Miners fear price volatility, says KPMG in 2021 global outlook

Surging commodity prices that have fuelled talk of a new mining boom haven’t dampened concerns in the global mining industry about price volatility.

Surging commodity prices that have fuelled talk of a new mining boom haven’t dampened concerns in the global mining industry about price volatility, according to accounting and consulting major KPMG.

KPMG will release its 2021 global mining outlook on Thursday, saying the volatility in commodities markets since its last executive survey has kept the risk of sharp price shocks at the forefront of executive minds.

Commodity prices were hit hard as the pandemic hit world economies last year, with metals tied to industrial output — such as aluminium, nickel, and copper — falling to multi-year lows, along with oil, gas and thermal coal prices.

Iron ore powered through the crisis largely undampened and China’s quick recovery from the initial impact of the pandemic, and strong recoveries in other major economies, has since set commodity prices surging.

But price risks remain at the top of issues nominated by global executives surveyed by KPMG for its latest risk outlook report.

KPMG global mining leader Trevor Hart told The Australian prices were always at the top of the minds of miners, despite the return of near-boom-time pricing in a suite of commodities.

“That hasn’t changed, and I don’t think it ever will because it’s one of those things they struggle to control. But with the volatility the market has seen in the 12 months to when the survey was taken, that makes a bit of sense as well,” he said.

Given the extraordinary impact of the pandemic across the globe, it is no surprise the risk of a resurgence — or even a new pandemic — has weighed in second on the list, and Mr Hart said the turmoil caused by the global health crisis had helped elevate concerns about a fresh economic downturn to the third top issue weighing on minds in the sector, up from No 6 a year ago.

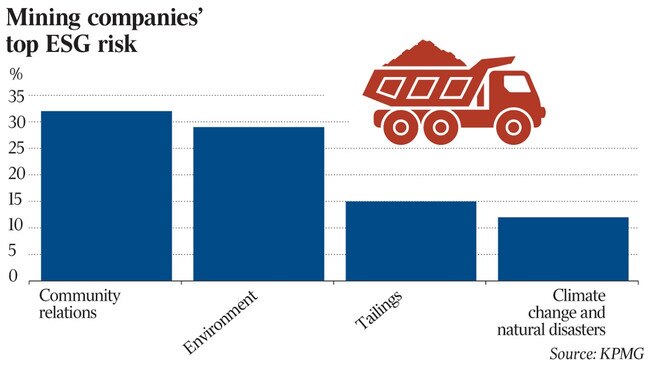

With the implications of Rio Tinto’s Juukan Gorge disaster still rippling across the globe, community relations and social licence to operate was the fourth top issue for miners.

Mr Hart said the increasing focus from investors, the community and executives on mitigating climate change had helped bump environmental risk management into the top five for the first time.

“The disconnect at the moment is that only a third (of respondents) are saying that investor expectations are well understood,” he said.

“So we’re still in the place where the investors, stakeholders and the market are trying to understand exactly what is expected of miners, and miners trying to lead and test the boundaries of what it is the market expects of them.”

The top 10 risks facing the industry, according to mining executives, include winning permitting permissions, political instability and resources nationalism, access to capital, dwindling reserves and resources, and new regulatory and compliance burdens.

But Mr Hart said the sector overall was much more positive than a year ago.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout