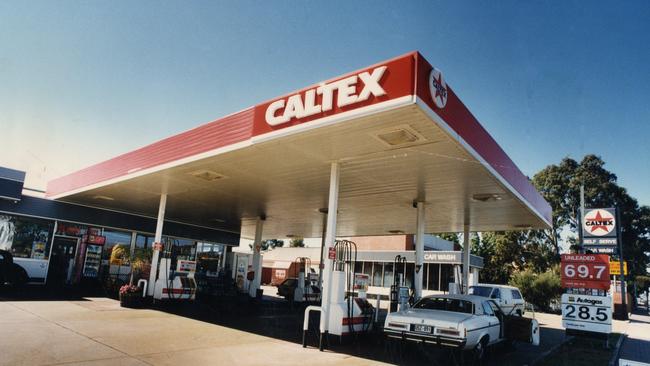

EG Group bid sets scene for Caltex fight

Caltex has received a takeover offer from the UK’s EG Group, setting the scene for a battle with Canada’s Couche-Tard.

Caltex has received a takeover offer from the UK’s EG Group, setting the scene for a battle with Canada’s Couche-Tard which had been the frontrunner after lobbing a $8.8bn bid.

EG has proposed paying $3.9bn in cash for Caltex’s convenience retail business with the existing fuel and infrastructure division to be listed on the ASX under the Ampol brand.

Caltex shareholders would receive $15.62 in cash and a security in Ampol for each Caltex share they own and the deal allows Caltex to continue paying dividends to investors until a deal is completed. EG will consider buying up to 10 per cent of Ampol for an extra cash payment.

A fully franked special dividend would also be paid by Caltex to pay out its franking credits under EG’s proposal.

Caltex said it is considering the proposal and seeking financial and legal advice.

Caltex on Monday granted full due diligence to Alimentation Couche-Tard, signalling the Canadian suitor’s improved $8.8bn takeover bid may win the backing of the fuel retailer’s board.

A $35.25 a share bid lobbed last Thursday, the third offer from the Quebec-based convenience store giant, appears to have received stronger support from Caltex shareholders and a change of attitude from the board, which rejected two earlier tilts.

Couche-Tard has declared its latest proposal a “best and final” price if no competitors emerge with rival offers.

EG had been in talks with Macquarie on a joint bid.

Caltex’s petrol retailing business operates across 880 sites and is estimated by analysts to be worth about $2bn, while the remaining value sits in the portfolio of 476 properties under its ownership and the Caltex wholesale operation.

Wholesale includes its Lytton refinery in Brisbane and Kurnell fuel importation and blending terminal, which accounts for about half the company’s earnings. The retailing operation has always been core to Caltex’s strategy and it was not expected to ever sell only that part of the business.

Working for EG Group, which is widely known to have been weighing up whether to make a counter bid, has been Jefferies Australia, Citi and Bank of America.

Couche-Tard has been working with Goldman Sachs for about a year, while UBS and Grant Samuel are the defence advisers for Caltex.

EG Group last year bought Woolworths petrol station portfolio for $1.725bn.

Couche-Tard was one of the bidders for that portfolio.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout