Lynas caves in over local processing

Lynas has bowed to pressure and agreed to shift part of its rare-earths processing plant to Australia.

Lynas has bowed to pressure from the Malaysian government and agreed to shift the most controversial part of its rare-earths processing plant to Australia, in a move that has sparked criticism of its suitor Wesfarmers.

Lynas yesterday changed tack and said it would now focus on replicating part of its Malaysian processing operations in Western Australia after Malaysian Prime Minister Mahathir Mohamad flagged tough new conditions for its operations there.

Lynas chief executive Amanda Lacaze has been under immense pressure by Malaysian authorities to find an alternative solution to its current processing operations in the country, and in particular the mildly radioactive waste that processing generates. Its current licence expires in September, and up until yesterday it had been pushing for a full extension of its current licence conditions.

On Friday, Dr Mahathir said that Lynas could continue with its operations if the early stage ‘‘cracking and leaching’’ processing — which generates the contentious waste — was carried out in Australia.

Those requirements are consistent with the plans flagged by Wesfarmers after it announced its $1.5 billion, $2.25-a-share takeover approach for Lynas two weeks ago.

The Australian revealed late last month that Wesfarmers had begun engaging with the Malaysian government over its alternatives, and Dr Mahathir on Friday directly referred to “other companies willing to buy up” Lynas that had “given us a promise” that they would decontaminate the rare-earths material before it arrived in Malaysia.

Matthew Ryland, a portfolio manager at big Lynas shareholder Greencape Capital, told The Australian that Wesfarmers’ engagement with Malaysian authorities raised “some corporate governance issues” for the company. “I think there will be more to come out if it,” Mr Ryland said.

“It raises some questions ethically. They’re trying to make undertakings to a foreign government about an asset that they don’t even own.”

CLSA analyst Dylan Kelly, meanwhile, said Wesfarmers had “brazenly torpedoed” Lynas’s negotiations with the Malaysian government and used Lynas’s investor call yesterday to ask the company if it had considered any “legal recourse” against Wesfarmers.

Wesfarmers defended its conduct, using a statement late yesterday to note that it had engaged with the Malaysian government to better understand the licensing and regulatory issues affecting Lynas and to present its credentials as a potential acquirer of the company.

“This is similar to an interested party engaging with FIRB or another Australian regulator in the context of a conditional proposal,” the company said.

“In all our discussions with Malaysian authorities we have made it clear that we don’t speak for Lynas, that our proposal to acquire Lynas remains subject to a number of conditions and there is no certainty it would result in a transaction.”

Either way, it now looks inevitable that Lynas — or Wesfarmers — will end up needing to foot the bill to replicate the cracking and leaching processing infrastructure back in Australia.

The cost of such a move could run into the hundreds of millions, although CLSA’s Mr Kelly said he expected it would cost about $100 million.

While Ms Lacaze yesterday said the company had been working on plans for additional processing in WA for several months, she gave no details on the scale or cost of the plan or how long it would take to deliver.

Ms Lacaze said the company had also identified five potential sites for the early processing, although she declined to say where they were.

The West Australian government confirmed it had not received any proposal from Lynas.

The need to replicate the cracking and leaching infrastructure in Australia will represent a substantial additional capital spend for a company that up until recently has battled significant balance sheet issues, but Lynas has already received strong indications of support from its key Japanese backers.

Lynas said Japan Australia Rare Earths, which is owned by Japanese duo JOGMEC and Sojitz, had affirmed their support for Lynas and its growth plans while Sojitz issued a statement in which it said “we look forward to continuing to grow our business alongside our colleagues in the Lynas management team”.

Greencape’s Mr Ryland said the support of Japan was important for Lynas, given the Japanese partners had extended cheaper debt to Lynas than that available within the much larger Wesfarmers.

Lynas’s Japanese-backed debt carried an interest rate of 3.75 per cent, which Mr Ryland said was cheaper the Wesfarmers’ cost of finance.

Ms Lacaze stressed that only Lynas had the skills to deliver on the conditions flagged by Dr Mahathir.

“The same work we’ve already done means we are very well placed to deal with any change in Malaysian government policy. If we do need to organise our operations, we are confident,” she said.

“That confidence is based on our experience, our proven performance, and our company-owned and developed IP, that we can do it faster, cheaper and with less risk than any other company.”

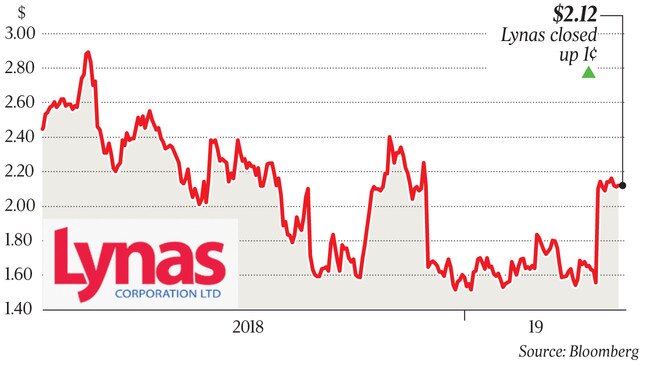

Shares in Lynas closed 1c higher at $2.12 each.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout