Pilbara miners plan $9bn iron ore rush

Miners are positioning themselves to ramp up exports if prices allow.

Pilbara iron ore exporters have applied for a combined 90 million-tonne increase in export capacity for the steelmaking commodity as they rake in the cash from high prices, with Gina Rinehart’s Roy Hill mine the latest to join the rush.

Thursday’s economic update by Josh Frydenberg underscored the importance of iron ore to Australia’s coronavirus-hit economy, forecasting the commodity could deliver a $9bn sweetener to GDP if prices remain high until the end of the year, and up to $2.2bn in tax receipts over the next two years.

And although most analysts — and the Treasurer’s department — forecast a sharp fall in the iron ore price by the end of the year, miners are positioning themselves to ramp up exports if prices allow.

Roy Hill is the latest to join the rush, submitting approval documents that could lift its Port Hedland exports by 10 million tonnes a year, to 70 million tonnes.

Its application comes on top of Fortescue Metals’ application to lift its export cap by 35 million tonnes to 210 million tonnes, and BHP’s application to raise its maximum throughput to 330 million tonnes, a 40 million-tonne increase.

The Pilbara Ports Authority has also flagged moves to lift the export cap at its Utah Point berth — used by smaller exporters including Mineral Resources and Gina Rinehart’s Atlas Iron — to 26.5 million tonnes.

If all the Pilbara’s iron ore miners hit their maximum new export rates, they would ship a combined $15bn worth of additional iron ore, at current prices, and send the total tonnes through Port Hedland to more than 635 million tonnes a year — almost 20 per cent more than the record 531.5 million tonnes shipped through the port last financial year.

BHP has also filed detailed plans around its proposals to lift Port Hedland facilities. They outline a substantial overhaul of its infrastructure at the port, including the replacement and upgrade of ship loaders, the installation of new train unloading machinery, and construction of new stockpile areas and associated equipment.

Although BHP has been at pains to note it has not put capital spending plans to its board, and the 330 million-tonne export cap is aspirational, not an export target, industry sources say the cost of the overhaul of its Port Hedland infrastructure could easily top $500m.

A BHP spokesman said the export cap approval documents had been lodged to provide options for the company as it planned the future of its Pilbara operations.

Improve productivity

“While our focus remains on reaching 290Mtpa in the medium term and continuing to improve productivity across our supply chain, this is prudent business planning to help provide long-term optionality for our WA iron ore business,” he said.

Of the Pilbara’s major producers, only Rio Tinto has not yet signalled plans to increase exports, and this year’s rush of interest in expanding Pilbara exports come as the company’s major competitors keep a nervous eye on its renewed interest in developing the giant Simandou iron ore project in Guinea.

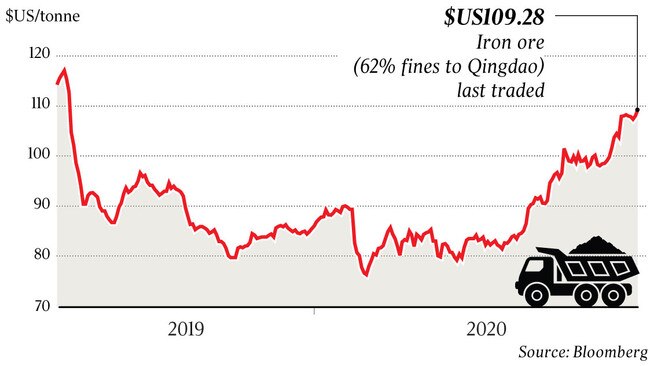

High iron ore prices have been sustained since early last year, when tailings dam collapses at Vale’s Brazilian operations curtailed global supplies, cracking open a window for new iron ore projects to gain traction.

While most analysts expect iron prices to fall in the second half of the year, current levels of more than $US100 a tonne are well above the level of $US70-$US80 a tonne seen as an “incentive price” for new projects and producers.

Chief among those is Simandou which, despite a $US14bn ($20bn) price tag, has the potential to open up a vast new high-grade iron ore province in Africa and relegate the Pilbara down the pecking order of China’s preferred suppliers.

Rio confirmed in its July 17 quarterly production report it was updating its 2015 feasibility study on the project, sending out plans for the 650km rail line and port infrastructure to “selected China-based design institutes” for review.

Chinese media sources have speculated that steelmaking giant Baowu is looking to lead a consortium of state-owned companies to take control of the Simandou stake held by Rio’s current joint venture partner Chinalco, potentially enabling the joint construction of infrastructure with the China-backed consortium that controls the other half of the deposit.

While a flood of new tonnes from the Pilbara would help push down iron ore prices in the medium term, it could also make the job of financing Simandou more complicated, helping maintain the Pilbara’s dominance in the face of the emerging threat.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout