Test for Pilbara as Rio Tinto talks to Baowu about Simandou ore deposit

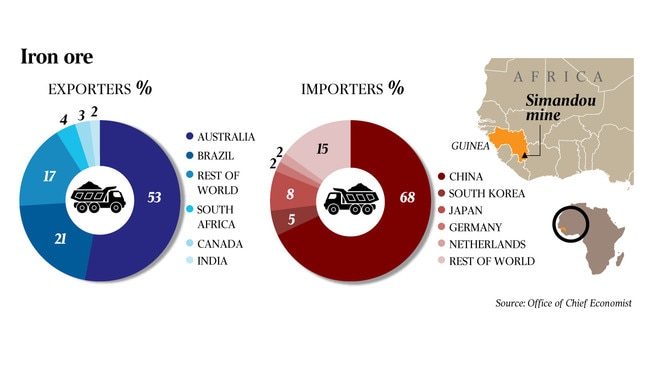

A mountain of Chinese money is about to change the dynamics of the iron market.

Rio Tinto chief executive Jean Sebastien Jacques has confirmed for the first time the company is discussing the development of Africa’s Simandou deposit with Chinese steel giant Baowu, in another signal China Inc is serious about the development of the co-called “Pilbara killer” deposit.

Chinese media outlets last month speculated that Baowu was set to lead a syndicate of Chinese state-owned companies prepared to buy out Rio’s existing partner, Chinalco, from its 40 per cent share of the deposit.

But no changes to Chinalco’s shareholding in the project have yet been disclosed, and Mr Jacques’s comments on an analyst call are the first indication Rio is directly engaging with Baowu as a likely co-owner of the giant deposit.

“Simandou will take place with or without the involvement of Rio Tinto,” he said.

“From what we can see the Chinese are pretty active in order to see if there is a pathway to develop those two blocks. We at Rio, the way we are looking at it with our partners Baowu and Chinalco, is to better understand the value of the option.”

China’s renewed interest in Simandou comes amid rising tensions between Beijing and Canberra, generated by broader geopolitical and trade issues and exacerbated by tensions over the use of Australia’s anti-dumping regime against Chinese steel and aluminium imports.

In May, China slapped hefty tariffs on Australian barley exports, and has hinted at import restrictions on Australian coal, seen as a tit-for-tat move for import duties imposed on its own goods.

China’s reliance on Australian iron ore to fuel its industrial heartland is a significant barrier to direct action against Australia’s most lucrative export commodity. But, as its state-owned majors circle Simandou, China has also ratcheted up its rhetoric around the iron ore trade.

In July, The Australian revealed a Chinese government submission to a dumping complaint filed by BlueScope Steel had noted action against Chinese steel exporters could also hurt iron ore sales.

“Intensive investigation into China’s steel products will also hurt the interests of Australian mining enterprises,” the submission said.

“If China’s steel enterprises reduce their iron ore imports due to the impact of trade remedy, it is likely to damage the interests of Australian iron ore producers.”

Despite an estimated $US14bn ($20bn) price tag, Simandou has the potential to open up a vast new high-grade iron ore province in Africa, potentially relegating the Pilbara down the pecking order of China’s preferred suppliers.

Chinalco owns 40 per cent of blocks 3 and 4, or Simandou South, with Rio Tinto holding 45 per cent and the Guinean government 15 per cent.

Simandou North, or blocks 1 and 2, is controlled by the SBM Winning consortium, which includes Singaporean shipowner Winning Shipping, Chinese aluminium producer Shandong Weiqiao, the Yantai Port group and Guinean transport and logistics company United Mining Supply.

Baowu is China’s biggest steelmaker and a major player in the iron ore market. Its entry into Simandou would be a clear signal China was getting serious about the development of both sides of the deposit, according to JP Morgan analyst Lydon Fagan.

“It would appear the Baowu-led consortium would be more motivated to develop Simandou than Chinalco. This could ultimately force Rio to essentially ‘use it or lose it’, rather than hold on to it as a long-term project option,” he said in a client note.

And Baowu would be a familiar partner for Rio if the Chinese steelmaker became involved in Simandou. The pair have a long-established joint venture at the Rio-operated Eastern Ranges iron ore mine in the Pilbara, and are discussing the joint development of a second nearby deposit.

While Simandou is almost certainly the best undeveloped iron ore deposit in the world, Guinea is a notoriously difficult country in which to operate, and Simandou is essentially a massive infrastructure project. Exploitation of the deposit would require construction of 670km of rail lines through difficult country, along with construction of a new port, at a cost of at least $US14bn.

But the SBM-Winning consortium already has significant runs on the board in the development of mines and infrastructure to export another bulk commodity from Guinea, bauxite, adding to the growing sense the giant mine will finally be developed.

But it is still not clear exactly what impact the project’s development would have on the Pilbara, which exported more than $100bn worth of iron ore over the past year.

UBS analyst Glynn Lawcock noted Simandou would cost far more to develop than the equivalent tonnage of new Pilbara mines, which already have infrastructure in place, and said there remained “uncertainty around whether Simandou tonnes would see oversupply in the market, cannibalise Chinese domestic tonnes, or international tonnes”.

The SMB-Winning consortium plans an 80 million tonne a year operation, according to releases from the Guinean government — a figure that could go up substantially if Rio elects to share infrastructure covering its half of the deposit.

A recent research report from Goldman Sachs resources analyst Paul Young said the development of either block would push the seaborne iron ore market into surplus by the middle of the decade, pushing marginal producers out of the market and forcing down prices of lower-grade products — including those from the Pilbara.

“Currently, we forecast the seaborne iron ore market to peak in 2023-2024 at 1.59 billion tonnes, and Chinese steel production to peak at just over 1 billion tonnes,” he said.

“Based on our assumptions, we see the seaborne market moving into a 100 million tonne surplus from 2025 with production from Simandou North at 80mtpa.”

Morgan Stanley’s Lyndon Fagan says Simandou would almost certainly have an impact on iron ore prices, potentially hitting Australian producers.

“A co-ordinated approach to developing blocks 1-4 could see 110mtpa enter the iron ore market in a relatively short space of time. Full rates wouldn’t be achieved until around 2030,” he said,

Mr Fagan said there would undoubtedly be a “pricing impact”.

“In our view it comes down to the Chinese steel industry looking to reduce its input cost. China consumes about 1.4bn tonnes of iron ore annually. $10/t reduction in the iron ore price equates to a $14bn saving to China Inc in terms of its raw material inputs. This is equivalent to the SMB-Winning tender amount,” he said.

“In reality, adding another 110mtpa into the seaborne market would likely have more than a 10 per cent impact on prices.”

The margins of the Pilbara’s big four — Rio, BHP, Fortescue and Roy Hill — are big enough that a 10 per cent price fall in the long-term price would only dent their profits, rather than force them from the market.

But they are still keeping a close eye on developments in Guinea.

Current prices of $US100 a tonne or better provide an easy incentive for the development of Simandou, but that case drops if prices fall back to levels of about $US70, analysts say.

BHP, Roy Hill and Fortescue have filed applications to increase their Pilbara exports, by a combined 90 million tonnes. Roy Hill and Fortescue have also built magnetic separation plants to improve the quality of their ore, and the construction of Fortescue’s multi-billion-dollar Iron Bridge magnetite mine, which will produce a concentrate grading of 67 per cent iron, is in full swing.

Fortescue chief executive Elizabeth Gaines told The Australian she believed Simandou wouldn’t enter the market within five years, but the company is planning for its eventual construction.

“I’m not sure I’m starting to get more concerned, but at some point in the next five to eight years, provided those feasibility studies stack up, there will be supply from Simandou,” she said.

“Having said that, people have been talking about Simandou for a very long time and it certainly has its challenges around infrastructure. So we’re not ignoring that, but we’re staying focused on our strategy of delivering our Iron Bridge project, which is a high-grade magnetite concentrate that will be in high demand in the market.”

While it would not drive major Pilbara mines out of business, analysts suggest Simandou could affect long-term investment decisions in Australia.

Mr Young noted that Rio had substantial upcoming capital requirements of its own in the Pilbara, and its Oyu Tolgoi copper mine in Mongolia.

“In addition to Simandou we highlight that Rio has another eight replacement mines in the Pilbara that need to be built by 2026,” he said.

He suggested it could make “strategic sense” for Rio to use Simandou to replace some Pilbara products.

“We think it is possible to replace tonnes from the lower-grade Yandi mine and the 50 per cent-owned Hope Downs mines in the Pilbara with higher-grade ore from Simandou South at a rate dictated by market conditions.”

Speaking after Rio delivered its half-year results on Wednesday, Mr Jacques confirmed it was considering Simandou’s place in its overall product mix, saying its new feasibility studies would consider Simandou ore’s value as a blending option for its Pilbara or Canadian iron ore products.

“Because what you want to offer is a blend which gets the maximum value,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout