Whitehaven says it’s ready for climate change policies

Australian coal will remain strong no matter how global governments respond to climate change, Whitehaven says.

Whitehaven Coal says it will survive and thrive under almost any policy mix introduced to combat global climate change, saying demand for Australian coal will remain strong no matter how governments across the world respond.

Whitehaven released its inaugural sustainability report on Wednesday, ahead of an investor day on Thursday, outlining its response to the threats posed to its business by climate change. It is the first coal company to make disclosures under the Financial Stability Board’s global climate framework.

The Australian coal major said it accepts the science underlying climate change and told shareholders it accepts that “the production and consumption of coal contributes to greenhouse gas (GHG) emissions”.

“We also acknowledge that a central challenge of climate change is how to integrate international emissions reduction efforts with the aim of supporting the legitimate economic and social development aspirations of people, communities and countries,” the company said.

“Limiting global temperature rises from climate change requires a reduction in global CO2 emissions, but achieving emissions reductions while maintaining a reliable energy supply poses some significant challenges.”

The coal major admitted it faces a growing threat to its reputation by remaining in the thermal coal business, saying community “misunderstanding” of the future role of high-grade coal from Australia could impact its social license to operate.

And persistent pressure by activist groups on bankers and insurers to avoid the coal industry could also drive up costs and major insurers leave the market, Whitehaven said.

But despite the recent collapse of thermal coal prices, which have slumped 45 per cent over the last year under pressure from a glut of liquefied natural gas flooding energy markets, Whitehaven said the build-out of new coal-fired power stations in Asia will ensure the long-term stability of demand for Australian energy coal.

“One aspect of this phenomenon is that coal-fired generation fleets in our customer countries are relatively young, especially compared with a country such as Australia, and utilise advanced technology to maximise efficiency with reduced environmental impact,” the report said.

“Coal-fired plants typically require large upfront capital expenditure, which in turn provides 40 to 50 years of operating life. Given the early life cycle of these assets, we are likely to see sustained demand for coal as a fuel input over a significant period of time.”

Whitehaven said a close review of its medium-term outlook shows its business is “resilient” in the face of most climate change policy scenarios, despite some emerging threats.

“In undertaking this analysis, we have stress-tested the resilience of our portfolio against the International Energy Association’s three most commonly referenced scenarios, as outlined in its World Energy Outlook series,” the company said.

The IEA’s last scenarios included a business as usual case, with no major change to current energy policies across the globe, which the IEA says would see warming of 6 degrees by 2100.

Also examined by Whitehaven was action to mitigate climate change to four degrees by 2100 and a “sustainable development” scenario, to limit global warming to 2 degrees by 2100.

Whitehaven said its stress tests show its business would survive under almost any policy response, saying demand for Australian thermal and metallurgical coal would remain strong.

“Under the sustainable development scenario, the IEA expects global seaborne thermal coal demand to contract by 4.5 per cent (compound annual growth rate) out to 2040,” Whitehaven said.

“Given the demand sources and the expectation of growing quality requirements within our region, we forecast Australia will perform better than the global seaborne market.

“Furthermore, in a carbon-constrained world, and given the quality of Gunnedah Basin coal and its lower CO2 emissions per unit of power produced, we expect demand for our coal to be better than the Australian average.”

Whitehaven said its modelling of the IEA’s 2018 forecasts for coal prices under the sustainable development scenario shows that, while they would be lower than the business as usual case, the business would still be cash flow positive out to 2040 — including new projects not yet fully developed.

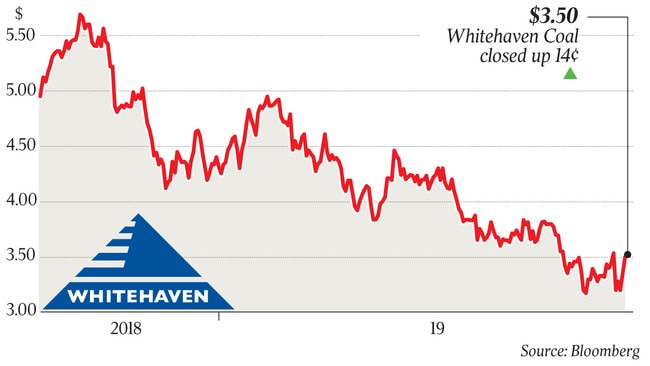

Whitehaven shares closed up 4.2 per cent, or 14c each at $3.50 on Wednesday.