Oil chaos looms after drone strike

Oil markets face heightened volatility after attacks on Saudi Arabian facilities spurred record price rises.

Oil markets face a period of heightened volatility after devastating attacks on Saudi Arabian facilities spurred record rises in crude prices amid fears major energy infrastructure may be vulnerable to further strikes as geopolitical tensions mount in the region.

The raid on the world’s biggest oil plant was the largest ever disruption to international supplies, with the 7 per cent cut to global output outstripping disruption caused by the invasion of Kuwait in 1990 and the subsequent war with Iraq, and Iran’s Islamic Revolution in 1979.

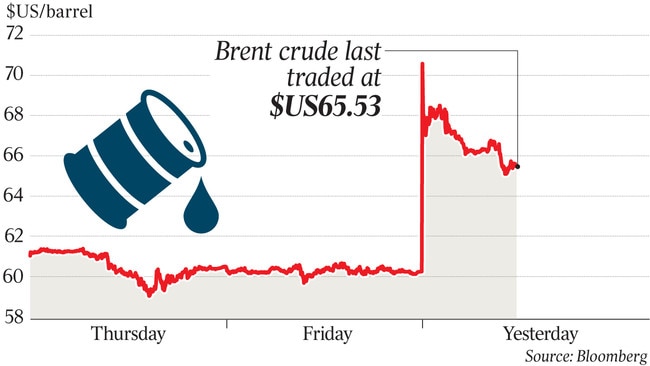

The benchmark Brent crude price soared on Monday, prompting a spike in Australian energy stocks locally. Brent leapt by 19.5 per cent — the most on record — before paring gains to trade 9 per cent higher at $US65.70 ($95) a barrel at 6pm on Monday.

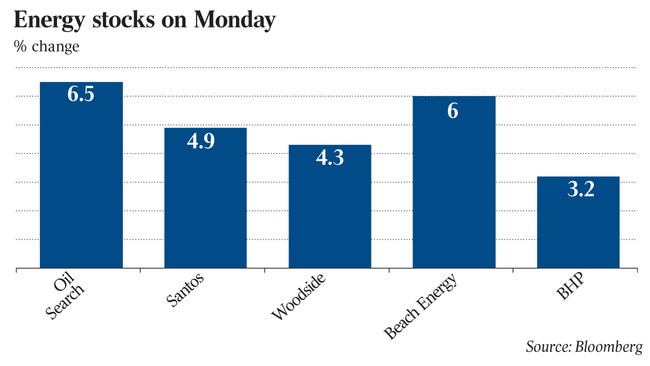

Oil Search jumped 6.5 per cent to $7.73, Santos rose 4.9 per cent to $7.75, Woodside Petroleum lifted 4.3 per cent to $32.70 and Beach Energy added 6 per cent to $2.66.

Prices were likely to spike further on the ratcheting-up of risk and geopolitical uncertainty, former federal resources minister Martin Ferguson said, with the US already authorising the release of oil from its emergency reserves.

“This is bound to have an ongoing impact on price, which will ultimately have an impact on consumers,” Mr Ferguson told The Australian.

“It will hinge on how long it takes to get those key Saudi facilities back into production. There will now be an added element of risk in the market and questions will be asked if other infrastructure could also be hit.”

The drone attack on two of the Middle Eastern kingdom’s facilities is unlikely to be a one-off, putting the region more squarely on the path to military conflict, experts say.

Former Woodside Petroleum boss Don Voelte, who worked for ExxonMobil during the 1990s in Saudi Arabia, helping oversee the US major’s partnership, said the big uncertainty was the length of the outage and the motivation for the attack.

”The bigger concern for me is whether this is a new form of terrorism,” Mr Voelte said from the US. “This could be an almost unstoppable thing — to have drones cause havoc — and it raises big questions of how do you protect yourself.”

The oil market will remain highly volatile until state-run oil giant Saudi Aramco can say when production will resume, amid broader questions about whether other facilities are targets.

“The one thing we know about Saudis is they can hold a secret better than just about anybody in the world,” Mr Voelte said. “So I doubt we are going to get a whole load of information. And of course no news has a risk factor in the market place. My suspicion is we’ll see a few wild trading days.”

Mr Voelte, who spent several years working for billionaire Kerry Stokes at Seven after leaving Woodside in 2010, said while the US was better prepared than a decade ago due to its domestic shale oil boom, they were not like-for-like replacements.

“If you ran straight barrels the US is self-sufficient, but that’s not how the market works because that’s not how refineries are set up. So there’s still a lot of treatment that goes on where the US imports crude and West Texas gets exported. Taking Saudi oil out of that equation obviously has a spin-on impact on the broader global crude market.”

While officials have tentatively indicated that some exports will restart in coming days, there was nothing to suggest Iranian-backed Houthi rebels would forgo further strikes on Saudi sites.

“There is nothing to suggest that this is a one-off event,” Royal Bank of Canada energy expert Helima Croft said.

The attack “was anything but surprising, as it merely marked the most dramatic in a series of recent attacks on Saudi energy infrastructure”, she said.

Global markets would no longer be able to ignore the threat, she said.

“Since the attack on the tankers off the coast of Fujairah in May, the oil market has largely shrugged off the wave of worrying security incidents in the Gulf region,” Ms Croft said.

“As long as no physical supplies were disrupted, market participants could focus their fears on the potential for an ongoing trade war between the US and China to destroy oil demand.”

Analysts at Sanford C. Bernstein also warned that Saudi oil infrastructure was vulnerable and could be attacked at will.

“These attacks could be repeated. We understand that there have been ongoing attacks since May 2019, but these have been the first to result in material damage,” Bernstein analyst Neil Beveridge said in a note to clients.

“Saudi oil infrastructure is vulnerable and could be attacked at will even if facilities can be repaired quickly.”

Saudi Arabia has approximately 185 million barrels of crude stocks in storage currently, and has drawn down its domestic crude stockpiles by more than 40 per cent since 2015, according to consultancy Rystad Energy.

However, the company warns there are limits globally to the volume of export replacement barrels.

“We believe US crude exports could potentially be increased by about 1 million barrels a day, from 3 million to 4 million barrels a day, if prices allow for higher utilisation of the current crude export capacity. Other countries with available capacity to increase exports by a few hundred thousand barrels per day each include UAE, Russia, Kuwait and Iraq,” Rystad said.