Shift to electric vehicles drives strong demand for metals

Moves towards global decarbonisation have accelerated since the Paris Agreement on climate change was forged in 2015, along with the recent COP26 meeting. This is bringing challenges and opportunities for business and investors.

The focus on decarbonisation and reducing emissions will see big changes in power, industry and transportation. Within these sectors, we see the biggest changes in the end demand for metals, rare earths or other commodities.

This, combined with technological advancements to reduce costs and make current and future energies including solar, wind, hydro and nuclear power more competitive against traditional fossil fuels, ensures a rich vein of decarbonisation business and investment opportunities – both here and globally. These opportunities are showing upstream and downstream, across all energy sources and storage technologies.

Wind generation has been around for several years and, like solar power, technology has seen efficiency increase and costs fall. It can be small-scale in remote situations or built up into onshore or offshore wind farms. This energy is also clearly weather-dependent. For example, large onshore wind turbines can generate five megawatts per wind turbine – enough to power 1100 homes daily – as opposed to their large offshore counterparts which can generate 15MW, powering some 3300 homes per wind turbine.

Either way, offshore and onshore wind power usage is increasing, increasing the need for commodities used in wind turbine construction such as steel and aluminium for the unit itself, copper for the generator, and increasingly rare earths for higher efficiency generators.

Electric vehicles are also driving critical metals demand. With the trend towards electrification of personal and public transport, increasing use of EVs is driving investment opportunities in battery materials including lithium, graphite, nickel and some copper, while ultimately reducing reliance on fossil fuels over time.

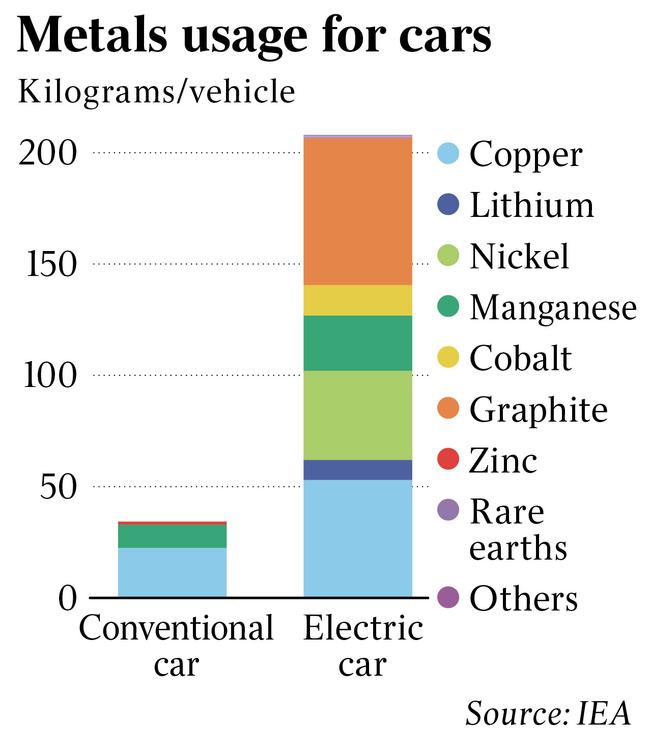

The statistics speak for themselves. As the chart highlights, the production of EVs consumes more than six times the key minerals and metals by weight than the production of conventional cars.

Of the approximately 207kg of minerals used in typical personal EV electrification system, 32 per cent is graphite, 26 per cent is copper, 19 per cent is nickel, 12 per cent manganese, 6 per cent cobalt and 4 per cent lithium. By contrast, conventional cars use mainly manganese and copper, but in much smaller measures.

Global transportation accounts for just under a third of greenhouse gas emissions, but is also gradually changing to meet decarbonisation targets. An example is the aviation industry. These days a Boeing 787 uses about half the fuel of the legacy 747. In part, this is due to technology supporting lightweight materials like carbon fibre, advanced alloys and aluminium – all creating opportunities in the natural resources universe.

In 1975, the everyday household fridge used around 2200KWh of energy per year. By 1985, this fell to 1700KWh, and had more than halved again by the 1990s to 850KWh. Now our refrigerators tend to use just 500KWh. Rare-earth magnet motors are the reason for this fall, increasing efficiency and using less power than traditional units.

We are seeing this same trend across other forms of energy consumption – heating, airconditioning, audiovisual and automation, as batteries, machines and semiconductors become much more efficient.

Decarbonisation is driving major demand for metals and other resources essential for the transition of energy generation, transport and energy demand towards more renewable and efficient sources. The chart summarises the major underlying demand growth expected in key metals.

Lithium has the highest projected demand. While lithium is somewhat abundant, current extraction and processing capacity is limited, the market is tight and demand is far exceeding supply. The lithium-ion battery is currently the incumbent battery technology, and this will not change any time soon.

We see a tight lithium market for at least 12-18 months as new projects and existing resource expansion are needed to meet growing demand.

Graphite can come from two sources – natural, where it is mined and processed; or synthetic, manufactured from oil/carbon sources. Synthetic graphite production is energy-intensive and can be environmentally damaging, but typically produces a more consistent product than natural graphite, which has less impact on the environment.

Right now, energy constraints in China are seeing constraints on synthetic graphite production, which is supportive of natural graphite prices in the near term.

One area we believe is underestimated by the market is the demand for NdPr, a rare earth used in high-strength magnets. Rare earth magnets are used to power energy-efficient motors. Their high magnetic strength means electric motors use less electrical power or energy to produce the same amount of mechanical power. This trend is likely to continue, and we expect to see rare earth magnets increasingly used in everything from EVs to vacuum cleaners and home appliances.

The shift towards renewables and decarbonisation is instigating a dramatic commodity-led response.

We see critical metals as being the primary winners and, unlike many of the boom-bust commodities cycles of the past, these metals may see a more structurally stable demand profile across the cycle, an enormous opportunity for business and investors alike.

James Stewart is a global resources portfolio manager at Ausbil Investment Management.