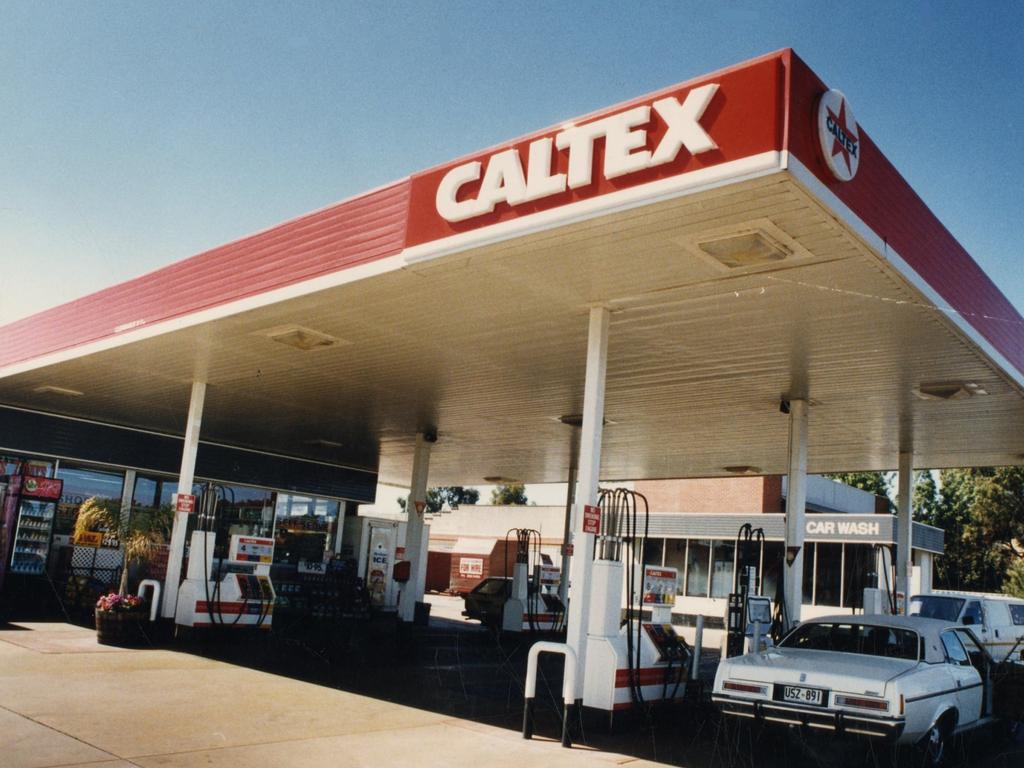

Takeover bids disrupt Caltex CEO succession

CEO Julian Segal will step down despite Caltex failing to find a permanent successor, as it juggles competing takeover offers.

Fuels retailer Caltex said long-serving chief executive Julian Segal would step down on March 2 despite it failing to find a permanent successor, as the board juggles two competing takeover bids from Couche-Tard and EG Group.

Mr Segal will step aside after nearly 11 years in the top role with chief financial officer Matt Halliday replacing him as interim chief executive, as the company reported a 38 per cent fall in annual benchmark net profit.

Caltex said while it had made significant progress in its search for an executive to replace Mr Segal, the takeover activity had hobbled progress.

“Given our recent announcements regarding the receipt of revised and new proposals to acquire Caltex, it is not possible for us to complete this search at this time,” said Caltex chairman Steven Gregg.

“The interim appointments we announce today will ensure we can continue to engage with interested parties on a potential transaction, while continuing to execute our strategy.”

Mr Halliday, a former Rio Tinto executive, only joined Caltex in April last year and quickly embarked on a plan to more aggressively unlock value in the company by cutting costs and embarking on a $1bn property sharemarket float.

However, three takeover bids by Canada’s Couche-Tard including its last offer of $8.8bn and a rival offer from EG have cast a shadow over management’s internal growth plans as expectations grow a deal could be sealed with one of its international suitors.

Caltex said it was still studying the merits of EG’s bid after previously granting due diligence to Couche-Tard.

“Matthew’s ASX-listed company experience and knowledge of M&A, capital management and transformation make him the ideal candidate to lead Caltex at this time,” said Mr Gregg. “He is highly respected by the market and by colleagues across the business and will work closely with the board as interim CEO.”

His elevation to the top role, albeit on an interim basis, may also surprise some investors given its fuels and infrastructure boss, Louise Warner, had been seen as the more likely candidate to be considered for the CEO position.

Ms Warner has instead been named interim chief operating officer while the current deputy chief financial officer, Jeff Etherington, is interim CFO.

The Caltex chairman said Ms Warner will work closely with Mr Halliday “to ensure we run the business well while we progress a potential transaction”.

Caltex’s underlying replacement cost operating profit plummeted to $344m from $558m in 2018 and compared with a $320m to $360m range guided by the company in December. It blamed lower earnings from its Lytton refinery and subdued conditions in refining and retail fuel with the Australian economy remaining weak.

A final dividend of 51c a share was announced, down 10c from a year earlier.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout