Creek in early December, saying it had lost days due to heavy smoke from nearby bushfires, and was having trouble recruiting enough skilled workers to maintain production levels.

It said on Thursday that that situation had improved, with run of mine output up slightly from almost 2 million tonnes in the September period to 2.2 million tonnes in the final quarter of 2019.

The company maintained its revised full-year guidance of 20 to 22 million tonnes for the financial year, with 10 to 11 million tonnes set to come from Maules Creek, which produced only 4.2 million tonnes in the first half of the year, on a run of mine basis.

Whitehaven will deliver its half-year results on February 20, against the backdrop of a coal price that fell sharply in 2019. The Newcastle benchmark price for Australian thermal coal plunged 35 per cent during the year, from an average $US104/t a tonne in the December 2018 quarter to $US67 a tonne a year later.

Whitehaven’s received prices also fell in the quarter, with metallurgical coal prices down 13 per cent to $US87 a tonne and thermal coal down 9.6 per cent to $US66/t — which Whitehaven partly attributed to the increased proportion of lower-grade coal in its sales mix, saying lower production of high-grade coal from its own mines limited blending opportunities.

In the December 2018 period Whitehaven averaged thermal coal sales at $US108/t and metallurgical coal at $US122/t.

But the company said it expected a recovery in 2020, both at its mines and on the market.

Whitehaven noted benchmark thermal coal prices stabilised in the second half of 2019.

“Whitehaven continues to see strong end user and trader demand for high quality thermal coal. The Newcastle coal price has found a floor in the past two quarters of circa $US67/t,” the company said.

“The Newcastle price levels have seen ‘swing’ suppliers from Colombia, Canada and the US withdraw from the market which has led to a rebalancing of the fundamentals, and pricing being well supported in a range around the high $US60s.”

Whitehaven said the first phase of a trade deal between the US and China should also boost global trade, helping support steel production and making a “welcome positive impact” on the price of coking coal.

Mr Flynn told analyst on Thursday many of the company’s operational challenges were easing, with recruitment ahead of schedule at Maules Creek, aided by management changes, and Narrabri production to rise after the longwall movement.

Whitehaven shares closed unchanged at $2.59.